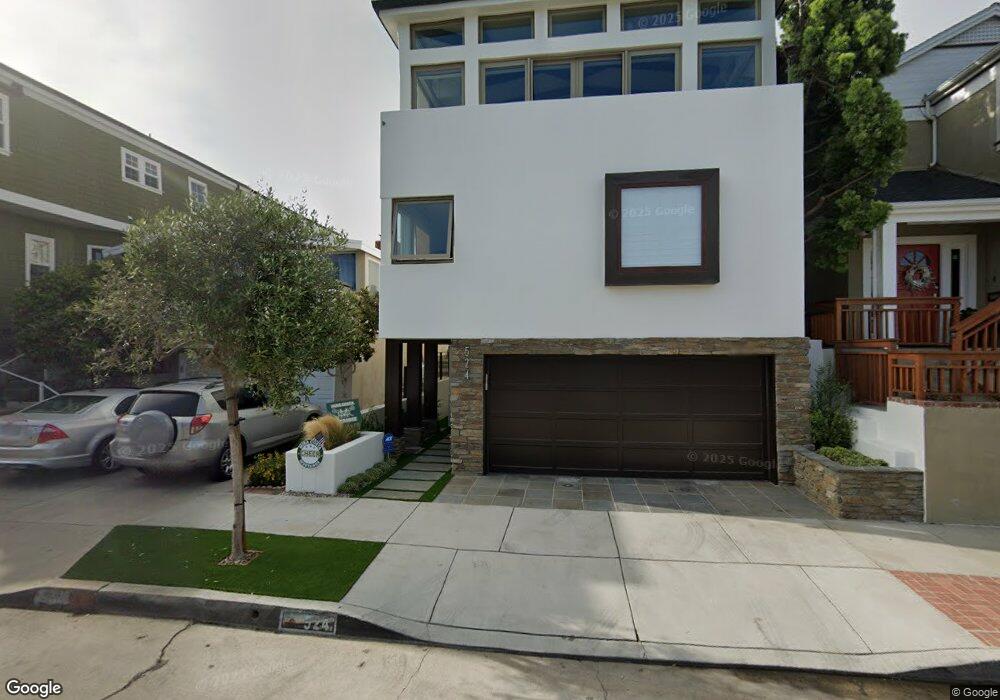

524 3rd St Manhattan Beach, CA 90266

Estimated Value: $3,984,000 - $6,280,000

4

Beds

5

Baths

3,800

Sq Ft

$1,378/Sq Ft

Est. Value

About This Home

This home is located at 524 3rd St, Manhattan Beach, CA 90266 and is currently estimated at $5,236,021, approximately $1,377 per square foot. 524 3rd St is a home located in Los Angeles County with nearby schools including Opal Robinson Elementary School, Manhattan Beach Middle School, and Mira Costa High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 5, 2025

Sold by

Catherine And Philip Brodkin Living Trus and Brodkin Catherine

Bought by

Catherin And Philip Brodkin Living Trust and Brodkin

Current Estimated Value

Purchase Details

Closed on

Feb 6, 2003

Sold by

Demarest Steven P and Demarest Catherine Jones

Bought by

Demarest Catherine Jones

Purchase Details

Closed on

Oct 27, 2001

Sold by

Demarest Steven and Demarest Catherine

Bought by

Demarest Steven

Purchase Details

Closed on

Aug 11, 1995

Sold by

Kieser Frederick C and Kieser Marylynne

Bought by

Demarest Steven P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$311,250

Interest Rate

7.5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Catherin And Philip Brodkin Living Trust | -- | None Listed On Document | |

| Demarest Catherine Jones | -- | -- | |

| Demarest Steven | -- | Gateway Title | |

| Demarest Steven P | $415,000 | Title Land Company Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Demarest Steven P | $311,250 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,805 | $1,467,657 | $551,531 | $916,126 |

| 2024 | $16,805 | $1,438,880 | $540,717 | $898,163 |

| 2023 | $16,323 | $1,410,667 | $530,115 | $880,552 |

| 2022 | $16,044 | $1,383,008 | $519,721 | $863,287 |

| 2021 | $15,774 | $1,355,891 | $509,531 | $846,360 |

| 2020 | $15,629 | $1,341,989 | $504,307 | $837,682 |

| 2019 | $15,354 | $1,315,676 | $494,419 | $821,257 |

| 2018 | $15,021 | $1,289,879 | $484,725 | $805,154 |

| 2016 | $13,871 | $1,239,793 | $465,903 | $773,890 |

| 2015 | $13,585 | $1,221,171 | $458,905 | $762,266 |

| 2014 | $13,398 | $1,197,251 | $449,916 | $747,335 |

Source: Public Records

Map

Nearby Homes

- 541 4th St

- 213 Bayview Dr

- 212 Manhattan Ave

- 207 S Poinsettia Ave

- 231 Longfellow Ave

- 934 1st St

- 626 Longfellow Ave

- 2919 Hermosa View Dr

- 927 9th St

- 352 27th St

- 124 11th St

- 225 27th St

- 525 Manhattan Beach Blvd

- 1140 Fisher Ave

- 620 12th St

- 628 13th St

- 724 13th St

- 649 Gould Terrace

- 2526 Hermosa Ave

- 624 14th St

Your Personal Tour Guide

Ask me questions while you tour the home.