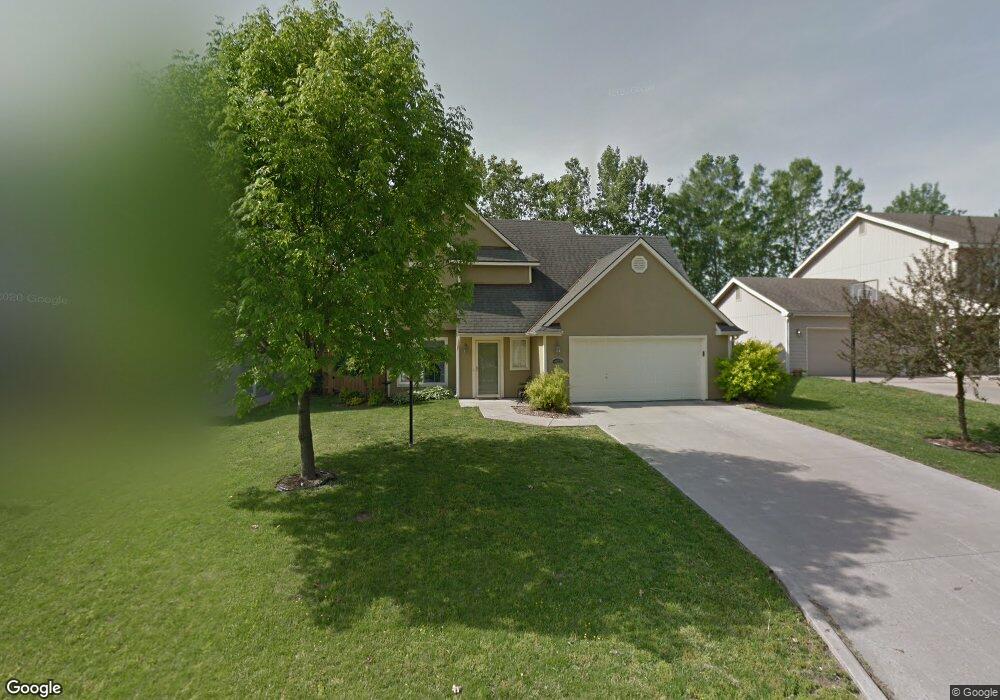

4429 W 25th Place Lawrence, KS 66047

Estimated Value: $290,000 - $336,000

3

Beds

3

Baths

1,472

Sq Ft

$216/Sq Ft

Est. Value

About This Home

This home is located at 4429 W 25th Place, Lawrence, KS 66047 and is currently estimated at $317,956, approximately $216 per square foot. 4429 W 25th Place is a home located in Douglas County with nearby schools including Sunflower Elementary School, Southwest Middle School, and Lawrence High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 7, 2006

Sold by

Skidgel David L and Skidgel Carol E

Bought by

Bennesch Richard C and Bennesch Loren M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Outstanding Balance

$83,023

Interest Rate

6.63%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$234,933

Purchase Details

Closed on

Aug 25, 2003

Sold by

Shenouda Peter V and Shenouda Deana C

Bought by

Skidgel David L and Skidgel Carol E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,725

Interest Rate

4.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 1, 2001

Sold by

Shenouda Chenouda Dr Victor M and Shenouda Margaret

Bought by

Chenouda Peter V and Chenouda Deana C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,760

Interest Rate

6.88%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bennesch Richard C | -- | Commerce Title | |

| Skidgel David L | -- | Commerce Title | |

| Chenouda Peter V | -- | Commerce Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bennesch Richard C | $140,000 | |

| Previous Owner | Skidgel David L | $147,725 | |

| Previous Owner | Chenouda Peter V | $104,760 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,168 | $34,753 | $7,475 | $27,278 |

| 2024 | $4,168 | $33,833 | $7,475 | $26,358 |

| 2023 | $4,035 | $31,510 | $5,520 | $25,990 |

| 2022 | $3,786 | $29,383 | $5,060 | $24,323 |

| 2021 | $3,245 | $24,369 | $4,830 | $19,539 |

| 2020 | $3,085 | $23,299 | $4,830 | $18,469 |

| 2019 | $2,918 | $22,080 | $4,830 | $17,250 |

| 2018 | $2,797 | $21,022 | $4,600 | $16,422 |

| 2017 | $2,745 | $20,413 | $4,600 | $15,813 |

| 2016 | $2,439 | $18,975 | $5,173 | $13,802 |

| 2015 | $2,464 | $19,159 | $5,173 | $13,986 |

| 2014 | $2,492 | $19,562 | $5,173 | $14,389 |

Source: Public Records

Map

Nearby Homes

- 4400 Gretchen Ct

- 2513 Scottsdale St

- 4812 Tempe St

- 2516 Via Linda Dr

- 2429 Via Linda Dr

- 4312 Wimbledon Dr

- 4112 Blackjack Oak Dr

- 2109 Riviera Dr

- 2101 Riviera Dr

- 2100 Inverness Dr

- 2009 Riviera Ct

- 4206 Nicklaus Dr

- 3713 Sunnybrook Ln

- 2523 Morningside Dr

- 1908 Crossgate Dr

- 4709 Carmel Place

- 4617 Merion Ct

- 1608 Prestwick Dr

- 3406 W 25th Terrace

- 4425 W 25th Place

- 4433 W 25th Place

- 4421 W 25th Place

- 4437 W 25th Place

- 4428 W 25th Place

- 4424 W 25th Place

- 4432 W 25th Place

- 4417 W 25th Place

- 4420 W 25th Place

- 2433 Jacob Ave

- 4416 W 25th Place

- 2429 Jacob Ave

- 4413 W 25th Place

- 4427 Gretchen Ct

- 4423 Gretchen Ct

- 4431 Gretchen Ct

- 2425 Jacob Ave

- 4419 Gretchen Ct

- 4412 W 25th Place

- 4409 W 25th Place