4003 Galapagos Way Oxnard, CA 93035

Channel Islands NeighborhoodEstimated Value: $1,401,000 - $1,612,000

4

Beds

4

Baths

2,851

Sq Ft

$527/Sq Ft

Est. Value

About This Home

This home is located at 4003 Galapagos Way, Oxnard, CA 93035 and is currently estimated at $1,501,166, approximately $526 per square foot. 4003 Galapagos Way is a home located in Ventura County with nearby schools including Christa Mcauliffe Elementary School and Oxnard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 21, 2021

Sold by

Summers Frankie

Bought by

Summers Frankie and Frankie Summers Trust

Current Estimated Value

Purchase Details

Closed on

Jan 24, 2011

Sold by

Us Bank National Association

Bought by

Summers Frankie

Purchase Details

Closed on

Oct 18, 2010

Sold by

Tresierras Mario and Tresierras Alexandria

Bought by

Us Bank National Association

Purchase Details

Closed on

Apr 12, 2007

Sold by

D R Horton Los Angeles Holding Co Inc

Bought by

Tresierras Mario and Tresierras Alexandria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,071

Interest Rate

6.18%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Summers Frankie | -- | None Available | |

| Summers Frankie | $480,000 | First American Title Company | |

| Us Bank National Association | $585,000 | Accommodation | |

| Tresierras Mario | $831,000 | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Tresierras Mario | $83,071 | |

| Previous Owner | Tresierras Mario | $664,569 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,402 | $614,949 | $211,386 | $403,563 |

| 2024 | $13,402 | $602,892 | $207,242 | $395,650 |

| 2023 | $13,120 | $591,071 | $203,178 | $387,893 |

| 2022 | $12,143 | $579,482 | $199,194 | $380,288 |

| 2021 | $11,756 | $568,120 | $195,288 | $372,832 |

| 2020 | $11,207 | $562,297 | $193,287 | $369,010 |

| 2019 | $12,145 | $551,273 | $189,498 | $361,775 |

| 2018 | $12,984 | $540,465 | $185,783 | $354,682 |

| 2017 | $12,652 | $529,869 | $182,141 | $347,728 |

| 2016 | $11,730 | $519,480 | $178,570 | $340,910 |

| 2015 | $11,383 | $511,679 | $175,889 | $335,790 |

| 2014 | $11,213 | $501,658 | $172,445 | $329,213 |

Source: Public Records

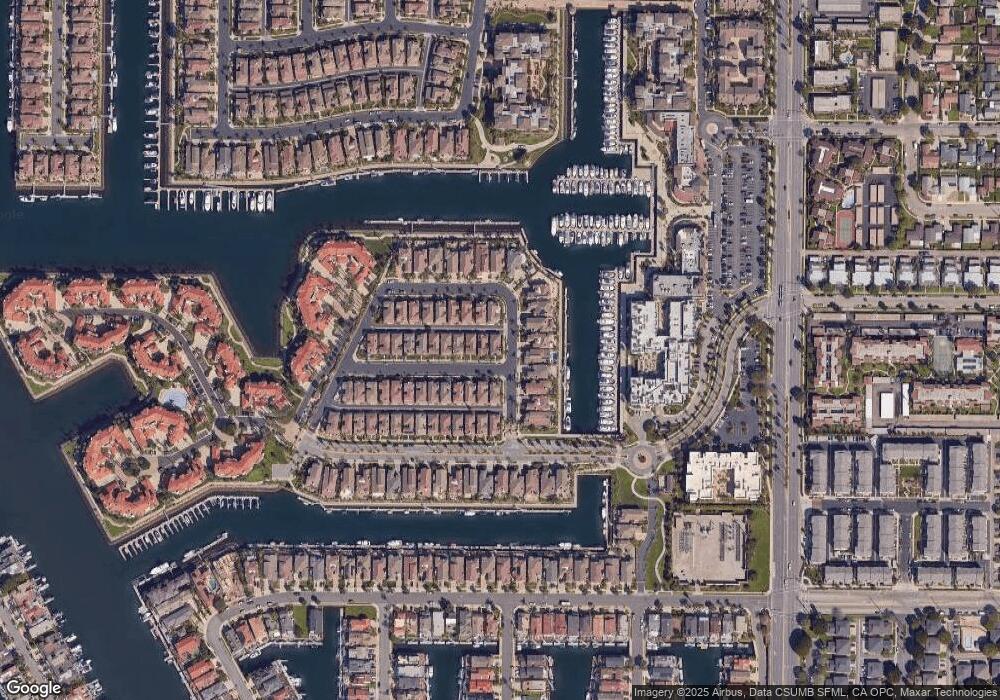

Map

Nearby Homes

- 4073 Galapagos Way

- 4045 Harbour Island Ln

- 4126 Harbour Island Ln

- 1901 S Victoria Ave Unit 116

- 1901 S Victoria Ave Unit 115

- 4114 Caribbean St

- 1544 Seabridge Ln

- 3960 W Hemlock St

- 2001 Peninsula Rd

- 1521 Windshore Way

- 1758 Emerald Isle Way

- 1506 Seabridge Ln

- 1547 Windshore Way

- 1901 Victoria Ave Unit 204

- 1541 Windshore Way

- 4229 Harbour Island Ln

- 2014 Napoli Dr

- 1503 Windshore Way

- 1421 Windshore Way

- 1423 Windshore Way

- 4013 Galapagos Way

- 4023 Galapagos Way

- 4002 Farralon Way

- 4012 Farralon Way

- 4033 Galapagos Way Unit 74

- 4033 Galapagos Way

- 1734 Aleutian Way

- 4022 Farralon Way

- 1744 Aleutian Way

- 1724 Aleutian Way

- 4004 Galapagos Way

- 4043 Galapagos Way Unit 75

- 4043 Galapagos Way

- 4014 Galapagos Way

- 1800 Aleutian Way

- 4032 Farralon Way

- 4020 Galapagos Way

- 1712 Aleutian Way

- 1804 Aleutian Way

- 4030 Galapagos Way

Your Personal Tour Guide

Ask me questions while you tour the home.