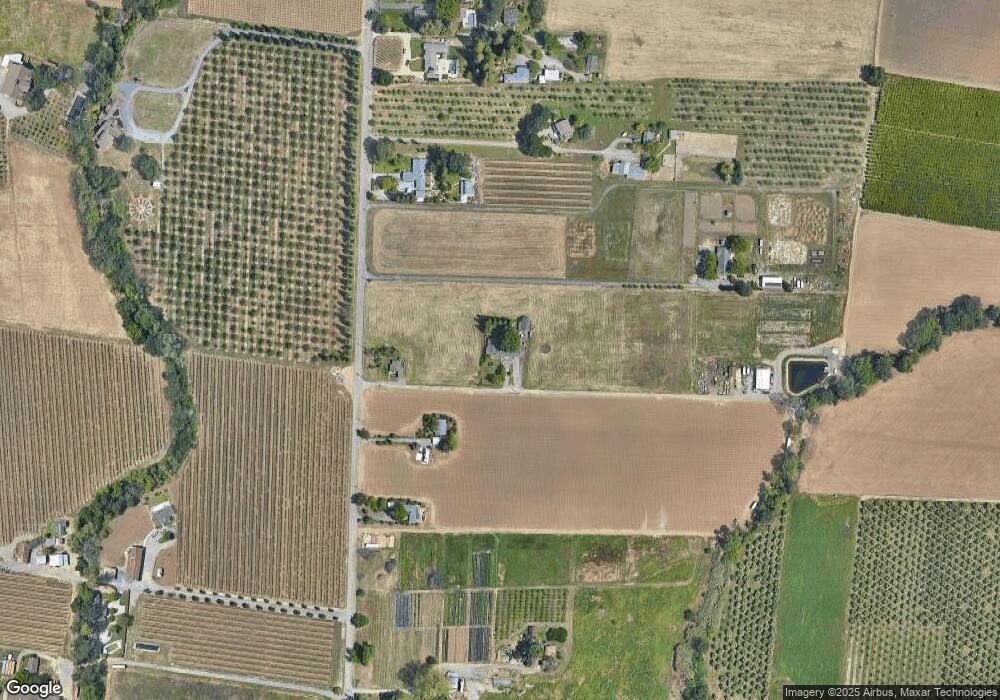

5134 Gordon Valley Rd Fairfield, CA 94534

Estimated Value: $1,631,029 - $2,120,000

4

Beds

3

Baths

3,000

Sq Ft

$645/Sq Ft

Est. Value

About This Home

This home is located at 5134 Gordon Valley Rd, Fairfield, CA 94534 and is currently estimated at $1,934,343, approximately $644 per square foot. 5134 Gordon Valley Rd is a home located in Solano County with nearby schools including Suisun Valley Elementary School and Angelo Rodriguez High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 22, 2023

Sold by

Entrust Group Inc

Bought by

Williams Richard L and Williams Patricia

Current Estimated Value

Purchase Details

Closed on

Jun 15, 2012

Sold by

Lindemann Curtis R and Lindemann Jeanette A

Bought by

The Entrust Group Inc

Purchase Details

Closed on

Apr 20, 2010

Sold by

Mason C Roy and Mason Elizabeth Garben

Bought by

Lindemann Curtis R and Lindemann Jeanette A

Purchase Details

Closed on

May 29, 1998

Sold by

Aldean Sharp F

Bought by

Mason C Roy and Mason Betty G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

7.1%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 15, 1998

Sold by

Aldean Sharp F

Bought by

Sharp Aldean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

7.1%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Williams Richard L | $1,750,000 | Fidelity National Title | |

| The Entrust Group Inc | $660,000 | Old Republic Title Company | |

| Lindemann Curtis R | -- | None Available | |

| Mason C Roy | -- | None Available | |

| Mason C Roy | $430,000 | Frontier Title Company | |

| Sharp Aldean | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mason C Roy | $300,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,109 | $977,009 | $334,409 | $642,600 |

| 2024 | $7,109 | $583,481 | $153,053 | $430,428 |

| 2023 | $6,897 | $564,918 | $142,929 | $421,989 |

| 2022 | $6,770 | $557,144 | $143,430 | $413,714 |

| 2021 | $6,672 | $543,846 | $138,244 | $405,602 |

| 2020 | $6,499 | $536,334 | $134,890 | $401,444 |

| 2019 | $5,792 | $476,551 | $132,003 | $344,548 |

| 2018 | $5,931 | $465,424 | $127,631 | $337,793 |

| 2017 | $5,746 | $461,971 | $130,801 | $331,170 |

| 2016 | $5,706 | $452,802 | $128,125 | $324,677 |

| 2015 | $5,320 | $443,562 | $123,761 | $319,801 |

| 2014 | $5,218 | $430,609 | $117,072 | $313,537 |

Source: Public Records

Map

Nearby Homes

- 5066 Clayton Rd

- 3337 Spyglass Ct Unit 5

- 2866 Birkham Ct

- 3273 Torrey Pines Dr

- 3262 Inwood Place

- 3266 Congressional Cir

- 3270 Formby Ln

- 3261 Congressional Cir

- 2900 Calle de Cordoba

- 3235 Hilton Head Dr

- 3233 Hilton Head Dr

- 4683 Abernathy Rd

- 2516 Bellevue Ct

- 3229 Seminole Cir

- 3220 Seminole Cir

- 2517 Kingsmill Ln

- 0 Suisun Valley Rd

- 124 Cannes Ct

- 4589 Abernathy Rd

- 3127 Cherry Valley Cir

- 5150 Gordon Valley Rd

- 5174 Gordon Valley Rd

- 722 Clayton Rd

- 5192 Gordon Valley Rd

- 5126 Gordon Valley Rd

- 5166 Gordon Valley Rd

- 5188 Gordon Valley Rd

- 5196 Gordon Valley Rd

- 5099 Clayton Rd

- 5081 Clayton Rd

- 5207 Clayton Rd

- 5118 Clayton Rd

- 5114 Gordon Valley Rd

- 5184 Gordon Valley Rd

- 5130 Clayton Rd

- 5213 Clayton Rd

- 5200 Gordon Valley Rd

- 5057 Clayton Rd

- 5062 Clayton Rd

- 5070 Clayton Rd