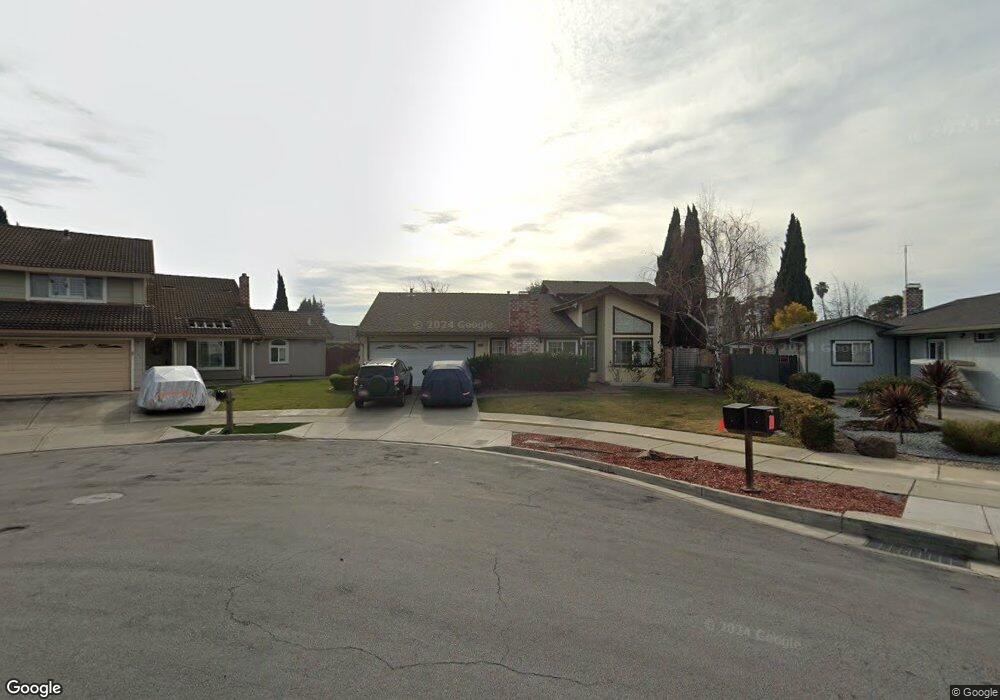

4142 Polonius Cir Fremont, CA 94555

Ardenwood NeighborhoodEstimated Value: $1,730,000 - $2,349,000

4

Beds

2

Baths

1,629

Sq Ft

$1,246/Sq Ft

Est. Value

About This Home

This home is located at 4142 Polonius Cir, Fremont, CA 94555 and is currently estimated at $2,029,818, approximately $1,246 per square foot. 4142 Polonius Cir is a home located in Alameda County with nearby schools including Ardenwood Elementary, Thornton Middle School, and American High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 2, 2025

Sold by

Dashora Mahesh and Dashora Prerana

Bought by

Dashora Family Trust and Dashora

Current Estimated Value

Purchase Details

Closed on

Nov 15, 2005

Sold by

Easterday Gayle E and Easterday Gary B

Bought by

Dashora Mahesh and Dashora Prerana

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$536,000

Interest Rate

6.5%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jul 16, 2004

Sold by

Easterday Gary and Easterday Gayle

Bought by

Easterday Gary B and Easterday Gayle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Interest Rate

6.27%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dashora Family Trust | -- | None Listed On Document | |

| Dashora Mahesh | $670,000 | New Century Title Company | |

| Easterday Gary B | -- | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Dashora Mahesh | $536,000 | |

| Previous Owner | Easterday Gary B | $350,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,081 | $1,014,070 | $274,658 | $746,412 |

| 2024 | $12,081 | $994,052 | $269,273 | $731,779 |

| 2023 | $11,762 | $981,429 | $263,995 | $717,434 |

| 2022 | $11,616 | $955,188 | $258,819 | $703,369 |

| 2021 | $11,328 | $936,328 | $253,746 | $689,582 |

| 2020 | $11,381 | $933,658 | $251,145 | $682,513 |

| 2019 | $11,250 | $915,358 | $246,222 | $669,136 |

| 2018 | $10,800 | $877,716 | $241,396 | $636,320 |

| 2017 | $10,312 | $841,885 | $236,665 | $605,220 |

| 2016 | $10,139 | $825,382 | $232,026 | $593,356 |

| 2015 | $10,006 | $812,991 | $228,543 | $584,448 |

| 2014 | $9,836 | $797,067 | $224,066 | $573,001 |

Source: Public Records

Map

Nearby Homes

- 4243 Nerissa Cir

- 4141 Deep Creek Rd Unit 137

- 4480 Norocco Cir

- 4516 Roderigo Ct

- 4512 Macbeth Ave

- 3691 Thrush Terrace

- 3851 Milton Terrace

- 3840 Springfield Common

- 33283 Sunriver Common

- 3355 Winter Wren Place

- 33228 Jamie Cir

- 33162 Lake Pyramid St

- 4272 Warbler Loop

- 34552 Nantucket Common

- 34512 Nantucket Common

- 34179 Bowling Green Common

- 34579 Bluestone Common

- 4015 Clydesdale Common

- 328 Waikiki Cir

- 33911 Mello Way

- 4132 Polonius Cir

- 4152 Polonius Cir

- 33746 Shylock Dr

- 33768 Shylock Dr

- 33726 Shylock Dr

- 4122 Polonius Cir

- 4205 Nerissa Cir

- 4162 Polonius Cir

- 4211 Nerissa Cir

- 4201 Nerissa Cir

- 4217 Nerissa Cir

- 33710 Shylock Dr

- 4112 Polonius Cir

- 4172 Polonius Cir

- 4147 Polonius Cir

- 4221 Nerissa Cir

- 4157 Polonius Cir

- 4102 Polonius Cir

- 4227 Nerissa Cir

- 4167 Polonius Cir