4320 Clares St Unit L Capitola, CA 95010

Estimated Value: $753,000 - $1,167,000

2

Beds

2

Baths

1,156

Sq Ft

$776/Sq Ft

Est. Value

About This Home

This home is located at 4320 Clares St Unit L, Capitola, CA 95010 and is currently estimated at $897,025, approximately $775 per square foot. 4320 Clares St Unit L is a home located in Santa Cruz County with nearby schools including Soquel Elementary School, New Brighton Middle School, and Mission Hill Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 19, 2024

Sold by

Breed Rose

Bought by

Rose Marie Breed Living Trust and Breed

Current Estimated Value

Purchase Details

Closed on

May 25, 2007

Sold by

Parchment Charles Christopher and Parchment Cynthia Louise

Bought by

Parchment Charles Christopher and Parchment Cynthia Louise

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$233,700

Interest Rate

6.14%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 7, 1997

Sold by

Barber Harold M and Kay Elizabeth

Bought by

Breed Dwight and Breed Rose

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rose Marie Breed Living Trust | -- | None Listed On Document | |

| Parchment Charles Christopher | -- | Accommodation | |

| Parchment Charles Christopher | -- | First American Title Company | |

| Breed Dwight | $220,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Parchment Charles Christopher | $233,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,648 | $351,295 | $210,777 | $140,518 |

| 2023 | $4,521 | $337,653 | $202,592 | $135,061 |

| 2022 | $4,444 | $331,032 | $198,619 | $132,413 |

| 2021 | $4,320 | $324,542 | $194,725 | $129,817 |

| 2020 | $4,259 | $321,214 | $192,728 | $128,486 |

| 2019 | $4,156 | $314,915 | $188,949 | $125,966 |

| 2018 | $4,072 | $308,740 | $185,244 | $123,496 |

| 2017 | $4,006 | $302,685 | $181,611 | $121,074 |

| 2016 | $3,781 | $296,750 | $178,050 | $118,700 |

| 2015 | $3,683 | $292,293 | $175,376 | $116,917 |

| 2014 | $3,603 | $286,568 | $171,941 | $114,627 |

Source: Public Records

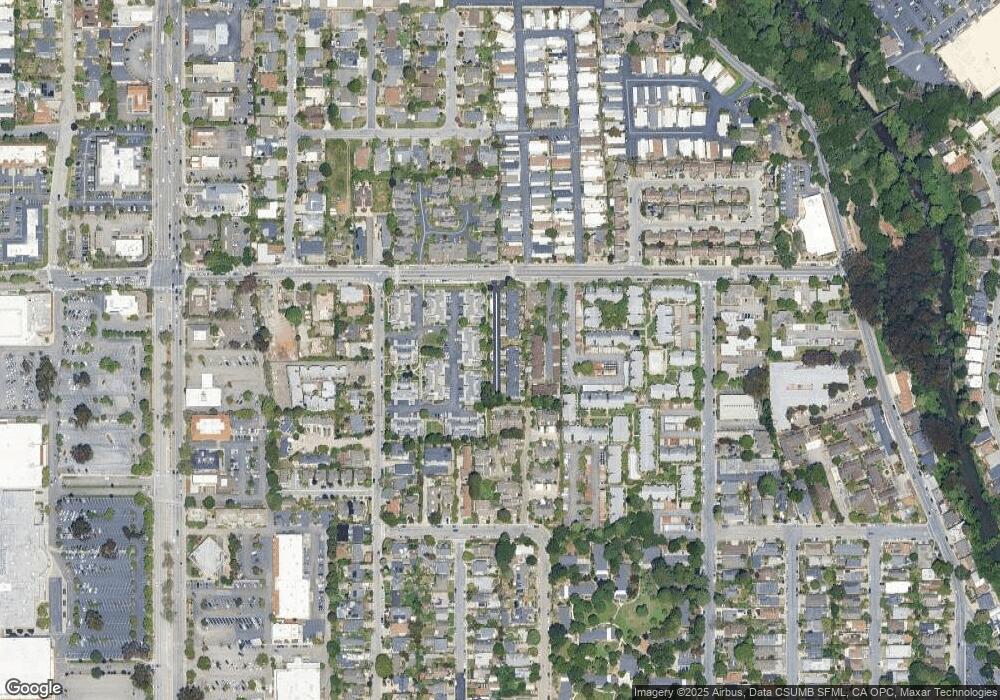

Map

Nearby Homes

- 1901 Courtyard Dr Unit D

- 4230 Grace St

- 1925 46th Ave Unit 158

- 1925 46th Ave Unit 71

- 1925 46th Ave Unit 121

- 1925 46th Ave Unit 60

- 4425 Clares St Unit 52

- 2155 Wharf Rd Unit 12

- 4475 Diamond St Unit 3

- 4750 Capitola Rd

- 1505 42nd Ave Unit 7

- 4380 Diamond St Unit 3

- 1420 Ruby Ct Unit 1

- 522 Oak Dr

- 1415 Ruby Ct Unit 1

- 5080 Garnet St

- 4528 Soquel Wharf Rd

- 4160 Jade St Unit 90

- 4870 Topaz St

- 312 Cherry Ave

- 4320 Clares St

- 4320 Clares St Unit F

- 4320 Clares St Unit G

- 4320 Clares St Unit H

- 4320 Clares St Unit I

- 4320 Clares St Unit K

- 4320 Clares St Unit A

- 4320 Clares St Unit B

- 4320 Clares St Unit C

- 4320 Clares St Unit D

- 4320 Clares St Unit E

- 4247 Sea Pines Ct

- 4245 Sea Pines Ct

- 4249 Sea Pines Ct

- 4350 Clares St Unit 8

- 4350 Clares St Unit 11

- 4350 Clares St Unit 10

- 4350 Clares St Unit 9

- 4350 Clares St Unit 8

- 4350 Clares St Unit 7