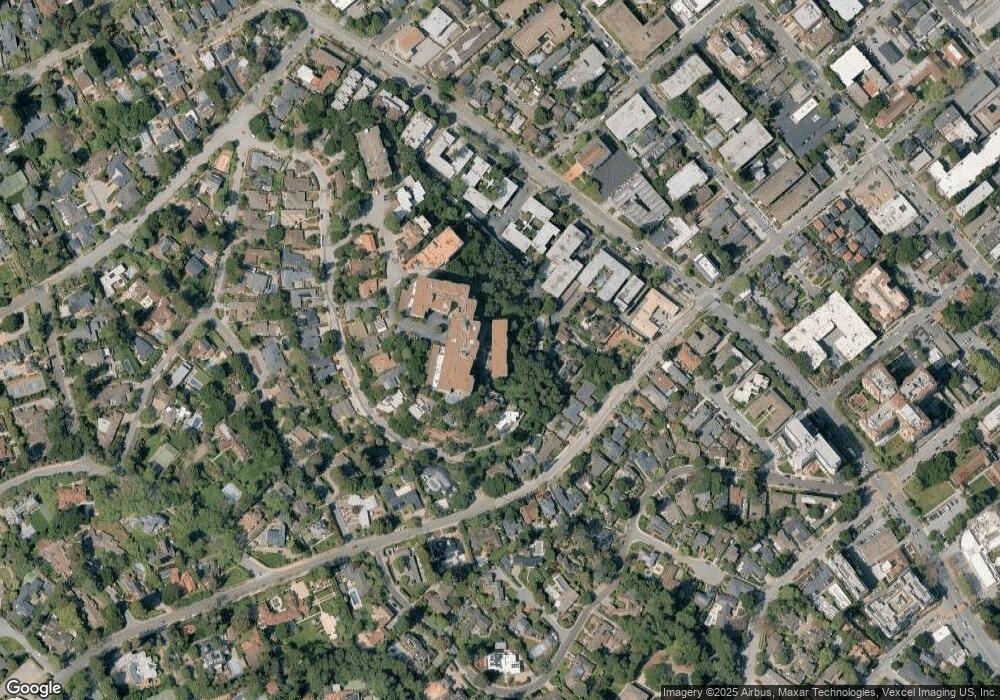

Top of the Mounds 50 Mounds Rd Unit 214 San Mateo, CA 94402

Baywood-Aragon NeighborhoodEstimated Value: $1,388,000 - $1,410,000

2

Beds

2

Baths

2,036

Sq Ft

$686/Sq Ft

Est. Value

About This Home

This home is located at 50 Mounds Rd Unit 214, San Mateo, CA 94402 and is currently estimated at $1,397,634, approximately $686 per square foot. 50 Mounds Rd Unit 214 is a home located in San Mateo County with nearby schools including San Mateo Park Elementary, Borel Middle School, and San Mateo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 11, 2025

Sold by

Kramer Family Trust and Kramer William R

Bought by

K S Myint Llc

Current Estimated Value

Purchase Details

Closed on

Dec 2, 2024

Sold by

Kramer Family Trust and Kramer William R

Bought by

Kramer Family Trust and Kramer

Purchase Details

Closed on

Dec 21, 2012

Sold by

Revocabl Hampton Lucy Wai Yeok

Bought by

Kramer William R and Kramer Anita V

Purchase Details

Closed on

Sep 20, 2005

Sold by

Hampton Lucy Wai Yeok and Hampton Lucy Wai Yuek

Bought by

Revocabl Hampton Lucy Wai Yeok

Purchase Details

Closed on

Apr 10, 2002

Sold by

Constantino Claire

Bought by

Hampton Lucy Wai Yuek

Purchase Details

Closed on

Feb 24, 2000

Sold by

Jatee Investments

Bought by

Constantino Claire

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| K S Myint Llc | $1,400,000 | Fidelity National Title Compan | |

| Kramer Family Trust | -- | None Listed On Document | |

| Kramer Family Trust | -- | None Listed On Document | |

| Kramer William R | $655,000 | North American Title Co Inc | |

| Revocabl Hampton Lucy Wai Yeok | -- | -- | |

| Hampton Lucy Wai Yuek | $730,000 | Fidelity National Title Co | |

| Constantino Claire | -- | Fidelity National Title Co | |

| Constantino Claire | $550,000 | Fidelity National Title |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,003 | $201,969 | $42,886 | $159,083 |

| 2023 | $2,003 | $194,128 | $41,222 | $152,906 |

| 2022 | $2,052 | $190,322 | $40,414 | $149,908 |

| 2021 | $2,054 | $186,591 | $39,622 | $146,969 |

| 2020 | $1,934 | $184,679 | $39,216 | $145,463 |

| 2019 | $1,783 | $181,059 | $38,448 | $142,611 |

| 2018 | $2,770 | $177,510 | $37,695 | $139,815 |

| 2017 | $2,542 | $174,030 | $36,956 | $137,074 |

| 2016 | $2,605 | $170,619 | $36,232 | $134,387 |

| 2015 | $2,517 | $168,057 | $35,688 | $132,369 |

| 2014 | $2,462 | $164,766 | $34,989 | $129,777 |

Source: Public Records

About Top of the Mounds

Map

Nearby Homes

- 50 Mounds Rd Unit 305

- 177 N El Camino Real Unit 34

- 177 N El Camino Real Unit 2

- 47 El Cerrito Ave

- 200 Elm St Unit 107

- 234 Elm St Unit 103

- 153 N San Mateo Dr Unit 106

- 1 Baldwin Ave Unit 503

- 1 Baldwin Ave Unit 911

- 1 Baldwin Ave Unit 510

- 1 Baldwin Ave Unit 903

- 1 Baldwin Ave Unit 709

- 1 Baldwin Ave Unit 616

- 1 Baldwin Ave Unit 214

- 1 Baldwin Ave Unit 417

- 1 Baldwin Ave Unit 410

- 1 Baldwin Ave Unit 221

- 1 Baldwin Ave Unit 323

- 1 Baldwin Ave Unit 222

- 1 Baldwin Ave Unit 516

- 50 Mounds Rd Unit 702

- 50 Mounds Rd Unit 403

- 50 Mounds Rd Unit 801

- 50 Mounds Rd Unit 311

- 50 Mounds Rd Unit 215

- 50 Mounds Rd Unit 207

- 50 Mounds Rd Unit 201

- 50 Mounds Rd Unit 108

- 50 Mounds Rd Unit 703

- 50 Mounds Rd Unit 202

- 50 Mounds Rd Unit 212

- 50 Mounds Rd Unit 507

- 50 Mounds Rd Unit 209

- 50 Mounds Rd Unit 414

- 50 Mounds Rd Unit 505

- 50 Mounds Rd Unit 404

- 50 Mounds Rd Unit 506

- 50 Mounds Rd Unit 502

- 50 Mounds Rd Unit 412

- 50 Mounds Rd Unit 402