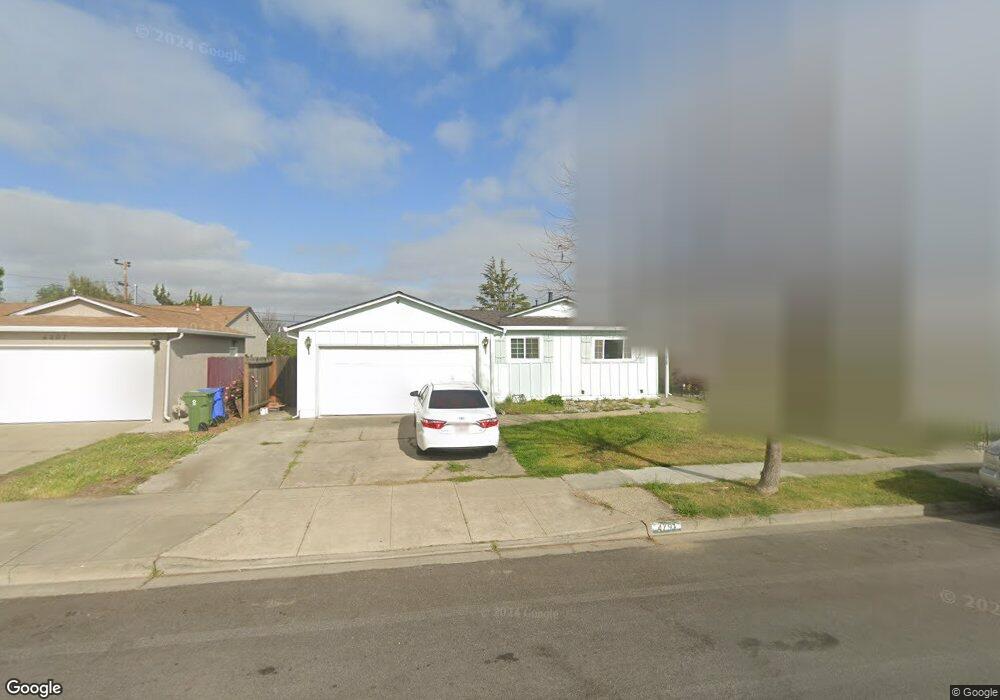

4791 Phelan Ave Fremont, CA 94538

Sundale NeighborhoodEstimated Value: $997,000 - $1,335,000

3

Beds

2

Baths

1,092

Sq Ft

$1,119/Sq Ft

Est. Value

About This Home

This home is located at 4791 Phelan Ave, Fremont, CA 94538 and is currently estimated at $1,222,118, approximately $1,119 per square foot. 4791 Phelan Ave is a home located in Alameda County with nearby schools including Joseph Azevada Elementary School, G.M. Walters Middle School, and John F. Kennedy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 26, 2003

Sold by

Schneider John F and Schneider Nancy J

Bought by

Valencia Richard and Valencia Maria

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$316,000

Outstanding Balance

$136,150

Interest Rate

5.79%

Mortgage Type

Stand Alone First

Estimated Equity

$1,085,968

Purchase Details

Closed on

Sep 20, 2000

Sold by

Schneider John F and Schneider Nancy J

Bought by

Schneider John F and Schneider Nancy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$248,500

Interest Rate

7.98%

Purchase Details

Closed on

May 6, 1998

Sold by

Roggasch Kirk A

Bought by

Schneider John F and Schneider Nancy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$174,182

Interest Rate

7.13%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 3, 1996

Sold by

Roggasch Lori A

Bought by

Roggasch Kirk Alan

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Valencia Richard | $434,500 | Chicago Title Co | |

| Schneider John F | -- | American Title Co | |

| Schneider John F | $196,000 | Old Republic Title Company | |

| Roggasch Kirk Alan | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Valencia Richard | $316,000 | |

| Previous Owner | Schneider John F | $248,500 | |

| Previous Owner | Schneider John F | $174,182 | |

| Closed | Valencia Richard | $39,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,131 | $568,319 | $171,611 | $403,708 |

| 2024 | $7,131 | $557,041 | $168,247 | $395,794 |

| 2023 | $6,932 | $552,984 | $164,949 | $388,035 |

| 2022 | $6,831 | $535,143 | $161,715 | $380,428 |

| 2021 | $6,666 | $524,516 | $158,545 | $372,971 |

| 2020 | $6,615 | $523,070 | $156,921 | $366,149 |

| 2019 | $6,540 | $512,815 | $153,844 | $358,971 |

| 2018 | $6,411 | $502,763 | $150,829 | $351,934 |

| 2017 | $6,250 | $492,908 | $147,872 | $345,036 |

| 2016 | $6,137 | $483,246 | $144,974 | $338,272 |

| 2015 | $6,050 | $475,990 | $142,797 | $333,193 |

| 2014 | $5,941 | $466,668 | $140,000 | $326,668 |

Source: Public Records

Map

Nearby Homes

- 4714 Serra Ave

- 4692 Nelson St

- 39530 Dorrington Ct

- 5033 Blacksand Rd

- 4600 Nelson St

- 4737 Boone Dr

- 5330 Coco Palm Dr

- 39090 Presidio Way Unit 237

- 4715 Mildred Dr

- 5580 Hemlock Terrace

- 39753 Placer Way

- 40116 Crockett St

- 39751 Bissy Common

- 4840 Piper St

- 5624 Chestnut Common

- 4715 Eggers Dr

- 38976 Primula Terrace

- 38984 Primula Terrace

- 38837 Fremont Blvd

- 39134 Memorial St

- 4783 Phelan Ave

- 4807 Phelan Ave

- 4854 Murphy Ct

- 4884 Murphy Ct

- 4815 Phelan Ave

- 4775 Phelan Ave

- 4823 Phelan Ave

- 4796 Phelan Ave

- 39367 Sutter Dr

- 4834 Murphy Ct

- 4778 Phelan Ave

- 4810 Phelan Ave

- 39375 Sutter Dr

- 39359 Sutter Dr

- 4760 Phelan Ave

- 39383 Sutter Dr

- 39391 Sutter Dr

- 4818 Phelan Ave

- 4894 Murphy Ct

- 4831 Phelan Ave