4847 N Windward Way Clovis, CA 93619

Estimated Value: $593,000 - $708,000

4

Beds

3

Baths

2,616

Sq Ft

$244/Sq Ft

Est. Value

About This Home

This home is located at 4847 N Windward Way, Clovis, CA 93619 and is currently estimated at $639,276, approximately $244 per square foot. 4847 N Windward Way is a home located in Fresno County with nearby schools including Fairmont Elementary School, Washington Academic Middle School, and Sanger High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 8, 2020

Sold by

Fermanian John Paul

Bought by

Fermanian John Paul and John Paul Fermanian 2020 Trust

Current Estimated Value

Purchase Details

Closed on

Sep 9, 2009

Sold by

Cooper Debra A

Bought by

Fermanian John Paul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$251,200

Outstanding Balance

$164,200

Interest Rate

5.18%

Mortgage Type

New Conventional

Estimated Equity

$475,076

Purchase Details

Closed on

Sep 3, 2002

Sold by

Quail Lake Properties Llc

Bought by

Cooper Michael L and Cooper Debra A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

6.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fermanian John Paul | -- | None Available | |

| Fermanian John Paul | $314,000 | Chicago Title Company | |

| Cooper Michael L | $319,000 | Stewart Title Of Fresno Cnty |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fermanian John Paul | $251,200 | |

| Previous Owner | Cooper Michael L | $100,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,561 | $405,303 | $129,073 | $276,230 |

| 2023 | $5,240 | $389,566 | $124,062 | $265,504 |

| 2022 | $5,166 | $381,929 | $121,630 | $260,299 |

| 2021 | $5,132 | $374,442 | $119,246 | $255,196 |

| 2020 | $4,992 | $370,604 | $118,024 | $252,580 |

| 2019 | $4,902 | $363,338 | $115,710 | $247,628 |

| 2018 | $4,719 | $356,215 | $113,442 | $242,773 |

| 2017 | $4,645 | $349,231 | $111,218 | $238,013 |

| 2016 | $4,398 | $342,385 | $109,038 | $233,347 |

| 2015 | $4,445 | $337,243 | $107,401 | $229,842 |

| 2014 | $4,430 | $330,638 | $105,298 | $225,340 |

Source: Public Records

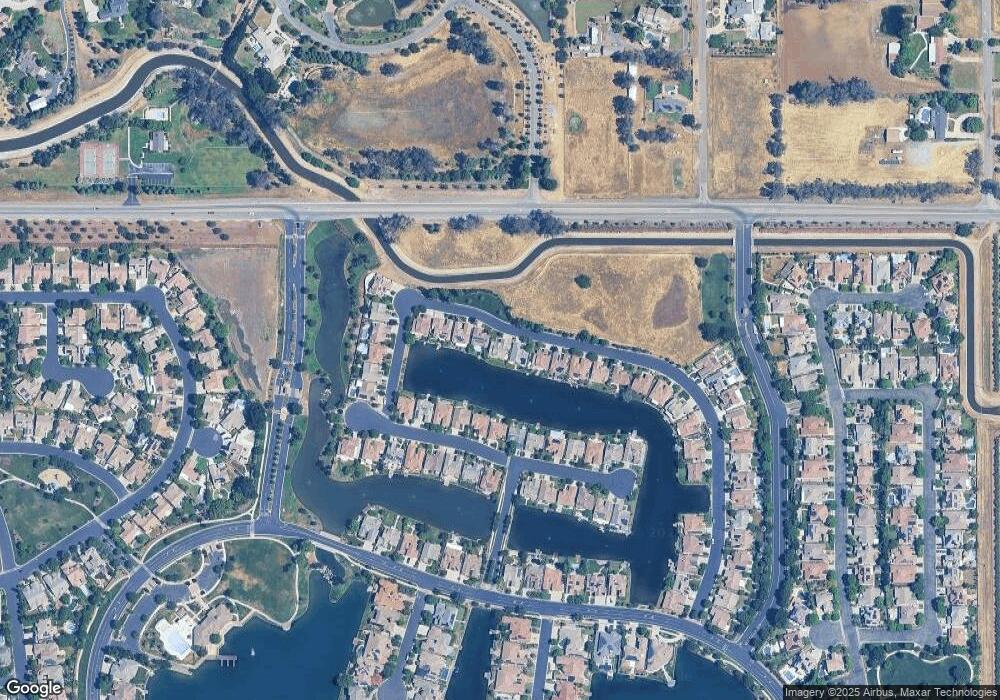

Map

Nearby Homes

- 4769 N Emerald Peak Dr

- 10588 E Fieldstone Ave

- 11078 Sawtooth Peak Way

- 4674 N Arrow Ridge Way

- 4626 N Arrow Ridge Way

- 10952 E Promontory Way

- 10595 E San Felipe Ave

- 4199 N Quail Crossing

- 4588 N Mccall Ave

- 4133 N Morro Bay

- 6090 Amber Ave

- 3215 Lourdes Ave

- 12000 E Shaw Ave

- 4373 Rialto Ave

- 3301 La Mirada Ave

- 2468 Montana Ave

- 4245 Fairmont Ave

- 6345 N Bethel Ave

- 3520 N Bethel Ave

- 4520 Griffith Ave

- 4835 N Windward Way

- 4859 N Windward Way

- 4871 N Windward Way

- 4823 N Windward Way

- 4811 N Windward Way

- 4883 N Windward Way

- 10810 E Clearwater Way

- 10798 E Clearwater Way

- 10822 E Clearwater Way

- 4895 N Windward Way

- 4799 N Windward Way

- 10784 E Clearwater Way

- 10834 E Clearwater Way

- 10772 E Clearwater Way

- 10840 E Clearwater Way

- 10852 E Clearwater Way

- 10760 E Clearwater Way

- 4775 N Windward Way

- 4875 N Shoreline Way

- 10791 E Clearwater Way