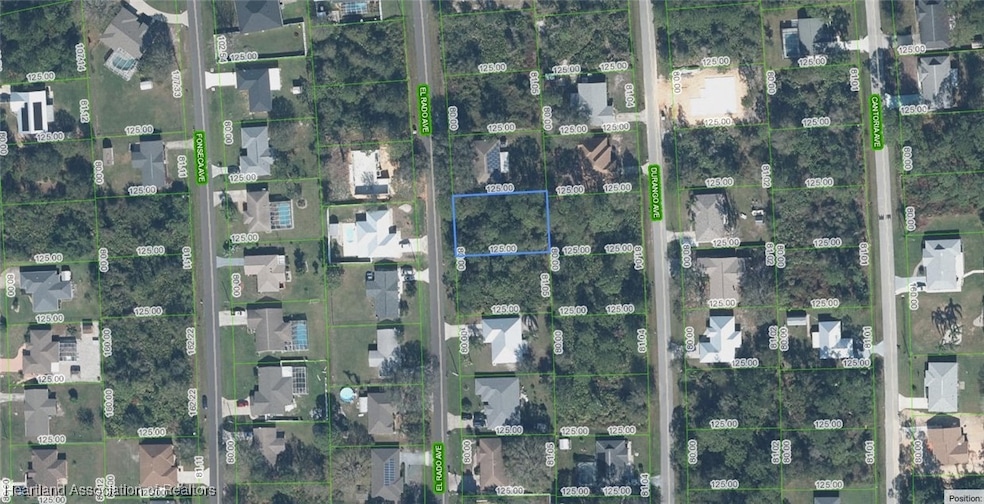

4038 El Rado Ave Sebring, FL 33872

Sun N Lake NeighborhoodEstimated payment $168/month

About This Lot

OWNER WILL FINANCE!!! Fantastic residential lot in the established Sun N' Lakes community. Build your dream home with city water, city sewer, paved roads, flood zone X, and electricity available. Located in the heart of Sebring’s growing golf community, enjoy two 18-hole golf course, pools, fitness center, tennis and pickleball courts, dog park, playgrounds, and pavilions—all just a short golf cart ride away. Close to hospitals, dining, and more. Act fast—this won’t last long! Motivated seller, bring your offer today! OWNER WILL FINANCE!!! 5K DOWN $493.05 A MONTH FOR 60 MONTHS @ 7% INTEREST.

Property Details

Property Type

- Land

Est. Annual Taxes

- $131

Lot Details

- 10,000 Sq Ft Lot

- Interior Lot

- Wooded Lot

- Zoning described as R1

Utilities

- Cable TV Available

Community Details

- Property has a Home Owners Association

Listing and Financial Details

- Assessor Parcel Number C-04-34-28-050-0560-0140

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $131 | $13,050 | $13,050 | -- |

| 2023 | $131 | $5,445 | $0 | $0 |

| 2022 | $98 | $5,400 | $5,400 | $0 |

| 2021 | $91 | $4,500 | $4,500 | $0 |

| 2020 | $109 | $5,750 | $0 | $0 |

| 2019 | $98 | $5,000 | $0 | $0 |

| 2018 | $98 | $5,000 | $0 | $0 |

| 2017 | $82 | $5,000 | $0 | $0 |

| 2016 | $84 | $5,000 | $0 | $0 |

| 2015 | $85 | $5,000 | $0 | $0 |

| 2014 | $86 | $0 | $0 | $0 |

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 01/16/2025 01/16/25 | For Sale | $29,900 | -- | -- |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Quit Claim Deed | $100 | None Listed On Document | |

| Quit Claim Deed | $100 | None Listed On Document | |

| Public Action Common In Florida Clerks Tax Deed Or Tax Deeds Or Property Sold For Taxes | $1,211 | Attorney | |

| Warranty Deed | $13,500 | First American Title Ins Co |

Source: Heartland Association of REALTORS®

MLS Number: 311851

APN: C-04-34-28-050-0560-0140

- 4115 El Rado Ave

- 3945 Durango Ave

- 4108 Garienda Ave

- 4008 Fonseca Ave

- 3919 Durango Ave

- 4121 Barbarossa Ave

- 6501 Matanzas Dr Unit 13

- 4133 Garienda Ave

- 3905 Barbarossa Ave

- 3917 Fonseca Ave

- 3800 Cantoria Ave

- 4020 Harlando Ave

- 4213 Almeria Ave

- 4015 Almeria Ave

- 4009 Almeria Ave

- 3905 Fonseca Ave

- 4117 Harlando Ave

- 4026 Mendoza Ave

- 8006 Bernal Dr

- 7002 Schumacher Rd

- 5762 Matanzas Dr Unit 103

- 5740 Matanzas Dr

- 3641 Edgewater Dr

- 3731 Edgewater Dr

- 3833 Edgewater Dr

- 5025 Granada Blvd

- 3915 Edgewater Dr

- 6831 Sun N Lake Blvd Unit 13

- 6831 Sun N Lake Blvd

- 5007 Granada Blvd

- 6982 Mexican Hat Dr

- 4918 Granada Blvd

- 7209 Ancha St

- 7213 Ancha St

- 7030 San Benito Dr

- 5509 Castania Dr

- 5354 Pebble Beach Dr