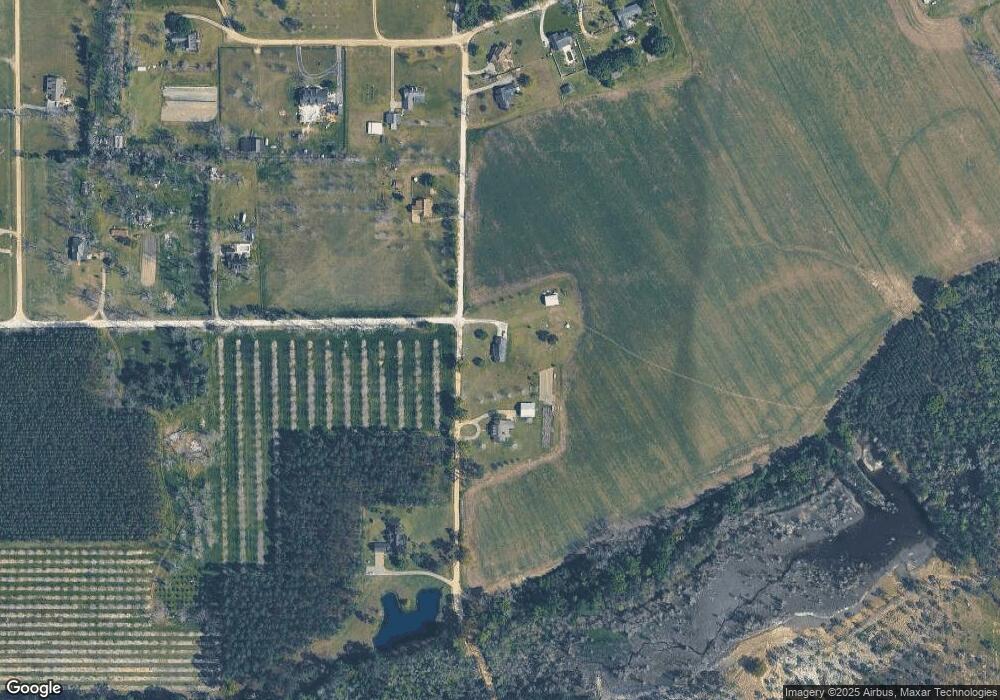

4908 Roberts Rd Blackshear, GA 31516

Estimated Value: $329,000 - $354,000

3

Beds

2

Baths

1,697

Sq Ft

$200/Sq Ft

Est. Value

About This Home

This home is located at 4908 Roberts Rd, Blackshear, GA 31516 and is currently estimated at $339,710, approximately $200 per square foot. 4908 Roberts Rd is a home located in Pierce County with nearby schools including Pierce County High School, Southeast Christian Academy, and Truth Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 26, 2024

Sold by

Carden Ty B

Bought by

Coppi Christopher and Coppi Stefanie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$348,570

Outstanding Balance

$343,913

Interest Rate

6.78%

Mortgage Type

FHA

Estimated Equity

-$4,203

Purchase Details

Closed on

Jun 20, 1994

Sold by

Bennett J Baxter

Bought by

Carden Ty B and Lauren Denise

Purchase Details

Closed on

Mar 7, 1994

Sold by

Bennett Baxter

Bought by

Carden Ty and Carden Denise

Purchase Details

Closed on

Nov 26, 1958

Sold by

Bennett Mable J

Bought by

Bennett J Baxter

Purchase Details

Closed on

Mar 21, 1934

Sold by

Summerall James

Bought by

James Duncan R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Coppi Christopher | $355,000 | -- | |

| Carden Ty B | -- | -- | |

| Carden Ty | $10,000 | -- | |

| Bennett J Baxter | -- | -- | |

| James Duncan R | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Coppi Christopher | $348,570 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,099 | $93,896 | $11,938 | $81,958 |

| 2024 | $1,099 | $90,457 | $11,938 | $78,519 |

| 2023 | $1,099 | $89,976 | $11,938 | $78,038 |

| 2022 | $1,052 | $70,467 | $12,580 | $57,887 |

| 2021 | $1,031 | $68,165 | $12,580 | $55,585 |

| 2020 | $1,048 | $65,863 | $12,580 | $53,283 |

| 2019 | $1,055 | $65,863 | $12,580 | $53,283 |

| 2018 | $1,052 | $62,963 | $11,982 | $50,981 |

| 2017 | $1,684 | $61,306 | $11,982 | $49,324 |

| 2016 | $1,053 | $61,306 | $11,982 | $49,324 |

| 2015 | $1,014 | $61,305 | $11,982 | $49,324 |

| 2014 | $1,014 | $61,306 | $11,982 | $49,324 |

| 2013 | $1,014 | $61,305 | $11,981 | $49,324 |

Source: Public Records

Map

Nearby Homes

- 3551 Cason Rd

- 3344 Strickland Ave

- 3360 Strickland Avenue Extension

- 322 Mcgregor St

- 515 Grady St

- 2936 Piney Grove Cir

- 862 Watson St

- 810 Jackson St

- 420 Jackson St

- 331 Central Ave W

- 121 Beaver Dr

- 131 Fawn Ln

- 101 Fawn Ln

- 0001 Georgia 121

- ST. ROUTE 121 Georgia 121

- 706 Jenkins St

- 622 E Main St

- 830 Jane St

- 1157 Tanner Cir

- TRACT 1 Trudie Rd

- 4928 Roberts Rd

- 3695 James Loop

- 4953 Roberts Rd

- 3711 James Loop

- 3110 Sheri Ln

- 3612 James Loop

- 3729 James Loop

- 3134 Sheri Ln

- 3739 James Loop

- 3601 James Loop

- 3756 James Loop

- 3109 Sheri Ln

- 5042 Roberts Rd

- 3748 James Loop

- 3125 Sheri Ln

- S Georgia 121

- 3758 James Loop

- 3586 James Loop

- 3145 Sheri Ln

- 3152 Sheri Ln