4553 W 56th St Unit 103 Chicago, IL 60629

West Elsdon NeighborhoodEstimated Value: $167,310 - $209,000

2

Beds

--

Bath

--

Sq Ft

0.8

Acres

About This Home

This home is located at 4553 W 56th St Unit 103, Chicago, IL 60629 and is currently estimated at $182,078. 4553 W 56th St Unit 103 is a home located in Cook County with nearby schools including Pasteur Elementary School, Richardson Middle School, and Curie Metropolitan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 10, 2020

Sold by

Belen Earling and Sanchez Belen Sanchez

Bought by

Sanchez Leos Belen and Sanchez Jonathan David Sanchez

Current Estimated Value

Purchase Details

Closed on

Nov 16, 2005

Sold by

Piatek Helena and Blevins Barbara

Bought by

Earling Belen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,114

Outstanding Balance

$69,007

Interest Rate

7.3%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$113,071

Purchase Details

Closed on

Feb 1, 2002

Sold by

Piatek Helena

Bought by

Piatek Helena and Podgorska Barbara

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,000

Interest Rate

7.23%

Purchase Details

Closed on

Mar 13, 1995

Sold by

Green Fred W and Green Joann H

Bought by

Piatek Helena

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,400

Interest Rate

8.43%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sanchez Leos Belen | -- | Attorney | |

| Earling Belen | $146,500 | Atg Search | |

| Piatek Helena | -- | Stewart Title Guaranty Compa | |

| Piatek Helena | $72,000 | Attorneys Natl Title Network |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Earling Belen | $117,114 | |

| Previous Owner | Piatek Helena | $52,000 | |

| Previous Owner | Piatek Helena | $68,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,822 | $16,339 | $842 | $15,497 |

| 2023 | $1,776 | $8,587 | $1,052 | $7,535 |

| 2022 | $1,776 | $8,587 | $1,052 | $7,535 |

| 2021 | $1,727 | $8,587 | $1,052 | $7,535 |

| 2020 | $1,408 | $6,281 | $1,052 | $5,229 |

| 2019 | $1,432 | $7,082 | $1,052 | $6,030 |

| 2018 | $1,408 | $7,082 | $1,052 | $6,030 |

| 2017 | $1,347 | $6,218 | $946 | $5,272 |

| 2016 | $1,254 | $6,218 | $946 | $5,272 |

| 2015 | $1,148 | $6,218 | $946 | $5,272 |

| 2014 | $1,663 | $8,893 | $894 | $7,999 |

| 2013 | $1,630 | $8,893 | $894 | $7,999 |

Source: Public Records

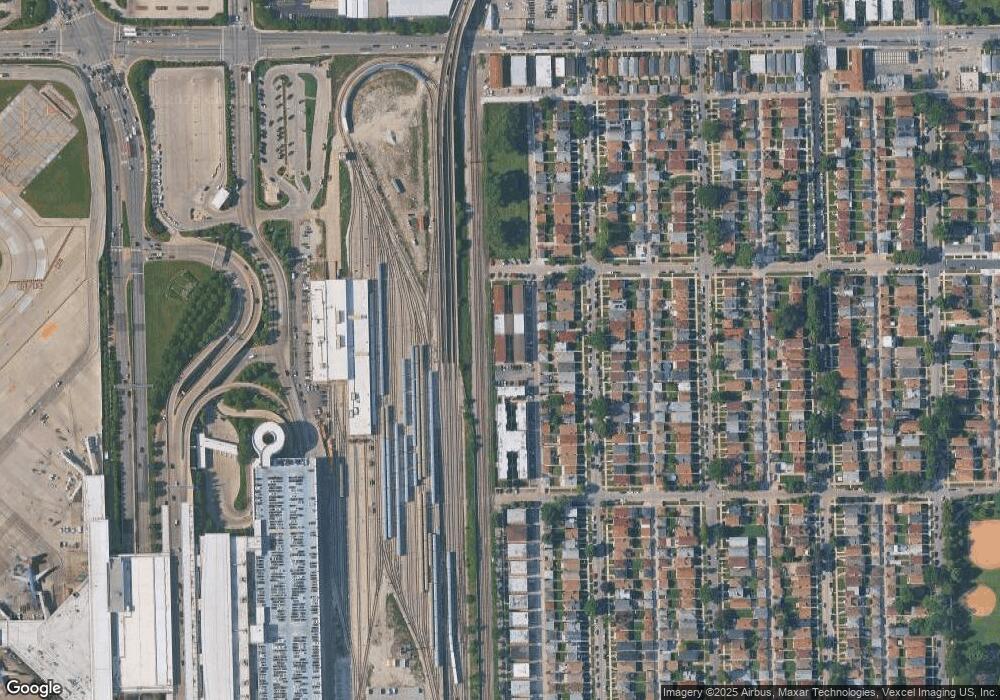

Map

Nearby Homes

- 5614 S Kolmar Ave

- 5532 S Kilbourn Ave

- 5551 S Kenneth Ave

- 5444 S Kenneth Ave

- 5749 S Kenneth Ave

- 5316 S Kenneth Ave Unit 201

- 5316 S Kenneth Ave Unit 101

- 5910 S Kilbourn Ave

- 5310 S Kilpatrick Ave

- 5339 S Kildare Ave

- 6004 S Kolmar Ave

- 5313 S Tripp Ave

- 5834 S Keeler Ave

- 4158 W 58th Place Unit 4158

- 6039 S Kilbourn Ave

- 5921 S Keeler Ave

- 4036 W 57th St

- 5117 S Keating Ave

- 6053 S Kostner Ave

- 5438 S Komensky Ave

- 4553 W 56th St Unit 206

- 4553 W 56th St Unit 303

- 4553 W 56th St Unit 304

- 4553 W 56th St Unit 202

- 4553 W 56th St Unit 111

- 4553 W 56th St Unit 107

- 4553 W 56th St Unit 102

- 4553 W 56th St Unit 108

- 4553 W 56th St Unit 105

- 4553 W 56th St Unit 201

- 4553 W 56th St Unit 205

- 4553 W 56th St Unit 302

- 4553 W 56th St Unit 212

- 4553 W 56th St Unit 204

- 4553 W 56th St Unit 301

- 4553 W 56th St Unit 203

- 4553 W 56th St Unit 310

- 4553 W 56th St Unit 109

- 4553 W 56th St Unit 309