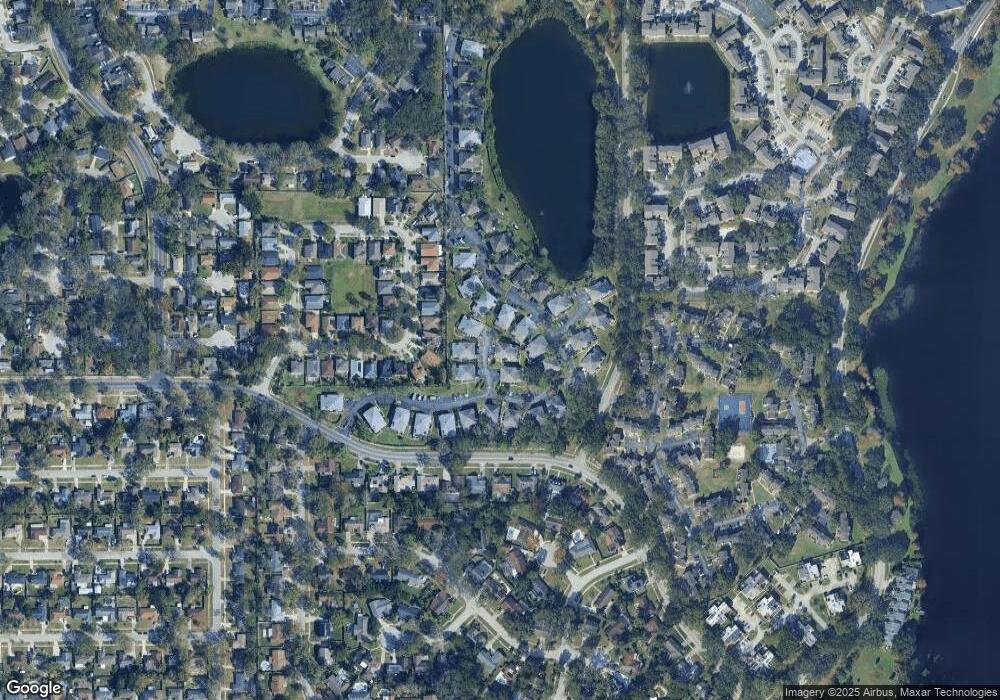

4415 Prairie Ct Unit 15C Orlando, FL 32808

Rosemont NeighborhoodEstimated Value: $163,511 - $181,000

2

Beds

2

Baths

1,084

Sq Ft

$161/Sq Ft

Est. Value

About This Home

This home is located at 4415 Prairie Ct Unit 15C, Orlando, FL 32808 and is currently estimated at $174,128, approximately $160 per square foot. 4415 Prairie Ct Unit 15C is a home located in Orange County with nearby schools including Rosemont Elementary, College Park Middle School, and Edgewater High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 24, 2022

Sold by

Crowl James C

Bought by

Brown David M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,005

Outstanding Balance

$139,785

Interest Rate

3.69%

Mortgage Type

New Conventional

Estimated Equity

$34,343

Purchase Details

Closed on

Dec 11, 2006

Sold by

Reo Florida Accounts Inc

Bought by

Crowl James C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,000

Interest Rate

7.25%

Mortgage Type

Unknown

Purchase Details

Closed on

Nov 30, 2004

Sold by

Greene Noel

Bought by

Reo Florida Accounts Inc

Purchase Details

Closed on

Mar 28, 2003

Sold by

Dunne French Patricia M and Dunne Patricia M

Bought by

Greene Noel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,750

Interest Rate

5.82%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brown David M | $157,900 | Leading Edge Title Partners | |

| Crowl James C | $110,000 | Attorney | |

| Reo Florida Accounts Inc | -- | -- | |

| Greene Noel | $62,900 | Equitable Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brown David M | $150,005 | |

| Previous Owner | Crowl James C | $88,000 | |

| Previous Owner | Greene Noel | $54,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,571 | $170,000 | -- | $170,000 |

| 2024 | $2,340 | $170,000 | -- | $170,000 |

| 2023 | $2,340 | $124,700 | $24,940 | $99,760 |

| 2022 | $1,445 | $92,100 | $18,420 | $73,680 |

| 2021 | $1,278 | $73,700 | $14,740 | $58,960 |

| 2020 | $1,175 | $73,700 | $14,740 | $58,960 |

| 2019 | $1,086 | $59,600 | $11,920 | $47,680 |

| 2018 | $990 | $52,000 | $10,400 | $41,600 |

| 2017 | $924 | $46,600 | $9,320 | $37,280 |

| 2016 | $822 | $36,900 | $7,380 | $29,520 |

| 2015 | $773 | $33,700 | $6,740 | $26,960 |

| 2014 | $100 | $33,700 | $6,740 | $26,960 |

Source: Public Records

Map

Nearby Homes

- 4436 Ring Neck Rd Unit C

- 4596 Pheasant Run Dr Unit C

- 4400 Ring Neck Rd Unit A

- 4449 Ring Neck Rd Unit C

- 4413 Ring Neck Rd Unit 4413

- 4440 Bleasdale Ave

- 4659 Boca Vista Ct

- 4655 Lighthouse Cir Unit 117

- 4611 Lighthouse Cir Unit 114

- 4420 Sugar Loaf Way

- 4026 Shannon Brown Dr

- 4687 Westgrove Way

- 4009 Shannon Brown Dr

- 4825 Lighthouse Cir Unit 4825

- 4804 Lake Ridge Rd Unit 10

- 4409 Watch Hill Rd

- 4732 Cherokee Rose Dr

- 4579 Westgrove Way

- 4892 Cherokee Rose Dr

- 4934 Samoa Cir Unit 7

- 4415 Prairie Ct Unit 30

- 4415 Prairie Ct Unit C

- 4413 Prairie Ct Unit B1

- 4411 Prairie Ct Unit B-2

- 4411 Prairie Ct Unit 15B

- 4411 Prairie Ct Unit B

- 4409 Prairie Ct Unit 15A

- 4403 Prairie Ct Unit B2

- 4403 Prairie Ct Unit B

- 4401 Prairie Ct Unit A

- 4407 Prairie Ct

- 4401 Prairie Ct Unit 11-A

- 4407 Prairie Ct Unit 30

- 4422 Prairie Ct

- 4422 Ring Neck Rd

- 4422 Ring Neck Rd Unit B

- 4422 Ring Neck Rd Unit B-2

- 4412 Ring Neck Rd Unit 18A

- 4405 Prairie Ct Unit B

- 4405 Prairie Ct