44676 Springvail Ct Unit 147 Temecula, CA 92592

Vail Ranch NeighborhoodEstimated Value: $660,000 - $706,000

3

Beds

3

Baths

2,180

Sq Ft

$312/Sq Ft

Est. Value

About This Home

This home is located at 44676 Springvail Ct Unit 147, Temecula, CA 92592 and is currently estimated at $679,814, approximately $311 per square foot. 44676 Springvail Ct Unit 147 is a home located in Riverside County with nearby schools including Pauba Valley Elementary School, Vail Ranch Middle School, and Great Oak High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 30, 2012

Sold by

Lacombe Edward

Bought by

Lacombe Monica

Current Estimated Value

Purchase Details

Closed on

Dec 20, 2002

Sold by

Lacombe Edward Joseph and Lacombe Monica Le Rai

Bought by

Lacombe Edward Joseph and Lacombe Monica Le Rai

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$261,000

Outstanding Balance

$115,169

Interest Rate

6.62%

Estimated Equity

$564,645

Purchase Details

Closed on

Nov 8, 2001

Sold by

William Lyon Homes Inc

Bought by

Lacombe Edward and Rance Monica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$178,800

Interest Rate

7.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lacombe Monica | -- | None Available | |

| Lacombe Edward Joseph | -- | Fntic | |

| Lacombe Edward | $224,000 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lacombe Edward Joseph | $261,000 | |

| Closed | Lacombe Edward | $178,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,400 | $363,247 | $81,235 | $282,012 |

| 2023 | $4,400 | $349,144 | $78,082 | $271,062 |

| 2022 | $3,942 | $311,799 | $76,551 | $235,248 |

| 2021 | $3,857 | $305,686 | $75,050 | $230,636 |

| 2020 | $3,813 | $302,553 | $74,281 | $228,272 |

| 2019 | $3,767 | $296,622 | $72,825 | $223,797 |

| 2018 | $3,691 | $290,807 | $71,398 | $219,409 |

| 2017 | $3,624 | $285,106 | $69,999 | $215,107 |

| 2016 | $3,555 | $279,517 | $68,627 | $210,890 |

| 2015 | $3,492 | $275,321 | $67,598 | $207,723 |

| 2014 | $3,386 | $269,930 | $66,275 | $203,655 |

Source: Public Records

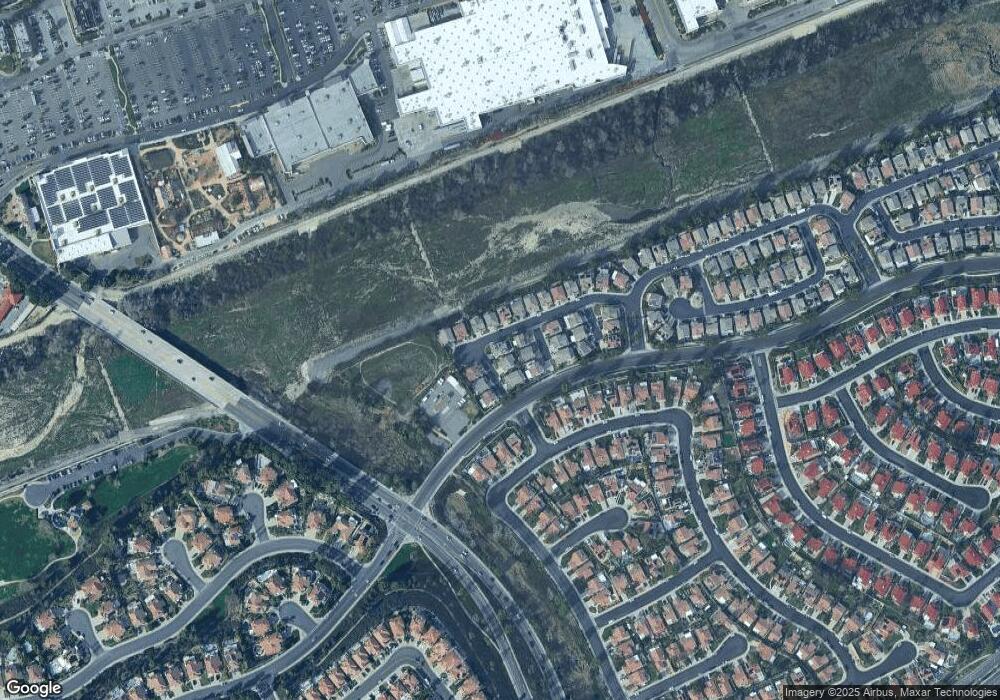

Map

Nearby Homes

- 44904 Linalou Ranch Rd

- 44753 Vail Oak Rd

- 32653 Hupa Dr

- 32764 Freesia Way

- 32095 Via Cordoba

- 45360 Vista Verde

- 32847 Saskia Pass

- 32122 Corte Eldorado

- 44011 Rivo Ct

- 45127 Tioga St

- 0 De Portola Unit SW25275250

- 0 De Portola Unit SW25275215

- 33012 Tulley Ranch Rd

- 45422 Camino Monzon

- 43065 Avola Ct

- 44686 Calle Hilario

- 45316 Saint Tisbury St

- 45211 Tioga St

- 45344 Saint Tisbury St

- 31593 Calle Los Padres

- 44683 Woodvail Ct Unit 145

- 44689 Springvail Ct

- 44689 Springvail Ct

- 44673 Woodvail Ct

- 44690 Woodvail Ct

- 32374 Gardenvail Dr

- 32366 Gardenvail Dr

- 32358 Gardenvail Dr

- 44679 Springvail Ct

- 44686 Springvail Ct Unit 148

- 32382 Gardenvail Dr

- 44696 Springvail Ct Unit 149

- 32390 Gardenvail Dr

- 32398 Gardenvail Dr

- 44693 Woodvail Ct

- 32406 Gardenvail Dr Unit 7

- 44699 Springvail Ct

- 44670 Woodvail Ct

- 44680 Woodvail Ct

- 32414 Gardenvail Dr