449 Mission Hills Way E Chanhassen, MN 55317

Estimated Value: $303,000 - $315,000

2

Beds

2

Baths

1,236

Sq Ft

$250/Sq Ft

Est. Value

About This Home

This home is located at 449 Mission Hills Way E, Chanhassen, MN 55317 and is currently estimated at $309,022, approximately $250 per square foot. 449 Mission Hills Way E is a home located in Carver County with nearby schools including Chanhassen Elementary School, Pioneer Ridge Middle School, and Chanhassen High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2020

Sold by

Vogelsgesang Rustin

Bought by

Kriz Alyson and Kriz Sandra

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$206,250

Interest Rate

2.71%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 31, 2018

Sold by

Gustafson Frank R and Gustafson Theresa M

Bought by

Vogelgesang Rustin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$199,975

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 27, 2006

Sold by

Harris Fred J and Harris Kelly K

Bought by

Gustafson Frank R and Gustafson Theresa M

Purchase Details

Closed on

Apr 30, 2004

Sold by

Harstad Carl L

Bought by

Harris Fred J

Purchase Details

Closed on

Mar 26, 1999

Sold by

Stutzman Ricky A and Stutzman Lisa A

Bought by

Harstad Carl L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kriz Alyson | $275,000 | Titlesmart Inc | |

| Vogelgesang Rustin | $210,500 | Title Mark | |

| Gustafson Frank R | $184,900 | -- | |

| Harris Fred J | $169,000 | -- | |

| Harstad Carl L | $115,000 | -- | |

| Kriz Alyson Alyson | $275,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kriz Alyson | $206,250 | |

| Previous Owner | Vogelgesang Rustin | $199,975 | |

| Closed | Kriz Alyson Alyson | $275,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,008 | $286,900 | $70,000 | $216,900 |

| 2024 | $2,924 | $304,500 | $65,000 | $239,500 |

| 2023 | $2,860 | $291,800 | $65,000 | $226,800 |

| 2022 | $2,716 | $288,200 | $61,400 | $226,800 |

| 2021 | $2,036 | $193,900 | $51,100 | $142,800 |

| 2020 | $1,946 | $182,300 | $51,100 | $131,200 |

| 2019 | $1,916 | $172,800 | $48,700 | $124,100 |

| 2018 | $1,728 | $172,800 | $48,700 | $124,100 |

| 2017 | $1,738 | $154,800 | $44,300 | $110,500 |

| 2016 | $1,998 | $145,400 | $0 | $0 |

| 2015 | $1,868 | $137,100 | $0 | $0 |

| 2014 | $1,868 | $126,400 | $0 | $0 |

Source: Public Records

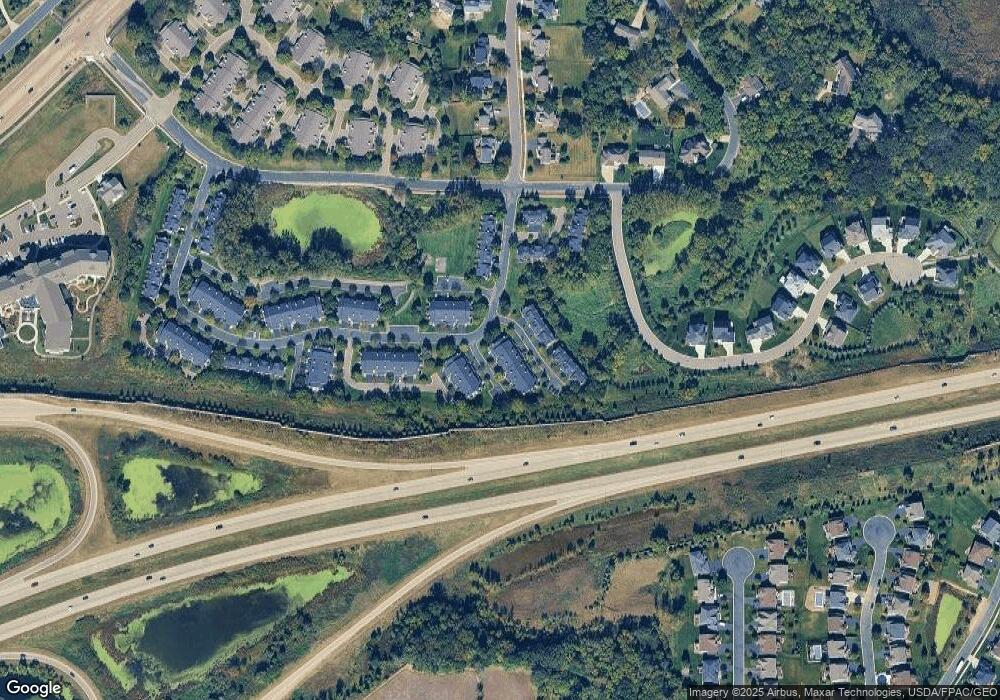

Map

Nearby Homes

- 420 Monk Ct

- 513 Mission Hills Way W

- 566 Mission Hills Way W

- 572 Blackbird Ct

- 537 Mission Hills Dr

- 179 Lakeview Rd E

- 732 Wildflower Ln

- 763 Stonegate Rd

- 8933 SW Village Loop

- 742 Maggie Way

- 600 Lyman Blvd

- 441 Lyman Blvd

- 8627 Lake Riley Dr

- 8973 SW Village Loop

- 25 Riley Ridge

- TBD County Road 101

- 9235 Lake Riley Blvd

- 18709 Melrose Chase

- 9002 Riley Lake Rd

- 18844 Bearpath Trail

- 449 Mission Hills Way E Unit 106

- 445 Mission Hills Way E

- 425 Monk Ct

- 421 Monk Ct

- 441 Mission Hills Way E

- 417 Monk Ct

- 417 Monk Ct Unit 97

- 437 Mission Hills Way E

- 413 Monk Ct

- 433 Mission Hills Way E

- 409 Monk Ct

- 459 Mission Hills Way E

- 455 Mission Hills Way E

- 463 Mission Hills Way E

- 451 Mission Hills Way E Unit 90

- 429 Mission Hills Way E

- 470 Mission Hills Way E

- 470 Mission Hills Way E Unit 115

- 405 Monk Ct Unit 100

- 424 Monk Ct