5143 Village 5 Unit 5 Camarillo, CA 93012

Estimated Value: $697,139 - $836,000

3

Beds

2

Baths

1,498

Sq Ft

$500/Sq Ft

Est. Value

About This Home

This home is located at 5143 Village 5 Unit 5, Camarillo, CA 93012 and is currently estimated at $748,285, approximately $499 per square foot. 5143 Village 5 Unit 5 is a home located in Ventura County with nearby schools including Tierra Linda Elementary School, Las Colinas Middle School, and Adolfo Camarillo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 27, 2018

Sold by

Stilson Patrick Ellis and Stilson Connie Jean

Bought by

Gofberg Sally C and The Gofberg Family Trust

Current Estimated Value

Purchase Details

Closed on

Oct 14, 2015

Sold by

Stilson Patrick and Stilson Connie

Bought by

Stilson Family Trust

Purchase Details

Closed on

Nov 13, 2008

Sold by

Newlin Lloyd H and Newlin Lawanda L

Bought by

Stilson Patrick and Stilson Connie

Purchase Details

Closed on

Mar 12, 2004

Sold by

Sieg Clela M and Richard L & Clela M Sieg Jr Tr

Bought by

Newlin Lloyd H and Newlin Lawanda L

Purchase Details

Closed on

Nov 13, 2000

Sold by

Mardirossian Pondella David G and Mardirossian Pondella Sylvia

Bought by

Sieg Richard L and Sieg Clela M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gofberg Sally C | $540,000 | Lawyers Title | |

| Stilson Family Trust | -- | None Available | |

| Stilson Patrick | $315,000 | Fidelity National Title Co | |

| Newlin Lloyd H | $365,000 | Old Republic Title Company | |

| Sieg Richard L | $240,000 | Chicago Title Co |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,512 | $233,804 | $40,175 | $193,629 |

| 2024 | $2,512 | $229,220 | $39,387 | $189,833 |

| 2023 | $2,421 | $224,726 | $38,615 | $186,111 |

| 2022 | $2,412 | $220,320 | $37,858 | $182,462 |

| 2021 | $2,325 | $216,000 | $37,115 | $178,885 |

| 2020 | $2,316 | $213,787 | $36,736 | $177,051 |

| 2019 | $2,304 | $209,596 | $36,016 | $173,580 |

| 2018 | $2,482 | $225,400 | $56,255 | $169,145 |

| 2017 | $2,336 | $220,981 | $55,152 | $165,829 |

| 2016 | $2,279 | $216,649 | $54,071 | $162,578 |

| 2015 | $2,254 | $213,396 | $53,259 | $160,137 |

| 2014 | $2,172 | $206,519 | $52,217 | $154,302 |

Source: Public Records

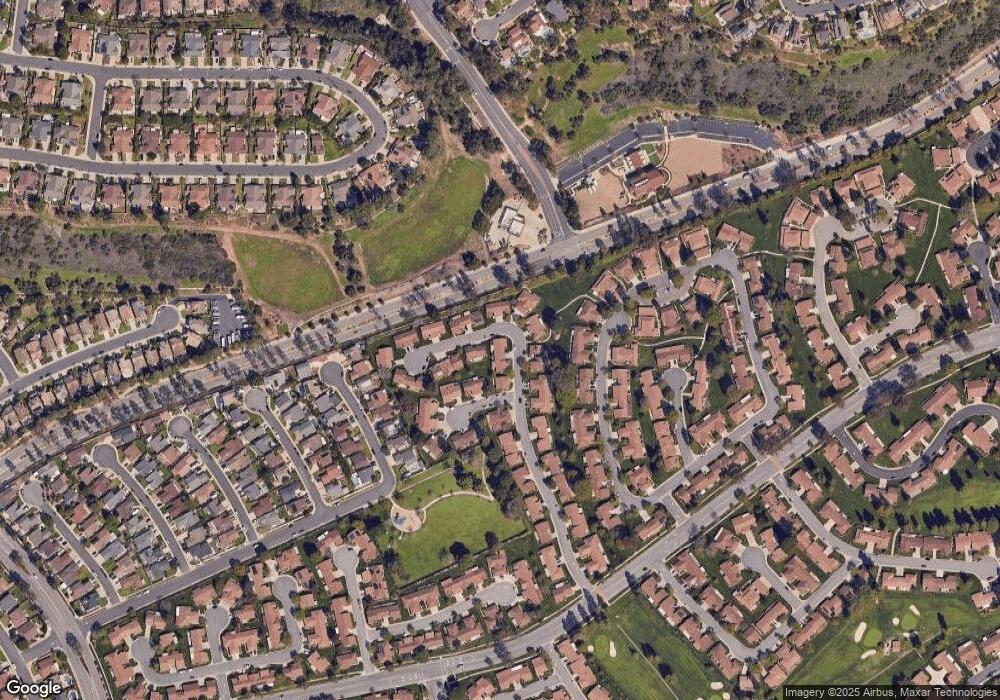

Map

Nearby Homes

- 5118 Village 5

- 7202 Village 7 Unit 7

- 6118 Village 6

- 16302 Village 16

- 5247 San Francesca Dr

- 11225 Village 11

- 5302 Paseo Ricoso

- 5662 Willow View Dr

- 16113 Village 16

- 17219 Village 17

- 17306 Village 17 Unit 17

- 17223 Village 17

- 860 Laurel Park Cir

- 5327 Heather St

- 25126 Village 25

- 1253 Mission Verde Dr Unit 1142

- 113 Camino el Rincon

- 676 Buenos Tiempos Dr

- 5004 Ladera Vista Dr

- 22106 Village 22

- 5143 Village 5

- 5141 Village 5

- 5161 Village 5 Unit 5

- 5161 Village 5

- 5137 Village 5

- 5144 Village 5 Unit 5

- 5144 Village 5

- 5142 Village 5

- 5160 Village 5

- 5156 Village 5 Unit 5

- 5156 Village 5

- 5148 Village 5

- 5146 Village 5

- 5154 Village Unit 5

- 5154 Village 5 Unit 5

- 5154 Village 5

- 5142 Village Unit 5

- 5202 Village 5

- 5162 Village 5 Unit 5

- 5150 Village 5