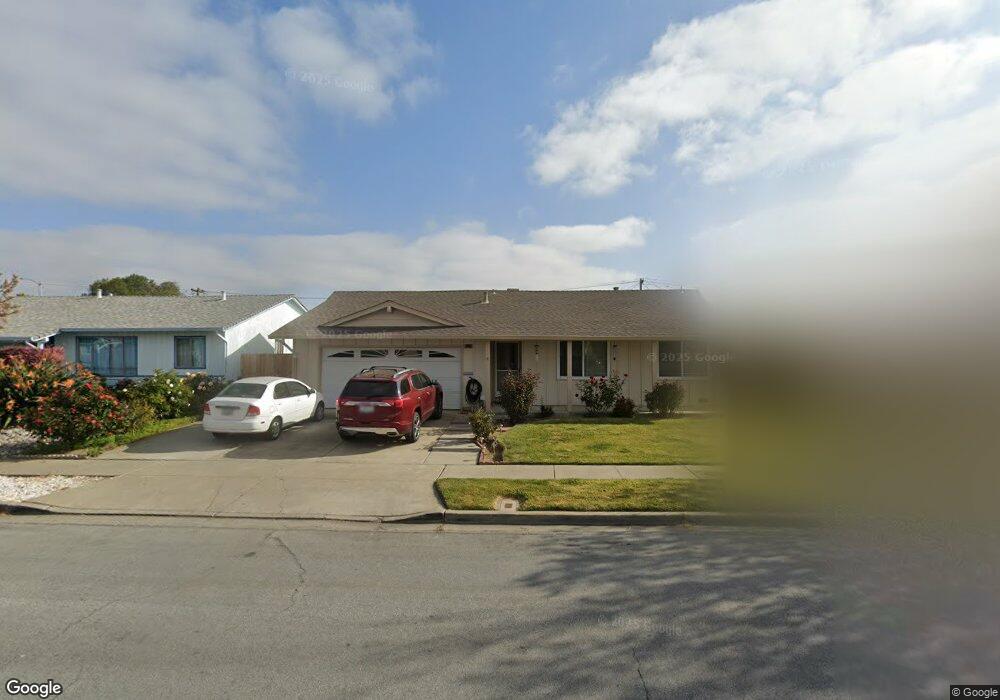

39486 Sutter Dr Fremont, CA 94538

Sundale NeighborhoodEstimated Value: $1,261,000 - $1,425,000

4

Beds

3

Baths

1,131

Sq Ft

$1,187/Sq Ft

Est. Value

About This Home

This home is located at 39486 Sutter Dr, Fremont, CA 94538 and is currently estimated at $1,342,940, approximately $1,187 per square foot. 39486 Sutter Dr is a home located in Alameda County with nearby schools including Brier Elementary School, G.M. Walters Middle School, and John F. Kennedy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2001

Sold by

Henning John P and Henning Johnna P

Bought by

Henning Johnna P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,000

Outstanding Balance

$100,884

Interest Rate

7.12%

Estimated Equity

$1,242,056

Purchase Details

Closed on

Jul 17, 1996

Sold by

Henning Cynthia L

Bought by

Henning John P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,733

Interest Rate

7.35%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Henning Johnna P | -- | Financial Title Company | |

| Henning John P | -- | First American Title Guarant | |

| Henning John | $167,500 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Henning Johnna P | $275,000 | |

| Previous Owner | Henning John P | $150,733 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,772 | $265,788 | $81,918 | $190,870 |

| 2024 | $3,772 | $260,439 | $80,311 | $187,128 |

| 2023 | $3,654 | $262,197 | $78,737 | $183,460 |

| 2022 | $3,584 | $250,056 | $77,193 | $179,863 |

| 2021 | $3,501 | $245,016 | $75,680 | $176,336 |

| 2020 | $3,438 | $249,433 | $74,904 | $174,529 |

| 2019 | $3,402 | $244,544 | $73,436 | $171,108 |

| 2018 | $3,332 | $239,750 | $71,996 | $167,754 |

| 2017 | $3,248 | $235,050 | $70,585 | $164,465 |

| 2016 | $3,180 | $230,442 | $69,201 | $161,241 |

| 2015 | $3,127 | $226,982 | $68,162 | $158,820 |

| 2014 | $3,064 | $222,536 | $66,827 | $155,709 |

Source: Public Records

Map

Nearby Homes

- 39511 Pardee Ct

- 4657 Pardee Ave

- 4833 Murphy Ct

- 4714 Serra Ave

- 39630 Blacow Rd

- 4600 Nelson St

- 4754 Bret Harte Ct

- 39151 Donner Way

- 4588 Sloat Rd

- 4369 Amador Rd

- 5132 Trade Wind Ln

- 39904 Lindsay Mcdermott Ln Unit 8

- 38952 Emrol Ave

- 39583 Buena Vista Terrace

- 5592 Dewey Place

- 4403 Burke Way

- 4013 Ralston Common Unit 4

- 40327 Blacow Rd

- 4859 Hilo St

- 4478 English Rose Common

- 39508 Sutter Dr

- 39440 Sutter Dr

- 39535 Pardee Ct

- 39523 Pardee Ct

- 39547 Pardee Ct

- 39520 Sutter Dr

- 39559 Pardee Ct

- 39483 Sutter Dr

- 39505 Sutter Dr

- 39441 Sutter Dr

- 39532 Sutter Dr

- 39517 Sutter Dr

- 39411 Sutter Dr

- 39571 Pardee Ct

- 39529 Sutter Dr

- 39544 Sutter Dr

- 39538 Pardee Ct

- 39550 Pardee Ct

- 39526 Pardee Ct

Your Personal Tour Guide

Ask me questions while you tour the home.