4871 Ashton Curve Saint Paul, MN 55129

Estimated Value: $722,000 - $813,000

5

Beds

5

Baths

3,342

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 4871 Ashton Curve, Saint Paul, MN 55129 and is currently estimated at $756,059, approximately $226 per square foot. 4871 Ashton Curve is a home with nearby schools including Red Rock Elementary School, Lake Middle School, and East Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 18, 2023

Sold by

Gawlik Joshua and Gawlik Bridgett

Bought by

Gawlik Joshua

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$493,000

Outstanding Balance

$481,766

Interest Rate

6.81%

Mortgage Type

New Conventional

Estimated Equity

$274,293

Purchase Details

Closed on

Mar 25, 2016

Bought by

Gawlik Bridgett Bridgett

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

3.65%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gawlik Joshua | $500 | None Listed On Document | |

| Gawlik Bridgett Bridgett | $522,900 | -- | |

| Gawlik Joshua | $522,939 | North American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gawlik Joshua | $493,000 | |

| Previous Owner | Gawlik Joshua | $417,000 | |

| Previous Owner | Gawlik Bridgett Bridgett | $409,293 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,134 | $708,800 | $170,000 | $538,800 |

| 2023 | $9,134 | $732,000 | $190,000 | $542,000 |

| 2022 | $7,818 | $682,200 | $174,000 | $508,200 |

| 2021 | $7,580 | $572,800 | $145,000 | $427,800 |

| 2020 | $7,938 | $562,800 | $135,000 | $427,800 |

| 2019 | $7,602 | $575,600 | $135,000 | $440,600 |

| 2018 | $7,424 | $536,500 | $135,000 | $401,500 |

| 2017 | $3,368 | $518,900 | $120,000 | $398,900 |

| 2016 | $532 | $248,700 | $110,000 | $138,700 |

| 2015 | -- | $0 | $0 | $0 |

Source: Public Records

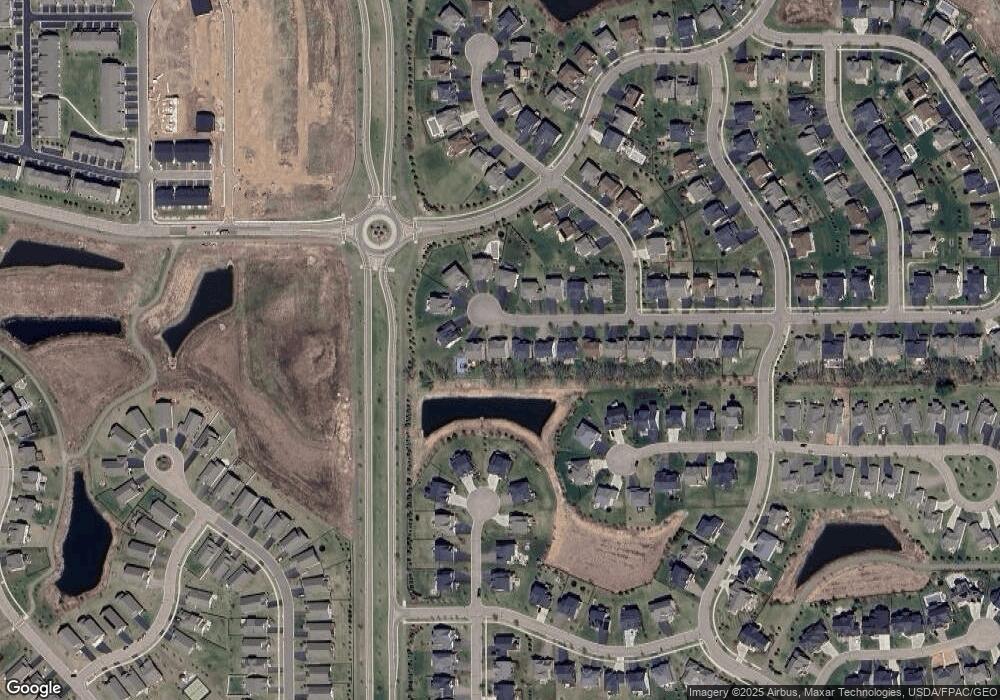

Map

Nearby Homes

- 4764 Ashton Curve

- 4418 Ashton Curve

- 5174 Sundial Ln

- 4983 Sunflower Dr

- 5194 Sundial Ln

- 5237 Windlass Dr

- 5054 Dale Ridge Rd

- The Somerset 3 Plan at The Villas at Summerhill Woodbury

- The Somerset 4 Plan at The Villas at Summerhill Woodbury

- The Somerset 2 Plan at The Villas at Summerhill Woodbury

- The Somerset 2B Plan at The Villas at Summerhill Woodbury

- The Somerset 1 Plan at The Villas at Summerhill Woodbury

- 5234 Sundial Ln

- 9125 Compass Pointe Rd

- 9612 Iron Horse Rd

- Vanderbilt Plan at Westwind - Landmark Collection

- Springfield Plan at Westwind - Discovery Collection

- Itasca Plan at Westwind - Landmark Collection

- McKinley Plan at Westwind - Landmark Collection

- Bristol Plan at Westwind - Discovery Collection

- 4859 Ashton Curve

- 4883 Ashton Curve

- 4895 Ashton Curve

- 4835 Ashton Curve

- 4848 Ashton Curve

- 4836 Ashton Curve

- 4860 Ashton Curve

- 4896 Ashton Curve

- 4823 Ashton Curve

- 4872 Ashton Curve

- 4882 Ashton Curve

- 4824 Ashton Curve

- 9010 Bur Oak Ct

- 4811 Ashton Curve

- 4878 Sunflower Alcove

- 4878 Sunflower Alcove

- 4878 Sunflower Alcove

- 9008 Bur Oak Ct

- 4812 Ashton Curve

- 4876 Sunflower Alcove