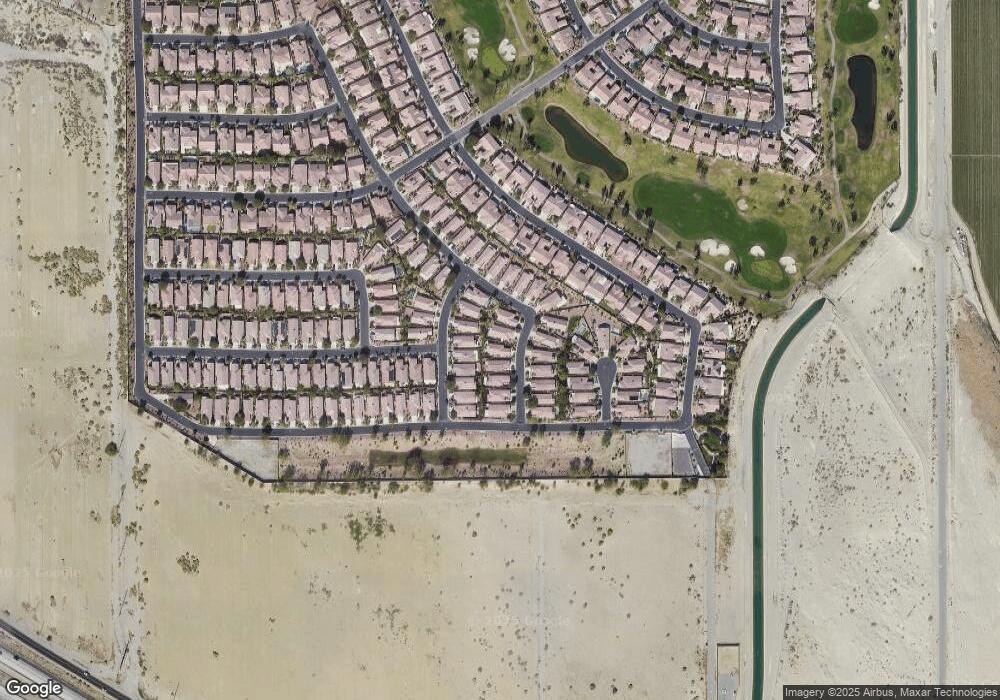

41503 Via Arleta Indio, CA 92203

Shadow Hills NeighborhoodEstimated Value: $381,000 - $422,000

2

Beds

2

Baths

1,276

Sq Ft

$311/Sq Ft

Est. Value

About This Home

This home is located at 41503 Via Arleta, Indio, CA 92203 and is currently estimated at $396,748, approximately $310 per square foot. 41503 Via Arleta is a home located in Riverside County with nearby schools including Ronald Reagan Elementary School, Desert Ridge Academy, and Shadow Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2011

Sold by

Mendez Philip and Mendez Maureen

Bought by

Haley Derek G and Haley Lynda S

Current Estimated Value

Purchase Details

Closed on

Feb 3, 2010

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Mendez Philip and Mendez Maureen

Purchase Details

Closed on

Sep 17, 2009

Sold by

Griffith Michael D

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Dec 8, 2005

Sold by

Griffith Kimberly A

Bought by

Griffith Michael D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$191,100

Interest Rate

6.5%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Nov 2, 2005

Sold by

Pulte Homes Corp

Bought by

Griffith Michael D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$191,100

Interest Rate

6.5%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Haley Derek G | $196,000 | Lawyers Title | |

| Mendez Philip | $169,500 | First American Title Ins Co | |

| Federal Home Loan Mortgage Corporation | $187,738 | None Available | |

| Griffith Michael D | -- | First American Title Company | |

| Griffith Michael D | $239,000 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Griffith Michael D | $191,100 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,250 | $251,088 | $62,766 | $188,322 |

| 2023 | $4,250 | $241,340 | $60,330 | $181,010 |

| 2022 | $4,007 | $236,609 | $59,148 | $177,461 |

| 2021 | $3,900 | $231,971 | $57,989 | $173,982 |

| 2020 | $3,814 | $229,594 | $57,395 | $172,199 |

| 2019 | $3,739 | $225,093 | $56,270 | $168,823 |

| 2018 | $3,653 | $220,680 | $55,167 | $165,513 |

| 2017 | $3,605 | $216,354 | $54,086 | $162,268 |

| 2016 | $3,560 | $212,113 | $53,026 | $159,087 |

| 2015 | $3,559 | $208,930 | $52,231 | $156,699 |

| 2014 | $3,503 | $204,840 | $51,209 | $153,631 |

Source: Public Records

Map

Nearby Homes

- 80731 Camino Los Campos

- 80642 Avenida Camarillo

- 80818 Camino Santa Elise

- 80629 Avenida San Fernando

- 41575 Calle San Elijo

- 80598 Camino Santa Juliana

- 80546 Avenida Camarillo

- 80529 Avenida Camarillo

- 80790 Camino San Lucas

- 80785 Avenida Santa Carmen

- 42501 Solicio Way

- 80775 Camino Santa Paula

- 81025 Avenida Lorena

- 80382 Avenida Santa Belinda

- 80608 Avenida Santa Carmen

- 81135 Avenida Pamplona

- 80362 Camino Santa Elise

- . Jefferson St

- 81138 Avenida Lorena

- 40882 Calle Claro

- 41521 Via Arleta

- 41487 Via Arleta

- 41539 Via Arleta

- 41506 Via Arbolitos

- 41488 Via Arbolitos

- 41469 Via Arleta

- 41522 Via Arbolitos

- 41466 Via Arbolitos

- 41508 Via Arleta

- 41557 Via Arleta

- 41538 Via Arbolitos

- 41480 Via Arleta

- 41440 Via Arbolitos

- 41528 Via Arleta

- 41544 Via Arleta

- 41556 Via Arbolitos

- 41410 Via Arbolitos

- 41562 Via Arleta

- 41444 Via Arleta

- 41574 Via Arbolitos

Your Personal Tour Guide

Ask me questions while you tour the home.