4108 Bryant Park Dr Unit 4108 Dublin, OH 43016

Tuttle NeighborhoodEstimated Value: $439,563 - $479,000

4

Beds

4

Baths

2,826

Sq Ft

$162/Sq Ft

Est. Value

About This Home

This home is located at 4108 Bryant Park Dr Unit 4108, Dublin, OH 43016 and is currently estimated at $459,141, approximately $162 per square foot. 4108 Bryant Park Dr Unit 4108 is a home located in Franklin County with nearby schools including Gables Elementary School, Ridgeview Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 22, 2014

Sold by

Alderman Vikki L and Alderman Oscar W

Bought by

Alderman Vikki L and Alderman Oscar W

Current Estimated Value

Purchase Details

Closed on

Jun 28, 2013

Sold by

Third Federal Savings And Loan Assn Of C

Bought by

Alderman Vikki L and Alderman Oscar W

Purchase Details

Closed on

May 20, 2013

Sold by

Walker Judith Ann

Bought by

Third Federal Savings & Loan Assn

Purchase Details

Closed on

Aug 18, 2006

Sold by

Gramercy Place Llc

Bought by

Walker Judith Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

6.83%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alderman Vikki L | -- | None Available | |

| Alderman Vikki L | $219,400 | Stewart Title Company | |

| Third Federal Savings & Loan Assn | $200,000 | None Available | |

| Walker Judith Ann | $373,400 | Ohio Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Walker Judith Ann | $240,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,716 | $127,370 | $24,500 | $102,870 |

| 2023 | $5,643 | $127,365 | $24,500 | $102,865 |

| 2022 | $6,210 | $119,740 | $25,200 | $94,540 |

| 2021 | $6,221 | $119,740 | $25,200 | $94,540 |

| 2020 | $6,229 | $119,740 | $25,200 | $94,540 |

| 2019 | $6,054 | $99,790 | $21,000 | $78,790 |

| 2018 | $5,817 | $99,790 | $21,000 | $78,790 |

| 2017 | $6,105 | $99,790 | $21,000 | $78,790 |

| 2016 | $6,161 | $93,000 | $19,640 | $73,360 |

| 2015 | $5,592 | $93,000 | $19,640 | $73,360 |

| 2014 | $5,766 | $93,000 | $19,640 | $73,360 |

| 2013 | $1,825 | $88,550 | $18,690 | $69,860 |

Source: Public Records

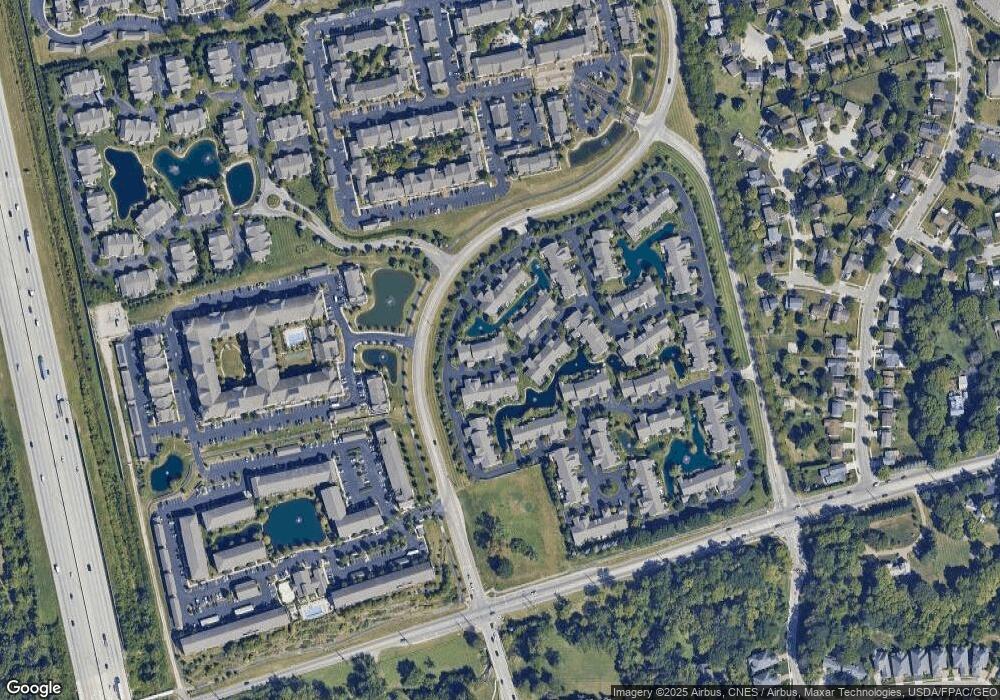

Map

Nearby Homes

- 4222 Bradhurst Dr Unit 15

- 5506 Shannon Heights Blvd

- 5500 Shannon Heights Blvd

- 4044 Dumfries Ct

- 5500 Saddlebrook Dr

- 3873 Oakbridge Ln Unit 262

- 3741 Baybridge Ln

- 3879 Ivygate Place

- 5049 Dinard Way

- 3940 Rennes Dr

- 3660 Rivervail Dr

- 3873 Tweedsmuir Dr

- 3761 Carnforth Dr

- 0 Riggins Rd

- 3894 Maidens Larne Dr

- 4898 Davidson Run Dr

- 3661 Mountshannon Rd

- 4827 Rays Cir Unit 4827

- 3552 Mountshannon Rd

- 4801 Rays Cir SW Unit 4801

- 4108 Bryant Park Dr Unit 32

- 4112 Bryant Park Dr Unit 4112

- 4116 Bryant Park Dr Unit 4116

- 4098 Bryant Park Dr Unit 4098

- 4120 Bryant Park Dr Unit 4120

- 4107 Bryant Park Dr Unit 4107

- 5548 Queens Park Dr Unit 5548

- 4111 Bryant Park Dr Unit 4119

- 4094 Bryant Park Dr Unit 4094

- 4099 Bryant Park Dr Unit 4099

- 4095 Bryant Park Dr Unit 4095

- 4115 Bryant Park Dr Unit 4115

- 5556 Queens Park Dr Unit 5556

- 4091 Bryant Park Dr Unit 4091

- 4090 Bryant Park Dr Unit 4090

- 4119 Bryant Park Dr

- 5564 Queens Park Dr Unit 5564

- 4086 Bryant Park Dr Unit 4086

- 5572 Queens Park Dr Unit 5572

- 4097 Delancy Park Dr Unit 4097