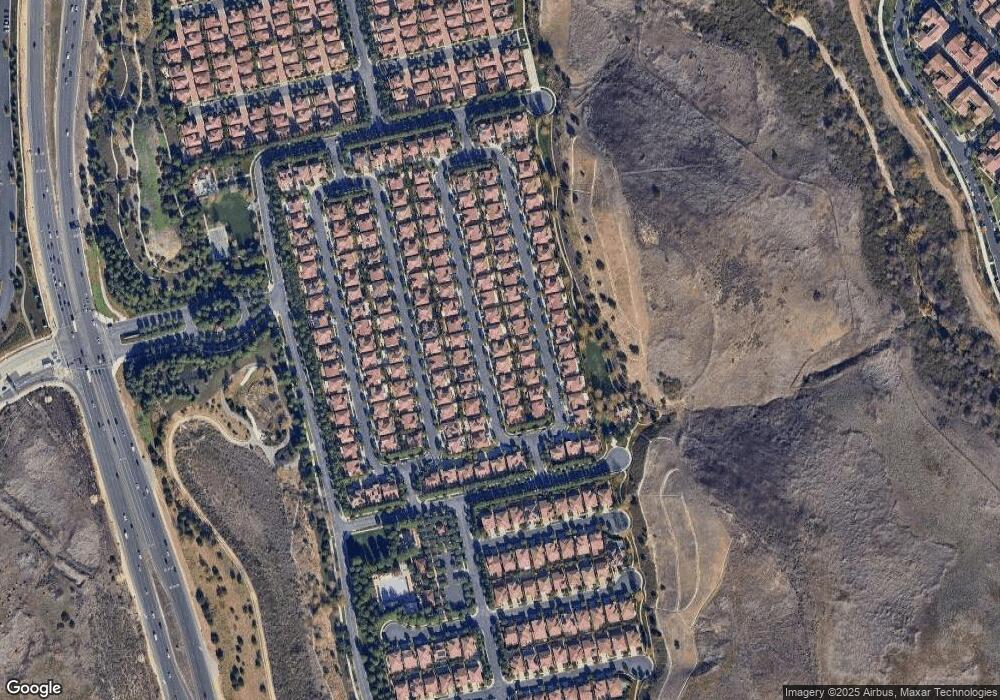

43 Umbria Irvine, CA 92618

Laguna Altura NeighborhoodEstimated Value: $2,681,679 - $3,461,000

3

Beds

3

Baths

2,827

Sq Ft

$1,091/Sq Ft

Est. Value

About This Home

This home is located at 43 Umbria, Irvine, CA 92618 and is currently estimated at $3,085,170, approximately $1,091 per square foot. 43 Umbria is a home with nearby schools including Alderwood Elementary, Rancho San Joaquin Middle School, and University High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 5, 2013

Sold by

Fu Michael Hanway

Bought by

Fu Jessica Iskandar

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$381,500

Interest Rate

2.5%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Feb 6, 2013

Sold by

Irvine Pacific Lp

Bought by

Iskandar Andrew Steven and Fu Jessica Iskandar

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$381,500

Interest Rate

2.5%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fu Jessica Iskandar | -- | First American Title Company | |

| Iskandar Andrew Steven | -- | First American Title Company | |

| Iskandar Andrew Steven | $1,056,500 | First American Title Company | |

| Irvine Pacific Lp | -- | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Iskandar Andrew Steven | $381,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $17,520 | $1,300,561 | $775,506 | $525,055 |

| 2024 | $17,520 | $1,275,060 | $760,300 | $514,760 |

| 2023 | $17,230 | $1,250,059 | $745,392 | $504,667 |

| 2022 | $16,973 | $1,225,549 | $730,777 | $494,772 |

| 2021 | $16,726 | $1,201,519 | $716,448 | $485,071 |

| 2020 | $16,592 | $1,189,199 | $709,101 | $480,098 |

| 2019 | $16,362 | $1,165,882 | $695,197 | $470,685 |

| 2018 | $16,172 | $1,143,022 | $681,566 | $461,456 |

| 2017 | $15,938 | $1,120,610 | $668,202 | $452,408 |

| 2016 | $15,710 | $1,098,638 | $655,100 | $443,538 |

| 2015 | $15,550 | $1,082,136 | $645,260 | $436,876 |

| 2014 | $16,188 | $1,060,939 | $632,620 | $428,319 |

Source: Public Records

Map

Nearby Homes

- 70 Livia

- 75 Lupari

- 61 Lupari

- 76 Bianco

- 105 Iron Gate

- Andalucia Residence 1 Plan at Andalucia

- Andalucia Residence 2 Plan at Andalucia

- Andalucia Residence 3 Plan at Andalucia

- 133 Weathervane

- 113 Bottlebrush

- 67 Canopy Unit 22

- 779 Benchmark

- 68 Dovetail Unit 116

- 22271 Caminito Arroyo Seco Unit 48

- 22256 Caminito Mescalero

- 228 Terra Cotta Unit 7

- 22131 Caminito Vino

- 23372 Caminito Andreta Unit 147

- 5311 Cantante

- 5231 Moya