48867 Eagle View Terrace Fremont, CA 94539

Weibel NeighborhoodEstimated Value: $2,704,000 - $4,447,000

4

Beds

4

Baths

3,195

Sq Ft

$1,109/Sq Ft

Est. Value

About This Home

This home is located at 48867 Eagle View Terrace, Fremont, CA 94539 and is currently estimated at $3,544,497, approximately $1,109 per square foot. 48867 Eagle View Terrace is a home located in Alameda County with nearby schools including Warm Springs Elementary School, James Leitch Elementary School, and John M. Horner Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2006

Sold by

Tran Anthony M and Nguyen Trang D

Bought by

Tran Anthony M and Nguyen Trang D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$850,000

Outstanding Balance

$576,117

Interest Rate

9.49%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$2,968,380

Purchase Details

Closed on

Jun 2, 1997

Sold by

Ponderosa Homes Inc

Bought by

Tran Anthony and Nguyen Trang

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Interest Rate

8.08%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tran Anthony M | -- | First American Title Co | |

| Tran Anthony | $630,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tran Anthony M | $850,000 | |

| Closed | Tran Anthony | $500,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,140 | $1,018,848 | $307,803 | $718,045 |

| 2024 | $12,140 | $998,735 | $301,768 | $703,967 |

| 2023 | $11,820 | $986,020 | $295,853 | $690,167 |

| 2022 | $11,673 | $959,688 | $290,052 | $676,636 |

| 2021 | $11,384 | $940,734 | $284,365 | $663,369 |

| 2020 | $11,438 | $938,021 | $281,451 | $656,570 |

| 2019 | $11,306 | $919,634 | $275,934 | $643,700 |

| 2018 | $11,086 | $901,607 | $270,525 | $631,082 |

| 2017 | $10,808 | $883,931 | $265,221 | $618,710 |

| 2016 | $10,627 | $866,603 | $260,022 | $606,581 |

| 2015 | $10,489 | $853,589 | $256,117 | $597,472 |

| 2014 | $10,311 | $836,871 | $251,101 | $585,770 |

Source: Public Records

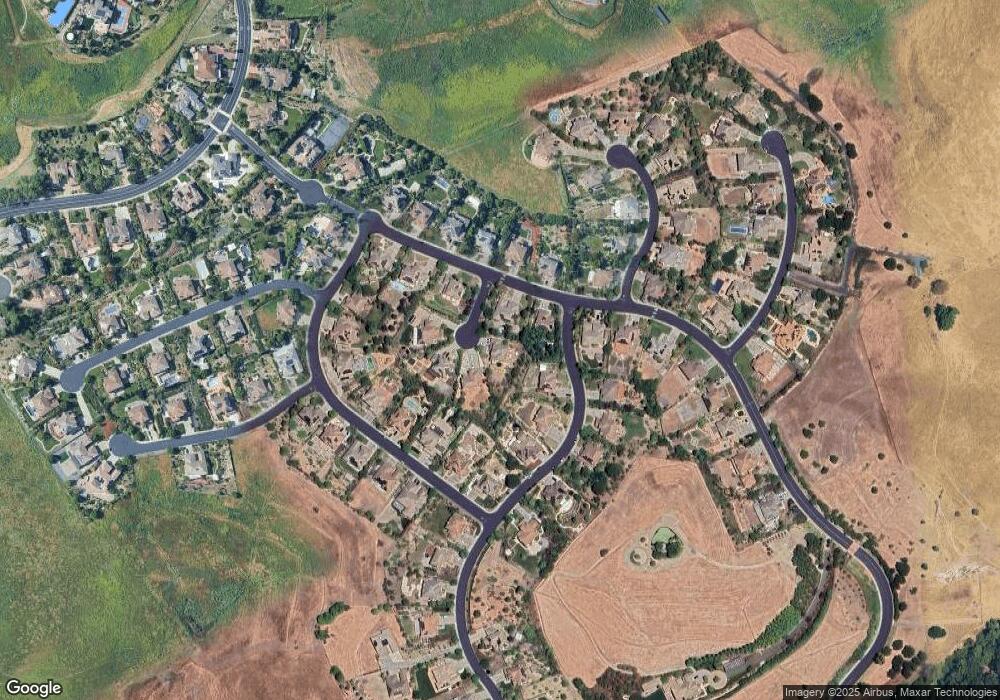

Map

Nearby Homes

- 1476 San Benito Dr

- 472 Mayten Way

- 296 Kansas Way

- 642 Mcduff Ave

- 47768 Wabana St

- 1339 Terra Vista Ct

- 145 Gamma Grass Terrace Unit U256

- 49002 Cinnamon Fern Common Unit 311

- 49002 Cinnamon Fern Common Unit 430

- 514 Bristle Grass Terrace

- 1109 El Camino Higuera

- 49199 Honeysuckle Terrace

- 60 Wilson Way Unit 171

- 60 Wilson Way Unit 158

- 1084 N Hillview Dr

- 46985 Ocotillo Ct

- 773 Heflin St

- 1269 Knollview Dr

- 47131 Yucatan Dr

- 47236 Cavanaugh Common

- 48871 Eagle View Terrace

- 48854 Crown Ridge Common

- 3254 Winding Vista Common

- 3248 Winding Vista Common

- 48870 Eagle View Terrace

- 48858 Crown Ridge Common

- 48862 Crown Ridge Common

- 48866 Eagle View Terrace

- 48862 Eagle View Terrace

- 3242 Winding Vista Common

- 48911 Crestview Common

- 48917 Crestview Common

- 48905 Crestview Common

- 48923 Crestview Common

- 3243 Winding Vista Common

- 3266 Winding Vista Common

- 3237 Winding Vista Common

- 48899 Crestview Common

- 48855 Crown Ridge Common

- 3236 Winding Vista Common