4941 Kristie Falls Unit B Columbus, OH 43221

Dexter Falls NeighborhoodEstimated Value: $160,000 - $237,000

2

Beds

3

Baths

1,208

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 4941 Kristie Falls Unit B, Columbus, OH 43221 and is currently estimated at $201,084, approximately $166 per square foot. 4941 Kristie Falls Unit B is a home located in Franklin County with nearby schools including Britton Elementary School, Hilliard Tharp Sixth Grade Elementary School, and Hilliard Weaver Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2015

Sold by

Peeva Ludmila and Peeva Marina

Bought by

Peeva Ludmila and Peeva Marina

Current Estimated Value

Purchase Details

Closed on

Mar 19, 2010

Sold by

Peeva Ludmila

Bought by

Peeva Ludmila and Peeva Marina

Purchase Details

Closed on

Feb 29, 2008

Sold by

Herkins William R and Herkins Mary

Bought by

Peeva Ludmila

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,250

Outstanding Balance

$45,634

Interest Rate

5.74%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$155,450

Purchase Details

Closed on

Jun 1, 1984

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Peeva Ludmila | -- | Stella Title | |

| Peeva Ludmila | -- | Attorney | |

| Peeva Ludmila | $82,300 | Chicago | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Peeva Ludmila | $73,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,226 | $49,210 | $9,100 | $40,110 |

| 2023 | $1,959 | $49,210 | $9,100 | $40,110 |

| 2022 | $1,284 | $29,760 | $3,820 | $25,940 |

| 2021 | $1,283 | $29,760 | $3,820 | $25,940 |

| 2020 | $1,279 | $29,760 | $3,820 | $25,940 |

| 2019 | $1,220 | $25,870 | $3,330 | $22,540 |

| 2018 | $1,279 | $25,870 | $3,330 | $22,540 |

| 2017 | $1,215 | $25,870 | $3,330 | $22,540 |

| 2016 | $1,433 | $27,450 | $4,870 | $22,580 |

| 2015 | $1,343 | $27,450 | $4,870 | $22,580 |

| 2014 | $1,346 | $27,450 | $4,870 | $22,580 |

| 2013 | $1,053 | $28,875 | $5,110 | $23,765 |

Source: Public Records

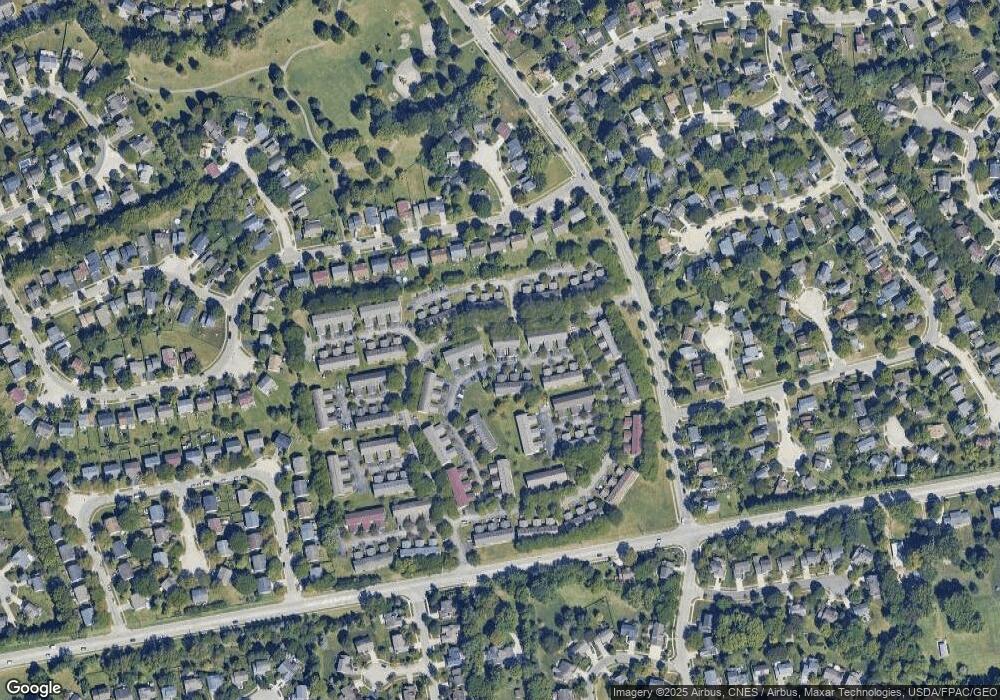

Map

Nearby Homes

- 3661 Mountshannon Rd

- 3894 Maidens Larne Dr

- 3873 Tweedsmuir Dr

- 3761 Carnforth Dr

- 4898 Davidson Run Dr

- 3552 Mountshannon Rd

- 4664 Cutwater Ln

- 5049 Dinard Way

- 3940 Rennes Dr

- 3578 Braidwood Dr

- 4400 Dublin Rd

- 5500 Saddlebrook Dr

- 3660 Rivervail Dr

- 5500 Shannon Heights Blvd

- 5506 Shannon Heights Blvd

- 4253 Davidson Rd

- 3936 Medford Square

- 4390 Dublin Rd

- 4372 Dublin Rd

- 3741 Baybridge Ln

- 4943 Kristie Falls Unit C

- 4939 Kristie Falls Unit AD

- 4945 Kristie Falls Unit D

- 4935 Kristie Falls Unit F

- 4949 Kristie Falls

- 3738 Dexter Row

- 4933 Kristie Falls Unit E

- 4951 Kristie Falls

- 3736 Dexter Row

- 3734 Dexter Row

- 4953 Kristie Falls

- 4931 Kristie Falls Unit D

- 3740 Dexter Row

- 4929 Kristie Falls

- 3742 Dexter Row

- 4938 Kristie Falls Unit B

- 4940 Kristie Falls Unit C

- 4942 Kristie Falls

- 4942 Kristie Falls Unit D

- 4944 Kristie Falls