5220 Myall Rd Ardmore, OK 73401

Estimated Value: $366,000 - $434,000

3

Beds

2

Baths

2,189

Sq Ft

$177/Sq Ft

Est. Value

About This Home

This home is located at 5220 Myall Rd, Ardmore, OK 73401 and is currently estimated at $387,959, approximately $177 per square foot. 5220 Myall Rd is a home located in Carter County with nearby schools including Plainview Primary School, Plainview Intermediate School, and Plainview Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 16, 2019

Sold by

Byers Jerry and Byers Brooke

Bought by

Morrow Tamra A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$279,837

Outstanding Balance

$244,680

Interest Rate

3.62%

Mortgage Type

FHA

Estimated Equity

$143,279

Purchase Details

Closed on

Oct 25, 2016

Sold by

Byers Jerry and Byers Brooke

Bought by

Byers Jerry and Byers Brooke

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,750

Interest Rate

3.48%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 23, 2001

Sold by

Plainview Development

Bought by

Byers Jerry and Byers Brooke

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morrow Tamra A | $285,000 | None Available | |

| Byers Jerry | -- | American Eagle Title Group | |

| Byers Jerry | $15,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Morrow Tamra A | $279,837 | |

| Previous Owner | Byers Jerry | $183,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,225 | $35,149 | $4,800 | $30,349 |

| 2024 | $3,225 | $37,373 | $4,800 | $32,573 |

| 2023 | $3,429 | $35,594 | $4,800 | $30,794 |

| 2022 | $3,224 | $35,594 | $4,800 | $30,794 |

| 2021 | $3,186 | $34,200 | $5,130 | $29,070 |

| 2020 | $3,220 | $34,200 | $5,130 | $29,070 |

| 2019 | $2,631 | $29,681 | $2,773 | $26,908 |

| 2018 | $2,526 | $28,817 | $2,664 | $26,153 |

| 2017 | $2,462 | $27,979 | $2,883 | $25,096 |

| 2016 | $2,401 | $27,163 | $1,800 | $25,363 |

| 2015 | $2,535 | $27,854 | $1,800 | $26,054 |

| 2014 | $2,465 | $27,043 | $1,800 | $25,243 |

Source: Public Records

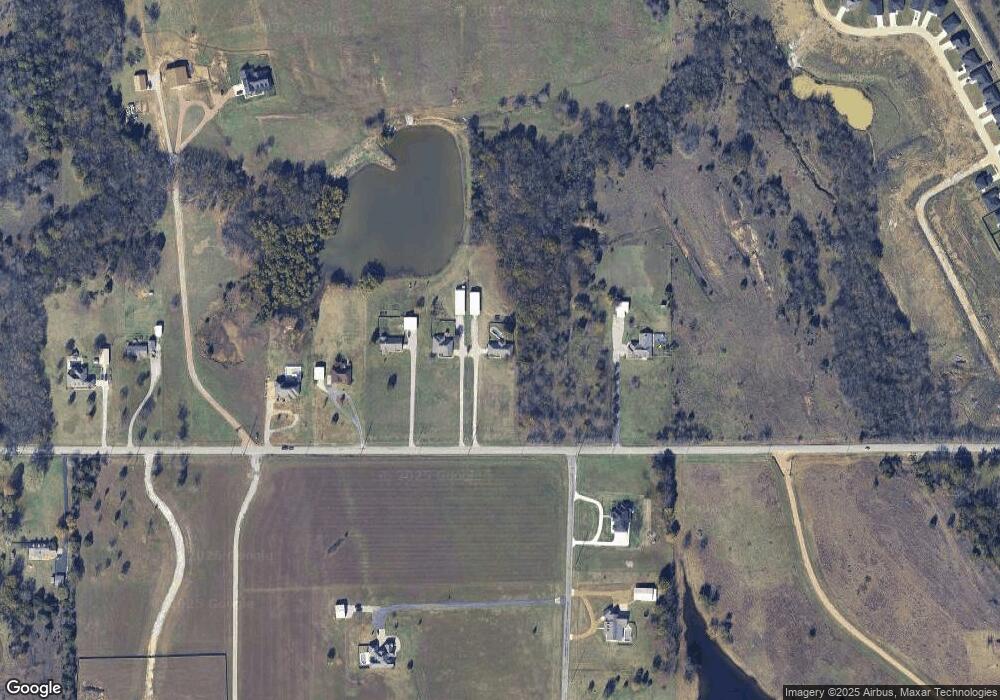

Map

Nearby Homes

- 815 Indian Plains Rd

- 803 Indian Plains Rd

- 737 Indian Plains Rd

- 909 Indian Plains Rd

- 921 Indian Plains Rd

- 925 Indian Plains Rd

- 725 Indian Plains Rd

- 1022 Indian Plains Rd

- 5648 Myall Rd

- 816 Boulder Dr

- 4110 Meadowlark Rd

- 4105 Meadowlark Rd

- 714 Prairie View Rd

- 808 Prairie View Rd

- 0 Foxden Rd Unit 2511367

- 1013 Prairie View Rd

- 913 Prairie View Rd

- 4101 Rolling Hills Dr

- 610 Sundance Dr

- 3501 W Broadway St

- 5256 Myall Rd

- 5288 Myall Rd

- 5128 Myall Rd

- 5294 Myall Rd

- 25 Valley Ranch Rd

- 3 Acres Valley Ranch Rd

- 5348 Myall Rd

- 105 Valley Ranch Rd

- 130 Valley Ranch Rd

- 5408 Myall Rd

- 5448 Myall Rd

- 163 Valley Ranch Rd

- 5464 Myall Rd

- 166 Valley Ranch Rd

- 5487 Myall Rd

- 1003 Indian Plains Rd

- 1007 Indian Plains Rd

- 1011 Indian Plains Rd

- 1015 Indian Plains Rd

- 263 Valley Ranch Rd