4440 Eagle Peak Rd Unit C Concord, CA 94521

Midtown Concord NeighborhoodEstimated Value: $551,000 - $685,000

4

Beds

3

Baths

1,496

Sq Ft

$395/Sq Ft

Est. Value

About This Home

This home is located at 4440 Eagle Peak Rd Unit C, Concord, CA 94521 and is currently estimated at $591,448, approximately $395 per square foot. 4440 Eagle Peak Rd Unit C is a home located in Contra Costa County with nearby schools including Mountain View Elementary School, El Dorado Middle School, and Concord High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 20, 2015

Sold by

Mosley Shawn

Bought by

Hom Jason

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$318,800

Outstanding Balance

$250,573

Interest Rate

3.85%

Mortgage Type

New Conventional

Estimated Equity

$340,875

Purchase Details

Closed on

Aug 17, 2000

Sold by

Lita Mejia

Bought by

Mosley Shawn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,750

Interest Rate

10.49%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hom Jason | $398,500 | Fidelity National Title Co | |

| Mosley Shawn | $227,500 | Placer Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hom Jason | $318,800 | |

| Previous Owner | Mosley Shawn | $204,750 | |

| Closed | Mosley Shawn | $13,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,116 | $471,737 | $213,081 | $258,656 |

| 2024 | $5,831 | $462,488 | $208,903 | $253,585 |

| 2023 | $5,831 | $453,420 | $204,807 | $248,613 |

| 2022 | $5,744 | $444,531 | $200,792 | $243,739 |

| 2021 | $5,595 | $435,815 | $196,855 | $238,960 |

| 2019 | $5,481 | $422,890 | $191,017 | $231,873 |

| 2018 | $5,267 | $414,599 | $187,272 | $227,327 |

| 2017 | $5,085 | $406,470 | $183,600 | $222,870 |

| 2016 | $4,951 | $398,500 | $180,000 | $218,500 |

| 2015 | $3,750 | $285,222 | $48,137 | $237,085 |

| 2014 | $3,750 | $279,636 | $47,195 | $232,441 |

Source: Public Records

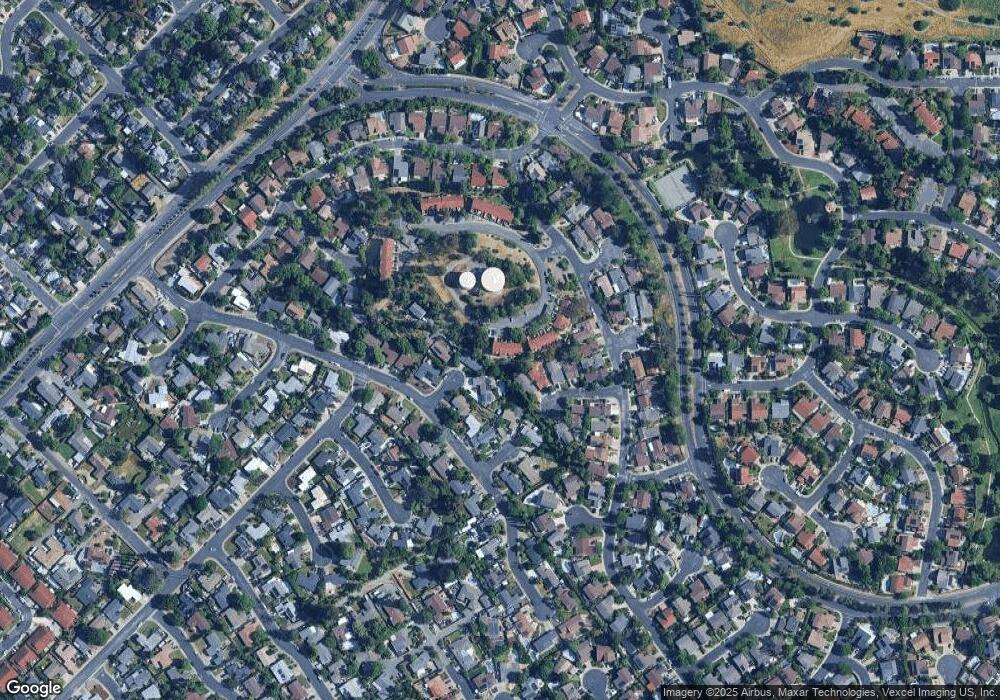

Map

Nearby Homes

- 1331 Waterfall Way

- 1272 Chelsea Way

- 4380 Saint Charles Place

- 4317 Cowell Rd

- 1431 Bel Air Dr Unit D

- 4413 Marsh Elder Ct

- 4520 Melody Dr Unit A

- 1337 Cape Cod Way

- 4185 Huckleberry Dr

- 4632 Melody Dr Unit E

- 4495 Wildberry Ct

- 4362 Lynn Dr

- 4044 Cowell Rd

- 1449 Cape Cod Way

- 4040 Davenport Ln

- 4501 Shellflower Ct

- 4058 Treat Blvd

- 1170 Green Gables Ct

- 4462 Machado Dr

- 1455 Latour Ln Unit 43

- 4440 Eagle Peak Rd Unit D

- 4440 Eagle Peak Rd Unit B

- 1327 Tudor Ct

- 1320 Tudor Ct

- 4430 Eagle Peak Rd Unit C

- 4430 Eagle Peak Rd

- 4430 Eagle Peak Rd Unit D

- 4430 Eagle Peak Rd Unit C

- 4430 Eagle Peak Rd Unit B

- 4430 Eagle Peak Rd Unit A

- 1311 Pineview Ln

- 1321 Pineview Ln

- 1321 Tudor Ct

- 1331 Pineview Ln

- 4367 Pembroke Dr

- 1319 Perth Ct

- 4361 Pembroke Dr

- 4373 Pembroke Dr

- 1341 Pineview Ln

- 4420 Eagle Peak Rd Unit D