5186 Union Rd Franklin, OH 45005

Estimated Value: $468,000 - $760,000

4

Beds

4

Baths

3,013

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 5186 Union Rd, Franklin, OH 45005 and is currently estimated at $606,038, approximately $201 per square foot. 5186 Union Rd is a home located in Warren County with nearby schools including Franklin High School, Summit Academy Community School for Alternative Learners - Middletown, and Summit Academy Secondary School - Middletown.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2022

Sold by

Miller Steven R and Miller Rebecca L

Bought by

Miller Family Trust

Current Estimated Value

Purchase Details

Closed on

Oct 1, 2003

Sold by

Aleksin David and Aleksin Linda

Bought by

Miller Steven R and Miller Rebecca

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$53,200

Interest Rate

6.49%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 13, 2000

Sold by

Barker Dale J

Bought by

Aleksin David M and Aleksin Linda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,750

Interest Rate

8.14%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller Family Trust | -- | None Listed On Document | |

| Miller Steven R | $62,600 | Technetitle | |

| Aleksin David M | $55,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Miller Steven R | $53,200 | |

| Previous Owner | Aleksin David M | $46,750 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,678 | $173,860 | $51,460 | $122,400 |

| 2024 | $7,678 | $173,860 | $51,460 | $122,400 |

| 2023 | $6,884 | $140,483 | $32,298 | $108,185 |

| 2022 | $6,737 | $140,483 | $32,298 | $108,185 |

| 2021 | $6,359 | $140,483 | $32,298 | $108,185 |

| 2020 | $5,876 | $114,212 | $26,257 | $87,955 |

| 2019 | $5,307 | $114,212 | $26,257 | $87,955 |

| 2018 | $5,307 | $114,212 | $26,257 | $87,955 |

| 2017 | $5,353 | $104,636 | $25,389 | $79,247 |

| 2016 | $5,468 | $104,636 | $25,389 | $79,247 |

| 2015 | $5,258 | $100,657 | $25,389 | $75,268 |

| 2014 | $4,578 | $85,310 | $24,430 | $60,880 |

| 2013 | $3,892 | $99,910 | $26,260 | $73,650 |

Source: Public Records

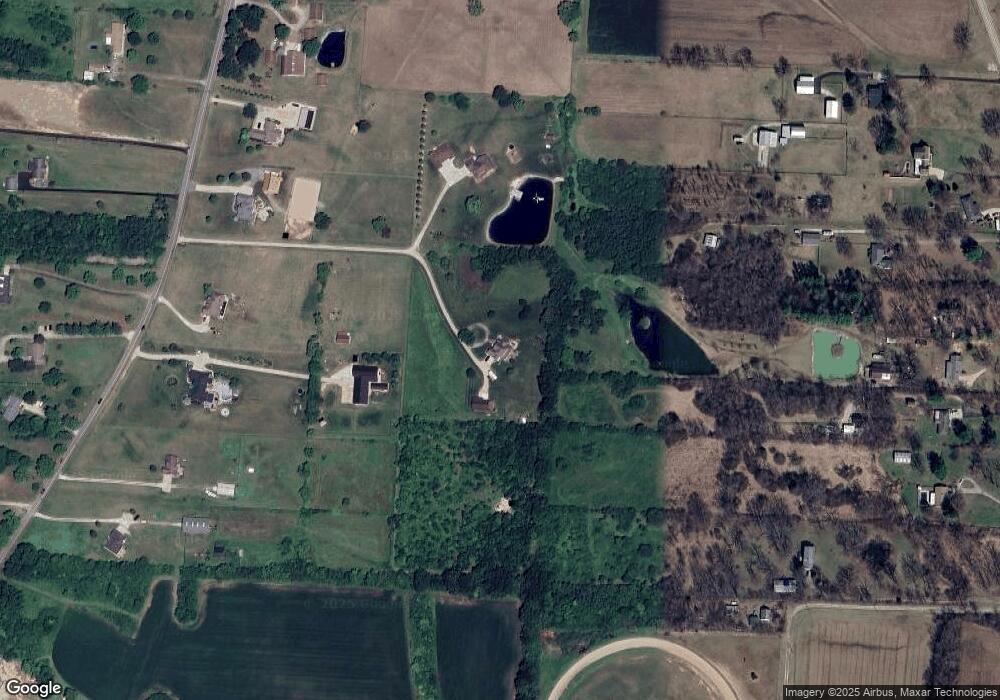

Map

Nearby Homes

- 5744 Lynn St

- 5845 Manchester Rd

- 4650 Shaker Rd

- 4640 Shaker Rd

- 25 Timber Creek Dr

- 65 Timber Creek Dr

- 100 Pleasant Hill Blvd

- 6334 Bevis Ln

- 5757 S Dixie Hwy

- 6323 Shaker Rd

- 6759 Manchester Rd

- 5696 Woodcreek Dr

- 6777 Crystal Harbour Dr

- 5667 Woodcreek Dr

- 5925 Millbrook Dr

- 5865 Hayden Dr

- 6633 Rivulet Dr

- 6645 Rivulet Dr

- 3833 Sterling Dr

- 6006 Tributary Park

Your Personal Tour Guide

Ask me questions while you tour the home.