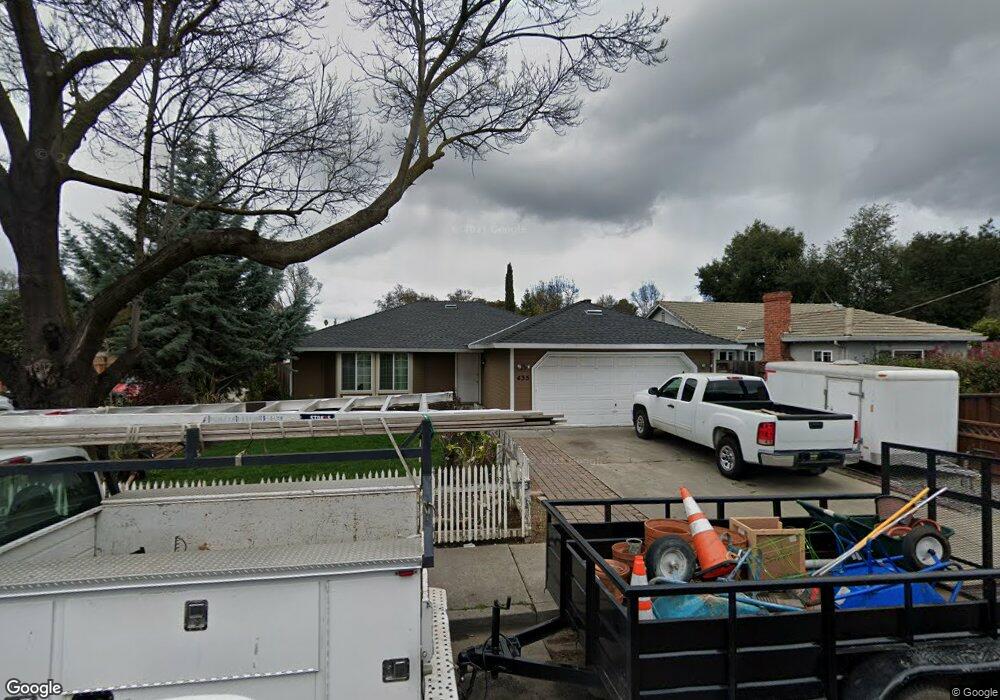

435 Lewis St Gilroy, CA 95020

Estimated Value: $822,000 - $1,003,861

5

Beds

3

Baths

1,380

Sq Ft

$656/Sq Ft

Est. Value

About This Home

This home is located at 435 Lewis St, Gilroy, CA 95020 and is currently estimated at $905,465, approximately $656 per square foot. 435 Lewis St is a home located in Santa Clara County with nearby schools including Eliot Elementary School, South Valley Middle School, and Brownell Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2022

Sold by

Celso Jimenez

Bought by

Jimenez Celso and Jimenez Guadalupe

Current Estimated Value

Purchase Details

Closed on

May 25, 2005

Sold by

Lara Carmelita

Bought by

Jimenez Celso

Purchase Details

Closed on

Jun 18, 2003

Sold by

Eggleston Lissette and Jakez Lissette

Bought by

Lara Carmelita

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$308,000

Interest Rate

6.07%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 10, 2001

Sold by

Williams Lillian

Bought by

Jakez Lissette

Purchase Details

Closed on

Jul 30, 2001

Sold by

Jakez Laura

Bought by

Jakez Lissette

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jimenez Celso | -- | None Listed On Document | |

| Jimenez Celso | $385,000 | -- | |

| Lara Carmelita | $385,000 | Old Republic Title Company | |

| Eggleston Lissette | -- | Old Republic Title Company | |

| Lara Carmelita | -- | Old Republic Title Company | |

| Jakez Lissette | -- | -- | |

| Jakez Lissette | -- | -- | |

| Jakez Laura | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lara Carmelita | $308,000 | |

| Closed | Lara Carmelita | $77,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,478 | $910,634 | $418,166 | $492,468 |

| 2024 | $9,478 | $763,367 | $409,967 | $353,400 |

| 2023 | $9,423 | $748,400 | $401,929 | $346,471 |

| 2022 | $9,269 | $733,727 | $394,049 | $339,678 |

| 2021 | $9,229 | $719,341 | $386,323 | $333,018 |

| 2020 | $9,232 | $711,966 | $382,362 | $329,604 |

| 2019 | $9,044 | $698,007 | $374,865 | $323,142 |

| 2018 | $8,444 | $684,321 | $367,515 | $316,806 |

| 2017 | $8,054 | $626,000 | $336,100 | $289,900 |

| 2016 | $7,479 | $581,000 | $312,000 | $269,000 |

| 2015 | $6,433 | $521,000 | $279,800 | $241,200 |

| 2014 | $6,458 | $516,000 | $277,100 | $238,900 |

Source: Public Records

Map

Nearby Homes

- 332 Lewis St Unit 1/2

- 332 Lewis St

- 7621 Forest St

- 160 Sarafina Way

- 262 E 6th St

- 0 Monterey Rd

- 7711 Monterey St

- 194 4th St

- 8282 Murray Ave Unit 99

- 8282 Murray Ave Unit 65

- 7691 Church St Unit B

- 7630 Hanna St

- 7681 Hanna St

- 7191 Eigleberry St

- 0 Pacheco Pass Hwy

- 0 Magic Springs Dr Unit ML82028522

- 0 Dorrance Rd Unit ML82002071

- 0000 Hecker Pass

- 7051 Eigleberry St

- 7310 Carmel St

- 441 Lewis St

- 421 Lewis St

- 431 Lewis St Unit AB

- 425 Lewis St Unit AB

- 7798 Chestnut St

- 440 Lewis St

- 411 Lewis St

- 7796 Chestnut St

- 430 Lewis St

- 420 Lewis St

- 7794 Chestnut St Unit 47

- 7990 Chestnut St

- 7788 Chestnut St

- 470 Lewis St

- 470 Lewis St

- 7792 Chestnut St

- 7786 Chestnut St

- 7784 Chestnut St Unit 52

- 7790 Chestnut St

- 7782 Chestnut St

Your Personal Tour Guide

Ask me questions while you tour the home.