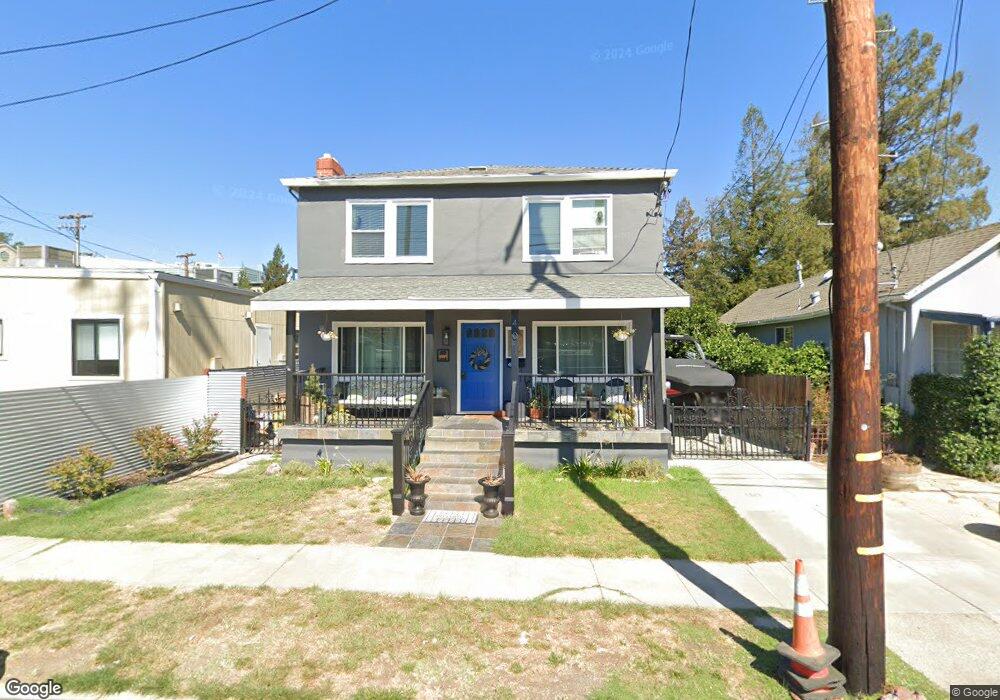

401 C St Martinez, CA 94553

Estimated Value: $737,000 - $899,089

4

Beds

2

Baths

2,772

Sq Ft

$291/Sq Ft

Est. Value

About This Home

This home is located at 401 C St, Martinez, CA 94553 and is currently estimated at $805,522, approximately $290 per square foot. 401 C St is a home located in Contra Costa County with nearby schools including John Muir Elementary School, Martinez Junior High School, and Alhambra Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 18, 2019

Sold by

Campos Jason M and Campos Kendra Lynn

Bought by

Campos Jason M and Campos Kendra Lynn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$535,500

Outstanding Balance

$470,796

Interest Rate

4.4%

Mortgage Type

New Conventional

Estimated Equity

$334,726

Purchase Details

Closed on

Apr 18, 2017

Sold by

Woolf Michael L and Woolf Tracy A

Bought by

Campos Jason and Campos Kendra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$540,038

Interest Rate

4.23%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 24, 2012

Sold by

Bordoni Larry

Bought by

Woolf Michael L and Woolf Tracy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$336,229

Interest Rate

3.88%

Mortgage Type

FHA

Purchase Details

Closed on

May 13, 2003

Sold by

Bordoni Louise M

Bought by

Bordoni Louise M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Campos Jason M | -- | Chicago Title Company | |

| Campos Jason | $550,000 | Lawyers Title Company | |

| Woolf Michael L | $345,000 | First American Title Company | |

| Bordoni Louise M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Campos Jason M | $535,500 | |

| Closed | Campos Jason | $540,038 | |

| Previous Owner | Woolf Michael L | $336,229 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,450 | $638,316 | $290,434 | $347,882 |

| 2024 | $7,936 | $625,801 | $284,740 | $341,061 |

| 2023 | $7,936 | $613,531 | $279,157 | $334,374 |

| 2022 | $7,806 | $601,502 | $273,684 | $327,818 |

| 2021 | $7,617 | $589,709 | $268,318 | $321,391 |

| 2019 | $7,400 | $572,219 | $260,360 | $311,859 |

| 2018 | $7,185 | $561,000 | $255,255 | $305,745 |

| 2017 | $4,925 | $373,375 | $158,008 | $215,367 |

| 2016 | $4,586 | $366,055 | $154,910 | $211,145 |

| 2015 | $4,532 | $360,558 | $152,584 | $207,974 |

| 2014 | $4,451 | $353,497 | $149,596 | $203,901 |

Source: Public Records

Map

Nearby Homes

- 500 Wano St

- 2437 Alhambra Ave

- 513 Arch St

- 1830 Richardson St

- 228 Arreba St

- 1021 Ulfinian Way

- 3102 Pine St

- 1002 Warren St

- 2350 W Shell Ave

- 2340 Yale St

- 1087 Hillside Dr

- 1121 Haven St

- 0 Berrellesa St

- 1333 Warren St

- 2220 S Crest Ave

- 1517 Brown St

- 2555 Orange St

- 871 Merle Ave

- 933-937 Las Juntas St

- 4030 Saint Marys St

- 411 C St

- 201 C St

- 307 C St Unit A up

- 307 C St Unit A

- 307 C St

- 0 C St Unit 40799307

- 0 C St Unit 41068824

- 0 C St Unit 41049749

- 0 C St Unit 41011778

- 0 C St Unit 40977738

- 205 C St

- 2635 Alhambra Ave

- 2615 Alhambra Ave

- 231 C St

- 2605 Alhambra Ave

- 2700 Marion Terrace

- 510 Flora St

- 221 C St

- 2710 Marion Terrace

- 525 Wano St

Your Personal Tour Guide

Ask me questions while you tour the home.