430 Robles Rd Paso Robles, CA 93446

Estimated Value: $824,000 - $2,030,000

3

Beds

3

Baths

2,242

Sq Ft

$536/Sq Ft

Est. Value

About This Home

This home is located at 430 Robles Rd, Paso Robles, CA 93446 and is currently estimated at $1,201,974, approximately $536 per square foot. 430 Robles Rd is a home located in San Luis Obispo County with nearby schools including Georgia Brown Dual Immersion Magnet Elementary School, George H. Flamson Middle School, and Paso Robles High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2010

Sold by

Guglielmo Joseph M and Guglielmo Sarah L

Bought by

Guglielmo Joseph M and Guglielmo Sarah L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$196,924

Interest Rate

4.17%

Mortgage Type

New Conventional

Estimated Equity

$1,005,050

Purchase Details

Closed on

Jan 9, 2008

Sold by

Guglielmo Joe and Guglielmo Sarah L

Bought by

Guglielmo Joseph M and Guglielmo Sarah L

Purchase Details

Closed on

Mar 24, 1998

Sold by

Ericson Dean and Ericson Heather

Bought by

Guglielmo Joe and Guglielmo Sarah L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

7.18%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Guglielmo Joseph M | -- | Chicago Title Company | |

| Guglielmo Joseph M | -- | Fidelity National Title Co | |

| Guglielmo Joseph M | -- | None Available | |

| Guglielmo Joe | $225,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Guglielmo Joseph M | $300,000 | |

| Closed | Guglielmo Joe | $180,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,725 | $359,233 | $151,672 | $207,561 |

| 2024 | $3,657 | $352,191 | $148,699 | $203,492 |

| 2023 | $3,657 | $345,286 | $145,784 | $199,502 |

| 2022 | $3,593 | $338,517 | $142,926 | $195,591 |

| 2021 | $3,521 | $331,880 | $140,124 | $191,756 |

| 2020 | $3,484 | $328,478 | $138,688 | $189,790 |

| 2019 | $3,414 | $322,038 | $135,969 | $186,069 |

| 2018 | $3,346 | $315,724 | $133,303 | $182,421 |

| 2017 | $3,132 | $309,535 | $130,690 | $178,845 |

| 2016 | $3,069 | $303,467 | $128,128 | $175,339 |

| 2015 | $3,021 | $298,910 | $126,204 | $172,706 |

| 2014 | $2,906 | $293,055 | $123,732 | $169,323 |

Source: Public Records

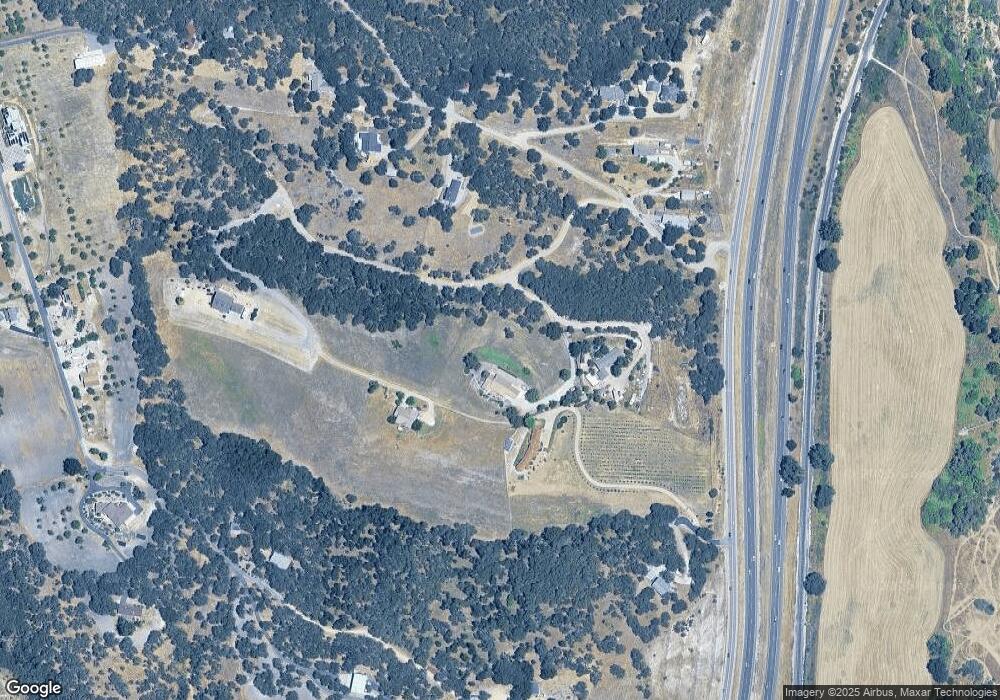

Map

Nearby Homes

- 3725 Plymouth Hill Ln

- 436 Calle Alto St

- 534 Fein Ave

- 1101 Vinaza Rd

- 1101 Mazzini Rd

- 1107 Mazzini Rd

- 1113 Vinaza Rd

- 1100 Mazzini Rd

- 1106 Mazzini Rd

- 1123 Mazzini Rd

- 1112 Mazzini Rd

- 1135 Vinaza Rd

- 1141 Mazzini Rd

- 1124 Vinaza Rd

- 1124 Mazzini Rd

- 1130 Vinaza Rd

- 3121 Spring St Unit 106

- 155 Fairview Ln

- 102 Glencrest Ln

- 2425 Traditions Loop

- 550 Villa Lots Rd

- 320 Camino Vista Cielo

- 0 Camino Vista Cielo Unit NS19216595

- 3790 Sky Ridge Dr

- 250 Villa Lots Rd

- 3200 Mira Vista Way

- 250 Wild Rose Ln

- 240 Wild Rose Ln

- 4220 Stockdale Rd

- 3725 Sky Ridge Dr

- 3730 Mira Vista Way

- 3700 Mira Vista Way

- 3811 Mira Vista Way

- 3750 Sky Ridge Dr

- 620 Villa Lots Rd

- 3780 Sky Ridge Dr

- 235 Villa Lots Rd

- 3715 Sky Ridge Dr

- 3711 Mira Vista Way

- 910 W Hollow Dr