465 11th St Red Wing, MN 55066

Estimated Value: $159,000 - $181,000

3

Beds

1

Bath

1,404

Sq Ft

$124/Sq Ft

Est. Value

About This Home

This home is located at 465 11th St, Red Wing, MN 55066 and is currently estimated at $174,060, approximately $123 per square foot. 465 11th St is a home located in Goodhue County with nearby schools including Sunnyside Elementary School, Burnside Elementary School, and Twin Bluff Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 15, 2021

Sold by

Mudgett Collin R

Bought by

Golla Katie Lynn and Lewis Cody

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,700

Outstanding Balance

$95,649

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$78,411

Purchase Details

Closed on

May 1, 2015

Sold by

Federal National Mortgage Association

Bought by

Mudgett Collin R

Purchase Details

Closed on

Feb 24, 2010

Sold by

Bank Of New York

Bought by

Koplin Cory R and Koplin Cristin

Purchase Details

Closed on

Aug 23, 2001

Sold by

Fickel Bryan L and Rogers Stephanie I

Bought by

Lance Chad A and Guenther Tamie D

Purchase Details

Closed on

Jul 7, 2000

Sold by

Morehead Michael D and Morehead Denice C

Bought by

Fickel Bryan L and Rogers Stephanie E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Golla Katie Lynn | $110,000 | Heritage Title | |

| Mudgett Collin R | -- | Alliance Title | |

| Koplin Cory R | $52,500 | -- | |

| Lance Chad A | $93,900 | -- | |

| Fickel Bryan L | $74,500 | -- | |

| Golla Katie Katie | $110,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Golla Katie Lynn | $106,700 | |

| Closed | Lance Chad A | -- | |

| Closed | Golla Katie Katie | $109,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,972 | $148,300 | $27,600 | $120,700 |

| 2024 | $1,972 | $145,600 | $27,600 | $118,000 |

| 2023 | $1,930 | $138,000 | $27,600 | $110,400 |

| 2022 | $1,766 | $137,100 | $27,600 | $109,500 |

| 2021 | $2,512 | $118,100 | $27,600 | $90,500 |

| 2020 | $1,634 | $111,200 | $27,600 | $83,600 |

| 2019 | $1,604 | $103,200 | $27,600 | $75,600 |

| 2018 | $1,334 | $102,500 | $26,400 | $76,100 |

| 2017 | $1,302 | $90,300 | $26,400 | $63,900 |

| 2016 | $1,204 | $89,200 | $26,400 | $62,800 |

| 2015 | $1,560 | $86,400 | $26,400 | $60,000 |

| 2014 | -- | $87,600 | $26,400 | $61,200 |

Source: Public Records

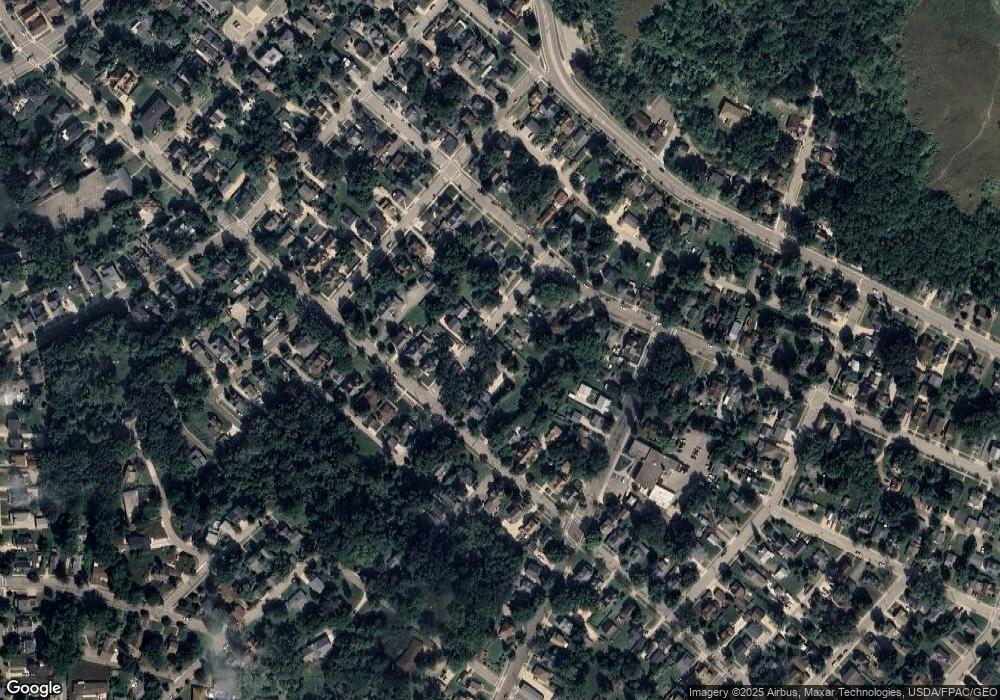

Map

Nearby Homes

- 1218 East Ave

- 418 8th St

- 759 Plum St

- 1315 12th St

- 814 Central Ave

- 737 McSorley St

- 402 W 7th St

- 320 W 7th St

- 1524 Bush St

- 523 East Ave Unit 211

- 1547 Bush St

- 1218 Central Ave

- 613 Potter St

- 121 W 6th St

- 103 W 6th St

- XXXX Skyline Heights

- 225 E 5th St

- 1004 College Ave

- 1050 Sturtevant St

- 222 Bush St Unit 402

Your Personal Tour Guide

Ask me questions while you tour the home.