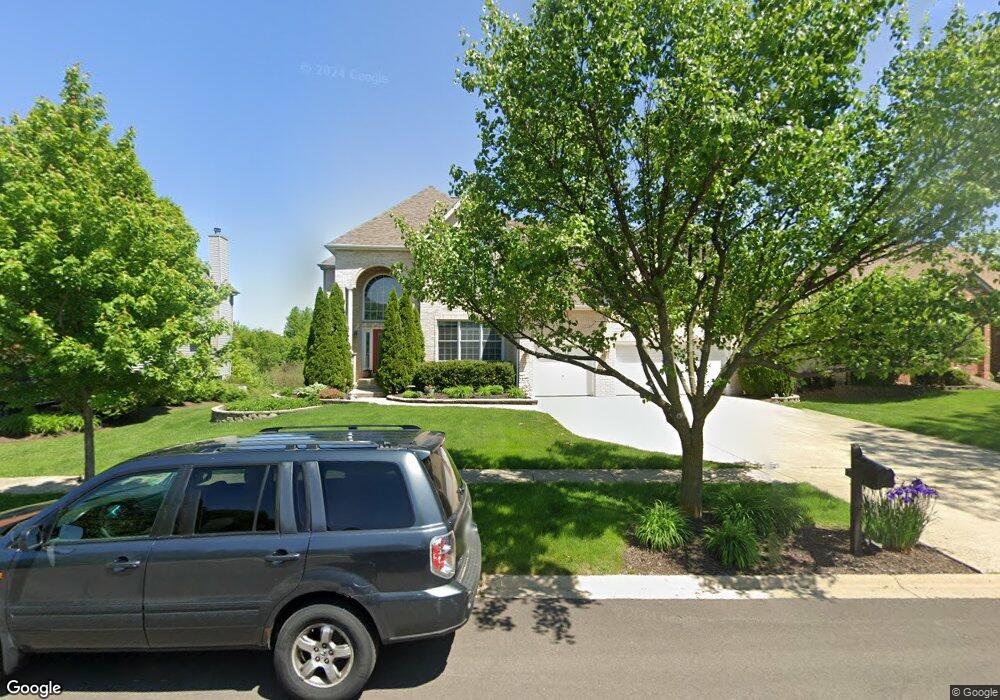

452 Sudbury Cir Oswego, IL 60543

South Oswego NeighborhoodEstimated Value: $579,193 - $638,000

4

Beds

3

Baths

3,646

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 452 Sudbury Cir, Oswego, IL 60543 and is currently estimated at $600,798, approximately $164 per square foot. 452 Sudbury Cir is a home located in Kendall County with nearby schools including Prairie Point Elementary School, Traughber Junior High School, and Oswego High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2019

Sold by

Sperandeo Joseph

Bought by

Sperandeo Joseph and Sperandeo Jennifer Lynn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$315,470

Outstanding Balance

$280,357

Interest Rate

4.75%

Mortgage Type

New Conventional

Estimated Equity

$320,441

Purchase Details

Closed on

Apr 28, 2005

Sold by

T J Baumgartner Custom Homes Corp

Bought by

Sperandeo Joseph

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$367,900

Interest Rate

7.12%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Feb 27, 2004

Sold by

Deerpath Development Corp

Bought by

T J Baumgartner Custom Homes Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sperandeo Joseph | -- | Title Source Inc | |

| Sperandeo Joseph | $460,500 | Chicago Title Insurance Comp | |

| T J Baumgartner Custom Homes Corp | $383,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sperandeo Joseph | $315,470 | |

| Closed | Sperandeo Joseph | $367,900 | |

| Closed | Sperandeo Joseph | $92,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $13,066 | $168,360 | $24,416 | $143,944 |

| 2023 | $11,690 | $148,991 | $21,607 | $127,384 |

| 2022 | $11,690 | $135,447 | $19,643 | $115,804 |

| 2021 | $11,284 | $126,586 | $18,358 | $108,228 |

| 2020 | $11,161 | $124,104 | $17,998 | $106,106 |

| 2019 | $11,237 | $123,053 | $17,998 | $105,055 |

| 2018 | $12,147 | $130,286 | $18,948 | $111,338 |

| 2017 | $11,869 | $121,762 | $17,708 | $104,054 |

| 2016 | $11,672 | $118,215 | $17,192 | $101,023 |

| 2015 | $11,988 | $115,897 | $16,855 | $99,042 |

| 2014 | -- | $112,521 | $16,364 | $96,157 |

| 2013 | -- | $112,521 | $16,364 | $96,157 |

Source: Public Records

Map

Nearby Homes

- 406 Windsor Dr

- 609 Chestnut Dr

- 482 Deerfield Dr

- 483 Deerfield Dr

- 538 Sudbury Cir

- 676 Cumberland Ln

- 668 Cumberland Ln

- 673 Cumberland Ln

- 315 White Pines Ln

- 770 Dartmouth Ln

- 777 Dartmouth Ln

- 851 Claridge Dr

- 639 Vista Dr

- 716 Pinehurst Ln

- 714 Pinehurst Ln

- 395 Danforth Dr

- 318 Monica Ln

- 2489 Semillon St

- 2486 Semillon St

- 2319 Hirsch Dr

- 450 Sudbury Cir

- 454 Sudbury Cir Unit 7

- 448 Sudbury Cir

- 456 Sudbury Cir

- 453 Sudbury Cir

- 451 Sudbury Cir

- 455 Sudbury Cir Unit 7

- 449 Sudbury Cir

- 446 Sudbury Cir Unit 7

- 458 Sudbury Cir

- 312 Morgan Valley Dr

- 447 Sudbury Cir Unit 7

- 310 Morgan Valley Dr

- 457 Sudbury Cir

- 314 Morgan Valley Dr Unit 1

- 444 Sudbury Cir Unit 7

- 445 Sudbury Cir

- 308 Morgan Valley Dr

- 460 Sudbury Cir Unit 7

- 459 Sudbury Cir