4810 Laurel Ridge Dr Riverside, CA 92509

Rubidoux NeighborhoodEstimated Value: $1,001,000 - $1,217,000

4

Beds

4

Baths

4,065

Sq Ft

$266/Sq Ft

Est. Value

About This Home

This home is located at 4810 Laurel Ridge Dr, Riverside, CA 92509 and is currently estimated at $1,081,013, approximately $265 per square foot. 4810 Laurel Ridge Dr is a home located in Riverside County with nearby schools including Camino Real Elementary, Jurupa Middle School, and Patriot High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 12, 2009

Sold by

Laoboonmi Janthipha

Bought by

Monzon Jose Alfredo and Monzon Sandra Angelica

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Outstanding Balance

$261,046

Interest Rate

4.92%

Mortgage Type

VA

Estimated Equity

$819,967

Purchase Details

Closed on

Mar 1, 2007

Sold by

Jurupa Hills 80 Lp

Bought by

Laoboonmi Janthipha

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$622,880

Interest Rate

1%

Mortgage Type

Negative Amortization

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Monzon Jose Alfredo | $440,000 | Lawyers Title | |

| Laoboonmi Janthipha | $779,000 | Chicago |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Monzon Jose Alfredo | $417,000 | |

| Previous Owner | Laoboonmi Janthipha | $622,880 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,735 | $650,301 | $193,625 | $456,676 |

| 2023 | $11,735 | $625,051 | $186,107 | $438,944 |

| 2022 | $11,507 | $612,796 | $182,458 | $430,338 |

| 2021 | $11,419 | $600,781 | $178,881 | $421,900 |

| 2020 | $11,338 | $594,621 | $177,047 | $417,574 |

| 2019 | $11,180 | $582,963 | $173,576 | $409,387 |

| 2018 | $10,938 | $571,533 | $170,174 | $401,359 |

| 2017 | $10,847 | $560,328 | $166,838 | $393,490 |

| 2016 | $10,734 | $549,342 | $163,567 | $385,775 |

| 2015 | $10,643 | $541,092 | $161,111 | $379,981 |

| 2014 | $10,223 | $530,495 | $157,956 | $372,539 |

Source: Public Records

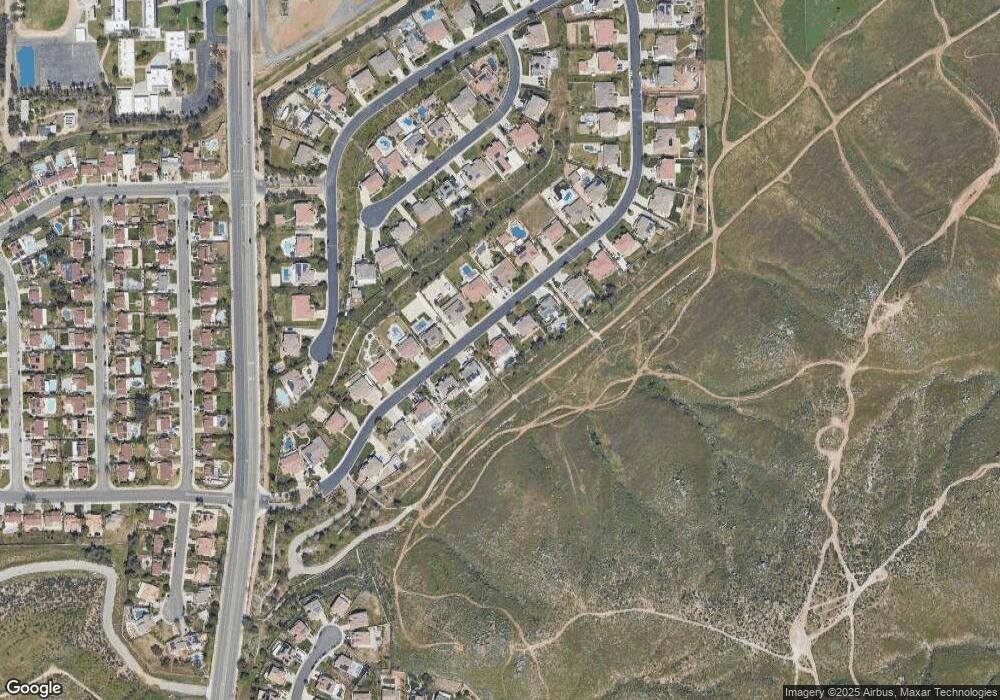

Map

Nearby Homes

- 7503 Whitney Dr

- 4688 Plaza Ln

- 6158 Sequanota St

- 4501 Corte Entrada

- 7556 Frazer Dr

- 7456 Joan Ave

- 7320 Percheron Ave

- 7487 Eddy Ave

- 5431 Skyloft Dr

- 7780 Bolero Dr

- 7627 Mission Blvd

- 0 Jewel St

- 4290 Hernandez St

- 6382 Rathke Dr

- 6392 Rustic Ln

- 6452 Mission Blvd

- 6568 Avenida Mariposa

- 7404 Hawkeye Ridge Rd

- Estrella - Plan 3 at Las Palmas

- Amada - Plan 2 at Las Palmas

- 4822 Laurel Ridge Dr

- 4798 Laurel Ridge Dr

- 4834 Laurel Ridge Dr

- 4786 Laurel Ridge Dr

- 4813 Laurel Ridge Dr

- 4801 Laurel Ridge Dr

- 4825 Laurel Ridge Dr

- 4789 Laurel Ridge Dr

- 4846 Laurel Ridge Dr

- 4774 Laurel Ridge Dr

- 4837 Laurel Ridge Dr

- 4777 Laurel Ridge Dr

- 4858 Laurel Ridge Dr

- 4849 Laurel Ridge Dr

- 4762 Laurel Ridge Dr

- 4765 Laurel Ridge Dr

- 4770 Eagle Ridge Ct

- 4758 Eagle Ridge Ct

- 4746 Eagle Ridge Ct

- 4861 Laurel Ridge Dr