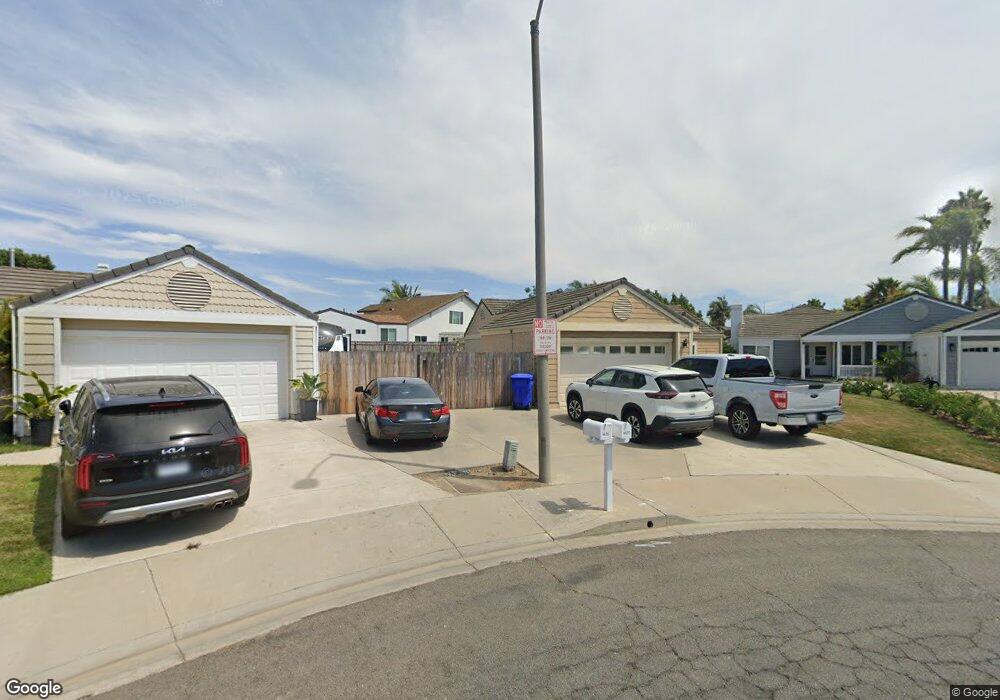

4475 Bermuda Dunes Place Oceanside, CA 92057

North Valley NeighborhoodEstimated Value: $704,040 - $898,000

3

Beds

2

Baths

1,191

Sq Ft

$670/Sq Ft

Est. Value

About This Home

This home is located at 4475 Bermuda Dunes Place, Oceanside, CA 92057 and is currently estimated at $797,760, approximately $669 per square foot. 4475 Bermuda Dunes Place is a home located in San Diego County with nearby schools including Reynolds Elementary School, Martin Luther King Jr. Middle School, and El Camino High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2008

Sold by

Andrews Michael G and Andrews Micheal G

Bought by

Andrews Michael G and Andrews Laura L

Current Estimated Value

Purchase Details

Closed on

Oct 22, 1999

Sold by

Sandiego Romeo B and Sandiego Carlota C

Bought by

Andrews Michael G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,275

Outstanding Balance

$47,222

Interest Rate

7.84%

Estimated Equity

$750,538

Purchase Details

Closed on

Jul 18, 1994

Sold by

Mcdougall Patrick Phillip

Bought by

Mcdougall Terry L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,800

Interest Rate

8.51%

Mortgage Type

VA

Purchase Details

Closed on

Jul 15, 1994

Sold by

Mcdougall Terry L and Hayden Terry L

Bought by

Sandiego Romeo B and Sandiego Carlota C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,800

Interest Rate

8.51%

Mortgage Type

VA

Purchase Details

Closed on

Mar 6, 1992

Purchase Details

Closed on

Apr 30, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Andrews Michael G | -- | None Available | |

| Andrews Michael G | $164,500 | First American Title Ins Co | |

| Mcdougall Terry L | -- | Commonwealth Land Title Co | |

| Sandiego Romeo B | $140,000 | Commonwealth Land Title Co | |

| -- | $145,000 | -- | |

| -- | $103,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Andrews Michael G | $156,275 | |

| Previous Owner | Sandiego Romeo B | $142,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,939 | $252,806 | $126,403 | $126,403 |

| 2024 | $2,939 | $247,850 | $123,925 | $123,925 |

| 2023 | $2,850 | $242,992 | $121,496 | $121,496 |

| 2022 | $2,806 | $238,228 | $119,114 | $119,114 |

| 2021 | $2,814 | $233,558 | $116,779 | $116,779 |

| 2020 | $2,730 | $231,164 | $115,582 | $115,582 |

| 2019 | $2,653 | $226,632 | $113,316 | $113,316 |

| 2018 | $2,624 | $222,190 | $111,095 | $111,095 |

| 2017 | $2,575 | $217,834 | $108,917 | $108,917 |

| 2016 | $2,493 | $213,564 | $106,782 | $106,782 |

| 2015 | $2,422 | $210,358 | $105,179 | $105,179 |

| 2014 | $2,333 | $206,238 | $103,119 | $103,119 |

Source: Public Records

Map

Nearby Homes

- 4466 Saint Andrews Place

- 213 Festival Dr

- 4413 Point Degada

- 4418 Jill St

- 4560 Calle Del Palo

- 4425 Arbor Cove Cir

- 4556 Mariners Bay

- 853 Dana Point Way

- 854 Dana Point Way

- 638 Sumner Way Unit 2

- 194 Avenida Descanso Unit H

- 625 Sumner Way Unit 4

- 625 Sumner Way Unit 2

- 27 Avenida Descanso

- 195 Avenida Descanso Unit 121

- 175 Avenida Descanso Unit 106

- 4616 N River Rd Unit 61

- 4273 Rockport Bay Way

- 783 Timber Cove Way

- 231 Riverview Way

- 777 Gregory Ln

- 4476 Bermuda Dunes Place

- 4467 Bermuda Dunes Place

- 781 Gregory Ln

- 773 Gregory Ln

- 4472 Bermuda Dunes Place

- 4463 Bermuda Dunes Place

- 4470 Pebble Beach Dr

- 4474 Pebble Beach Dr

- 4468 Bermuda Dunes Place

- 785 Gregory Ln

- 4466 Pebble Beach Dr

- 4478 Pebble Beach Dr

- 4462 Pebble Beach Dr

- 4482 Pebble Beach Dr

- 4459 Bermuda Dunes Place

- 4464 Bermuda Dunes Place

- 791 Gregory Ln

- 4469 Tamarisk Cir

- 4458 Pebble Beach Dr