4222 E Brown Rd Unit 21 Mesa, AZ 85205

Citrus NeighborhoodEstimated Value: $1,026,000 - $1,227,000

Studio

5

Baths

3,512

Sq Ft

$321/Sq Ft

Est. Value

About This Home

This home is located at 4222 E Brown Rd Unit 21, Mesa, AZ 85205 and is currently estimated at $1,128,466, approximately $321 per square foot. 4222 E Brown Rd Unit 21 is a home located in Maricopa County with nearby schools including Bush Elementary School, Franklin at Brimhall Elementary School, and Franklin West Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 5, 2004

Sold by

Eaton Thomas W and Eaton Wanda K

Bought by

Eaton Thomas W and Eaton Wanda K

Current Estimated Value

Purchase Details

Closed on

Jun 26, 2003

Sold by

Eaton Thomas W and Eaton Wanda K

Bought by

Eaton Thomas W and Eaton Wanda K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$271,900

Interest Rate

5.26%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 22, 1995

Sold by

Gossling Sheldon Neil and Gossling Denise L

Bought by

Eaton Thomas W and Eaton Wanda K

Purchase Details

Closed on

Sep 9, 1994

Sold by

Smith James P and Smith Andie Lou

Bought by

Gossling Sheldon Neil and Gossling Denise L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eaton Thomas W | -- | -- | |

| Eaton Thomas W | -- | -- | |

| Eaton Thomas W | -- | Security Title Agency | |

| Eaton Thomas W | $57,900 | Security Title Agency | |

| Gossling Sheldon Neil | $52,000 | Stewart Title & Trust |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Eaton Thomas W | $271,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,418 | $59,299 | -- | -- |

| 2024 | $5,436 | $56,475 | -- | -- |

| 2023 | $5,436 | $68,760 | $13,750 | $55,010 |

| 2022 | $5,315 | $52,620 | $10,520 | $42,100 |

| 2021 | $5,358 | $49,270 | $9,850 | $39,420 |

| 2020 | $5,276 | $47,380 | $9,470 | $37,910 |

| 2019 | $4,899 | $44,250 | $8,850 | $35,400 |

| 2018 | $4,827 | $44,420 | $8,880 | $35,540 |

| 2017 | $4,668 | $44,080 | $8,810 | $35,270 |

| 2016 | $4,548 | $47,800 | $9,560 | $38,240 |

| 2015 | $4,249 | $44,200 | $8,840 | $35,360 |

Source: Public Records

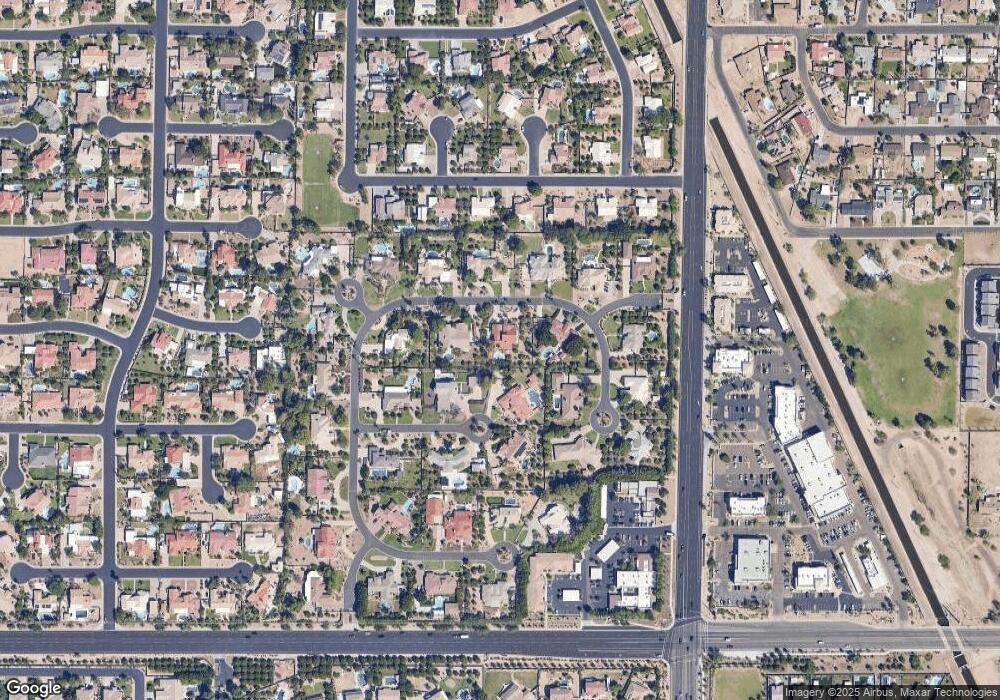

Map

Nearby Homes

- 4326 E Fairbrook Cir

- 1244 N Norfolk Cir

- 4230 E Fountain St

- 4335 E Fox Cir

- 4528 E Hobart St

- 4038 E Glencove St

- 4245 E Fountain St

- 4064 E Hale Cir

- 4042 E Hope St

- 1126 N Nassau

- 4222 E Mclellan Cir Unit 15

- 4222 E Mclellan Cir Unit 17

- 3831 E Huber St

- 4562 E Elmwood St

- 3931 E Fox Cir

- 3843 E Fargo St

- 3856 E Fairfield St

- 4831 E Hobart St

- 4906 E Brown Rd Unit 38

- 4429 E Downing Cir

- 4222 E Brown Rd Unit 35

- 4222 E Brown Rd Unit 15

- 4222 E Brown Rd Unit 29

- 4222 E Brown Rd Unit 11

- 4222 E Brown Rd Unit 2

- 4222 E Brown Rd Unit 25

- 4222 E Brown Rd Unit 22

- 4222 E Brown Rd Unit 27

- 4222 E Brown Rd Unit 6

- 4222 E Brown Rd Unit 17

- 4222 E Brown Rd Unit 16

- 4222 E Brown Rd Unit 20

- 4222 E Brown Rd Unit 28

- 4222 E Brown Rd Unit 10

- 4222 E Brown Rd Unit 12

- 4222 E Brown Rd Unit 1

- 4222 E Brown Rd Unit 23

- 4222 E Brown Rd Unit 3

- 4222 E Brown Rd Unit 4

- 4222 E Brown Rd Unit 30

Your Personal Tour Guide

Ask me questions while you tour the home.