4443 Corte Arbusto Camarillo, CA 93012

Estimated Value: $791,000 - $841,000

3

Beds

2

Baths

1,473

Sq Ft

$555/Sq Ft

Est. Value

About This Home

This home is located at 4443 Corte Arbusto, Camarillo, CA 93012 and is currently estimated at $817,433, approximately $554 per square foot. 4443 Corte Arbusto is a home located in Ventura County with nearby schools including La Mariposa Elementary School, Las Colinas Middle School, and Adolfo Camarillo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 12, 2009

Sold by

Lobdell Donna J

Bought by

Paolella Stephen and Paolella Melissa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,910

Outstanding Balance

$222,410

Interest Rate

5.15%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$595,023

Purchase Details

Closed on

Jun 8, 2006

Sold by

Lobdell Donna J

Bought by

Lobdell Donna J

Purchase Details

Closed on

Oct 22, 2004

Sold by

Pollnow Linda S

Bought by

Lobdell Donna J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$370,000

Interest Rate

5.79%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 2, 2001

Sold by

Pardee Construction Company

Bought by

Pollnow Linda S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$244,864

Interest Rate

6.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Paolella Stephen | $390,000 | Lawyers Title Company | |

| Lobdell Donna J | -- | None Available | |

| Lobdell Donna J | $450,000 | Southland Title Company | |

| Pollnow Linda S | $306,500 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Paolella Stephen | $350,910 | |

| Previous Owner | Lobdell Donna J | $370,000 | |

| Previous Owner | Pollnow Linda S | $30,608 | |

| Previous Owner | Pollnow Linda S | $244,864 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,525 | $502,077 | $251,039 | $251,038 |

| 2024 | $5,525 | $492,233 | $246,117 | $246,116 |

| 2023 | $5,327 | $482,582 | $241,291 | $241,291 |

| 2022 | $5,311 | $473,120 | $236,560 | $236,560 |

| 2021 | $5,120 | $463,844 | $231,922 | $231,922 |

| 2020 | $5,102 | $459,090 | $229,545 | $229,545 |

| 2019 | $5,079 | $450,090 | $225,045 | $225,045 |

| 2018 | $4,985 | $441,266 | $220,633 | $220,633 |

| 2017 | $4,692 | $432,614 | $216,307 | $216,307 |

| 2016 | $4,580 | $424,132 | $212,066 | $212,066 |

| 2015 | $4,532 | $417,764 | $208,882 | $208,882 |

| 2014 | $4,501 | $409,584 | $204,792 | $204,792 |

Source: Public Records

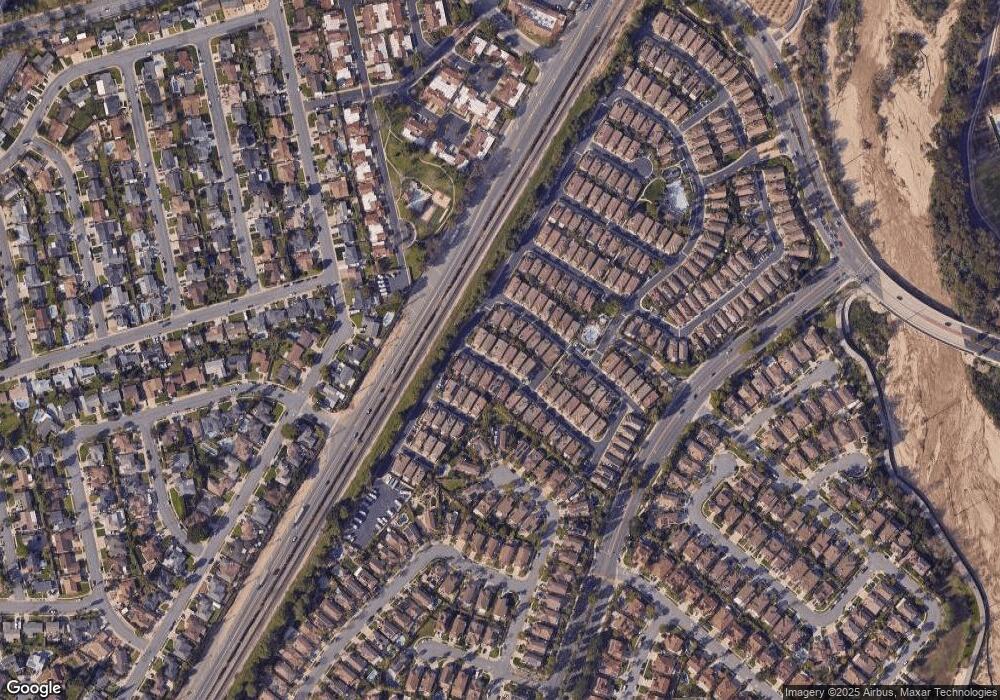

Map

Nearby Homes

- 2052 Santo Domingo

- 4718 La Puma Ct

- 4532 Los Damascos Place

- 2255 Placita San Rufino

- 4130 Fortuna Ave

- 1631 Alta Vista Place

- 2854 Via Descanso

- 2860 Via Descanso

- 1492 Via Bonito

- 2576 Villamonte Ct

- 5016 Trevor Dr

- 2410 Quartsite Dr

- 2424 Quartsite Dr

- 2420 Quartsite Dr

- 2722 Antonio Dr

- 2533 Antonio Dr Unit 302

- 2713 Antonio Dr Unit 110

- 2713 Antonio Dr Unit 108

- 2713 Antonio Dr Unit 105

- 232 Talud Terrace Unit 19

- 4425 Corte Arbusto

- 4459 Corte Arbusto

- 4475 Corte Arbusto

- 4409 Corte Arbusto

- 4452 Via Aciando

- 4430 Via Aciando

- 4464 Via Aciando

- 4408 Via Aciando

- 4491 Corte Arbusto

- 4444 Corte Arbusto

- 4436 Corte Arbusto

- 4490 Via Aciando

- 4460 Corte Arbusto

- 4422 Corte Arbusto

- 4506 Via Aciando

- 4476 Corte Arbusto

- 4408 Corte Arbusto

- 4522 Via Aciando

- 4490 Corte Arbusto

- 4459 Las Veredas Place