4839 Vir Mar St Unit 16 Fair Oaks, CA 95628

Estimated Value: $198,000 - $230,055

1

Bed

1

Bath

808

Sq Ft

$272/Sq Ft

Est. Value

About This Home

This home is located at 4839 Vir Mar St Unit 16, Fair Oaks, CA 95628 and is currently estimated at $219,514, approximately $271 per square foot. 4839 Vir Mar St Unit 16 is a home located in Sacramento County with nearby schools including Albert Schweitzer Elementary School, John Barrett Middle School, and Del Campo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 28, 2017

Sold by

Lonero Galia

Bought by

Sayers Edward and Sayers Lisa Audet

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,200

Outstanding Balance

$90,996

Interest Rate

3.91%

Mortgage Type

New Conventional

Estimated Equity

$128,518

Purchase Details

Closed on

Jul 23, 2015

Sold by

Gross Kelly

Bought by

Lonero Galia

Purchase Details

Closed on

Apr 9, 2009

Sold by

Gallagher Joseph D and Gallagher Jean Marie

Bought by

Gross Kelly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,152

Interest Rate

5.17%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 8, 2006

Sold by

Gallagher Joseph D and Gallagher Jean Marie

Bought by

Gallagher Joseph D and Gallagher Jean Marie

Purchase Details

Closed on

Feb 19, 2002

Sold by

Souza Kenneth A

Bought by

Gallagher Joseph D and Gallagher Jean M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sayers Edward | $146,000 | First American Title Company | |

| Lonero Galia | $67,000 | None Available | |

| Gross Kelly | $102,000 | Placer Title Company | |

| Gallagher Joseph D | -- | None Available | |

| Gallagher Joseph D | $93,500 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sayers Edward | $109,200 | |

| Previous Owner | Gross Kelly | $100,152 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,032 | $166,117 | $45,510 | $120,607 |

| 2024 | $2,032 | $162,861 | $44,618 | $118,243 |

| 2023 | $1,973 | $159,669 | $43,744 | $115,925 |

| 2022 | $2,447 | $156,539 | $42,887 | $113,652 |

| 2021 | $1,927 | $153,471 | $42,047 | $111,424 |

| 2020 | $1,900 | $151,898 | $41,616 | $110,282 |

| 2019 | $1,852 | $148,920 | $40,800 | $108,120 |

| 2018 | $1,811 | $146,000 | $40,000 | $106,000 |

| 2017 | $1,414 | $112,200 | $35,700 | $76,500 |

| 2016 | $1,323 | $110,000 | $35,000 | $75,000 |

| 2015 | $1,229 | $109,286 | $53,572 | $55,714 |

| 2014 | $1,202 | $107,146 | $52,523 | $54,623 |

Source: Public Records

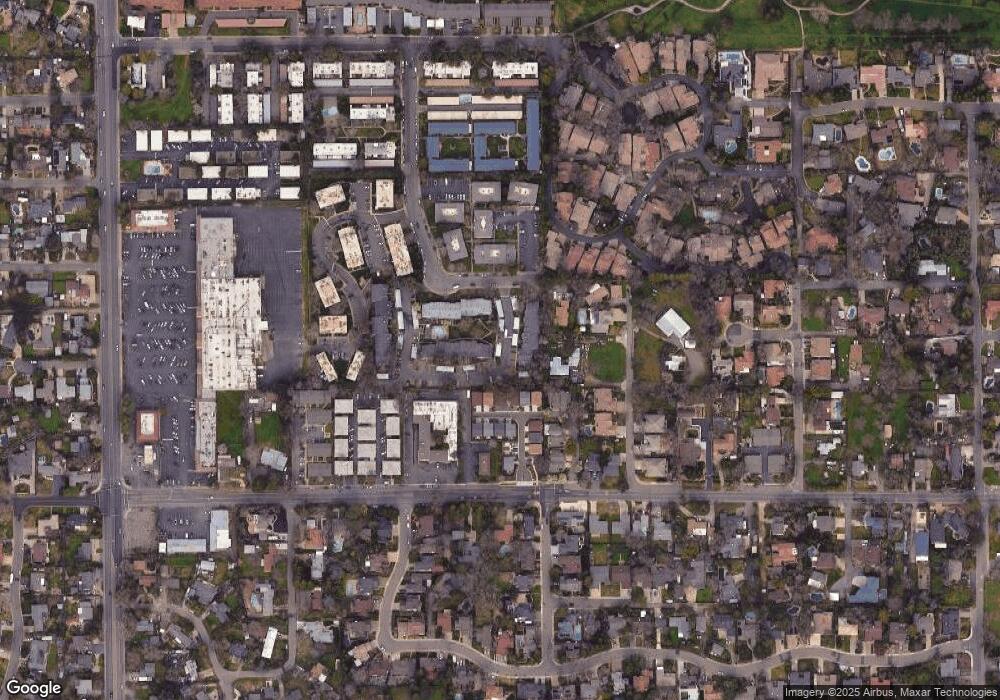

Map

Nearby Homes

- 7605 Sunset Ave

- 7518 Fairway Two Ave

- 7634 Pineridge Ln

- 7492 Fairway Two Ave

- 7529 Pineridge Ln

- 4753 San Juan Ave

- 7400 San Nita Way

- 7736 Greenridge Way

- 7225 Zelinda Dr

- 7825 Greenridge Way

- 7440 Tierra Way

- 5200 Roseana Ct

- 7201 Cardinal Rd

- 4704 Johnson Dr

- 5136 Romero Way

- 7832 Ahl Way

- 4433 Plantation Dr

- 4406 Crestridge Rd

- 7621 Palisade Way

- 7125 Gail Way

- 4839 Vir Mar St Unit 54

- 4839 Vir Mar St Unit 3

- 4839 Vir Mar St Unit 9

- 4839 Vir Mar St Unit 18

- 4839 Vir Mar St Unit 50

- 4839 Vir Mar St Unit 11

- 4839 Vir Mar St Unit 70

- 4839 Vir Mar St

- 4839 Vir Mar St Unit 28

- 4839 Vir Mar St Unit 49

- 4839 Vir Mar St Unit 12

- 4839 Vir Mar St Unit 15

- 4839 Vir Mar St Unit 69

- 4839 Vir Mar St Unit 72

- 4839 Vir Mar St Unit 29

- 4839 Vir Mar St Unit 48

- 4839 Vir Mar St Unit 25

- 4839 Vir Mar St Unit 13

- 4839 Vir Mar St Unit 60

- 4839 Vir Mar St Unit 36