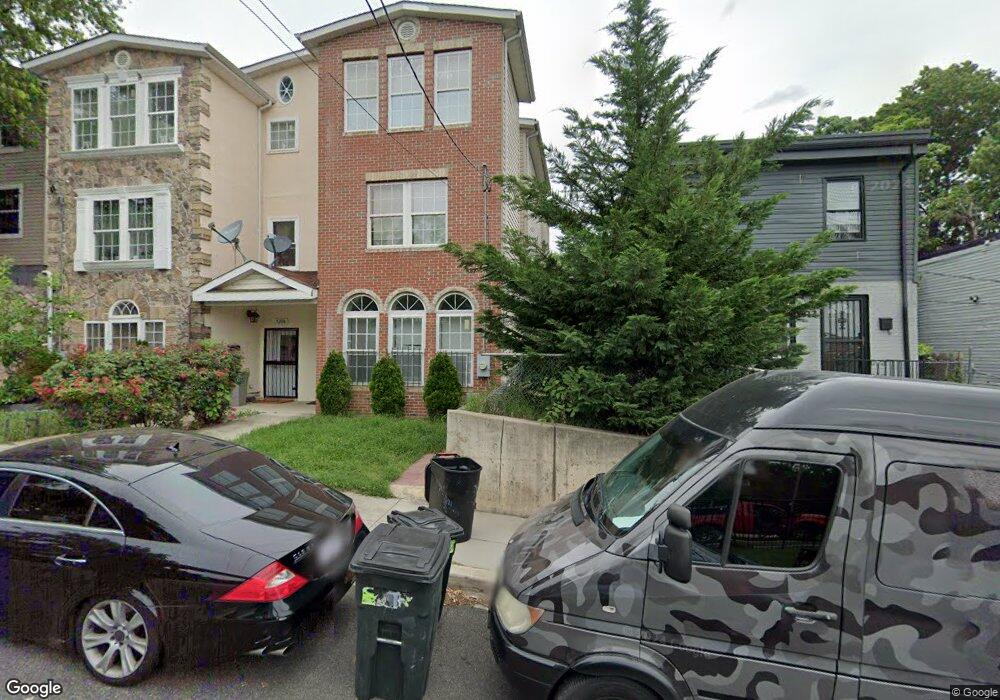

5208 Queens Stroll Place SE Washington, DC 20019

Marshall Heights NeighborhoodEstimated Value: $464,000 - $627,000

4

Beds

4

Baths

2,834

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 5208 Queens Stroll Place SE, Washington, DC 20019 and is currently estimated at $542,522, approximately $191 per square foot. 5208 Queens Stroll Place SE is a home located in District of Columbia with nearby schools including C.W. Harris Elementary School, Kelly Miller Middle School, and H.D. Woodson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2024

Sold by

Aiken Michael and Aiken Lisa

Bought by

Mohammed Hanan A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$367,500

Outstanding Balance

$364,236

Interest Rate

6.72%

Mortgage Type

New Conventional

Estimated Equity

$178,286

Purchase Details

Closed on

Oct 13, 2017

Sold by

Aiken Michael

Bought by

Aiken Michael and Aiken Lisa

Purchase Details

Closed on

Aug 8, 2016

Sold by

Jbt Investments Llc A District Of Columb

Bought by

Aiken Michael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$335,805

Interest Rate

5.5%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 8, 2008

Sold by

Drake Properties Llc

Bought by

Jbt Investments Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mohammed Hanan A | $490,000 | Citizens Title | |

| Aiken Michael | -- | None Available | |

| Aiken Michael | $342,000 | District Title | |

| Jbt Investments Llc | $276,560 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mohammed Hanan A | $367,500 | |

| Previous Owner | Aiken Michael | $335,805 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,130 | $648,420 | $139,760 | $508,660 |

| 2024 | $4,650 | $634,150 | $136,180 | $497,970 |

| 2023 | $4,366 | $617,080 | $133,560 | $483,520 |

| 2022 | $4,010 | $583,080 | $126,920 | $456,160 |

| 2021 | $3,664 | $550,870 | $126,380 | $424,490 |

| 2020 | $3,336 | $513,620 | $121,480 | $392,140 |

| 2019 | $3,039 | $484,840 | $120,240 | $364,600 |

| 2018 | $2,774 | $405,510 | $0 | $0 |

| 2017 | $2,530 | $370,070 | $0 | $0 |

| 2016 | $2,932 | $344,960 | $0 | $0 |

| 2015 | $2,810 | $330,640 | $0 | $0 |

| 2014 | $2,579 | $303,390 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 5100 F St SE Unit 7

- 5217 F St SE

- 5219 F St SE

- 5102 Call Place SE

- 5332 D St SE

- 5045 Call Place SE Unit 102

- 5009 D St SE Unit 303

- 5009 D St SE Unit 202

- 5102 Fitch St SE

- 5002 Kimi Gray Ct SE

- 5231 Bass Place SE

- 5109 Bass Place SE

- 5310 B St SE

- 5432 Call Place SE

- 214 54th St SE

- 5137 Astor Place SE

- 4950 Call Place SE Unit B2

- 5030 B St SE

- 5032 Hanna Place SE

- 922 Abel Ave

- 5206 Queens Stroll Place SE Unit 805

- 5206 Queens Stroll Place SE

- 5206 Queens Stroll Place SE

- 5204 Drake Place SE

- 5204 Queens Stroll Place SE

- 5212 Queens Stroll Place SE

- 5212 Drake Place SE

- 5202 Queen Stroll Place SE

- 5202 Drake Place SE

- 5214 Queens Stroll Place SE

- 5214 Drake Place SE

- 5200 Drake Place SE

- 5200 Queens Stroll Place SE

- 0 Drake Place SE

- 5209 Queens Stroll Place SE

- 5209 D St SE

- 5209 Drake Place SE

- 5221 D St SE

- 5219 D St SE

- 5201 Queens Stroll Place SE