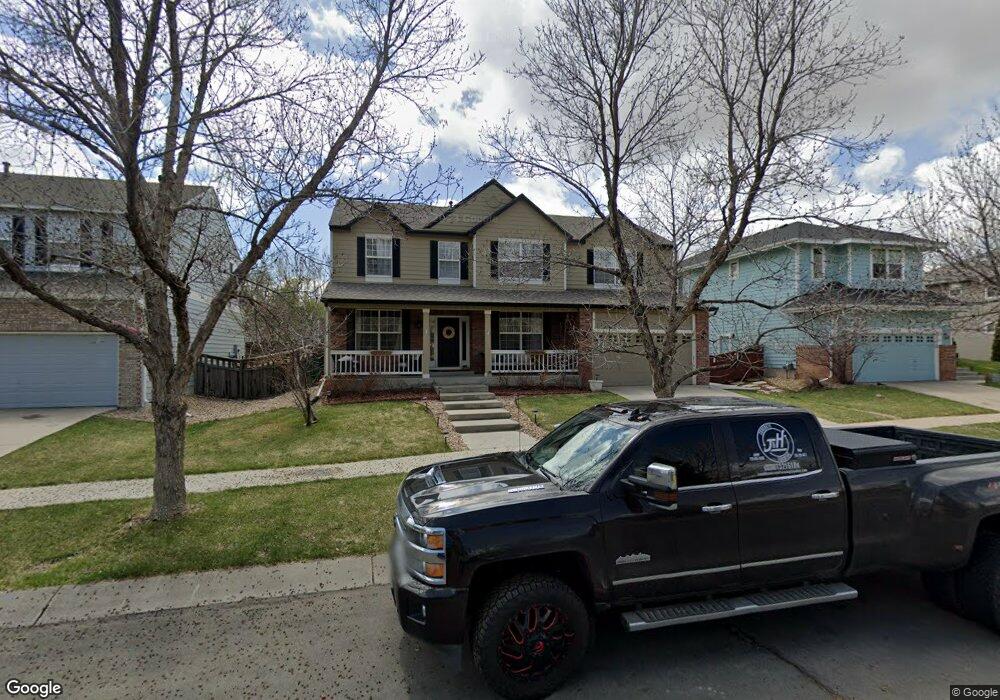

5276 Red Hawk Pkwy Brighton, CO 80601

Estimated Value: $538,000 - $597,000

4

Beds

3

Baths

2,667

Sq Ft

$209/Sq Ft

Est. Value

About This Home

This home is located at 5276 Red Hawk Pkwy, Brighton, CO 80601 and is currently estimated at $557,283, approximately $208 per square foot. 5276 Red Hawk Pkwy is a home located in Adams County with nearby schools including Pennock Elementary School, Overland Trail Middle School, and Brighton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 27, 2020

Sold by

Kelsey Theresa Dawn

Bought by

Becerra Ramon Lopez and Garcia Hugo M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$395,100

Outstanding Balance

$318,804

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$238,479

Purchase Details

Closed on

Dec 6, 2019

Sold by

Callum Theresa Dawn

Bought by

Kelsey Theresa Dawn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,415

Interest Rate

4.12%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 30, 2018

Sold by

Bacerra Victor M and Hernandez Baudelio

Bought by

Callum Theresa Dawn

Purchase Details

Closed on

Mar 19, 2001

Sold by

Richmond American Homes Of Colorado Inc

Bought by

Becerra Victor M and Hernandez Baudelio

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$259,400

Interest Rate

7.11%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Becerra Ramon Lopez | $445,100 | Land Title Guarantee | |

| Kelsey Theresa Dawn | -- | None Available | |

| Callum Theresa Dawn | $405,000 | Tiago Title Llc | |

| Becerra Victor M | $253,842 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Becerra Ramon Lopez | $395,100 | |

| Previous Owner | Kelsey Theresa Dawn | $140,415 | |

| Previous Owner | Becerra Victor M | $259,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,318 | $35,130 | $6,250 | $28,880 |

| 2023 | $6,294 | $40,660 | $6,360 | $34,300 |

| 2022 | $4,799 | $28,740 | $6,530 | $22,210 |

| 2021 | $4,799 | $28,740 | $6,530 | $22,210 |

| 2020 | $4,492 | $27,980 | $6,220 | $21,760 |

| 2019 | $4,498 | $27,980 | $6,220 | $21,760 |

| 2018 | $4,104 | $25,480 | $6,480 | $19,000 |

| 2017 | $4,107 | $25,480 | $6,480 | $19,000 |

| 2016 | $3,297 | $21,130 | $3,660 | $17,470 |

| 2015 | $3,283 | $21,130 | $3,660 | $17,470 |

| 2014 | -- | $17,540 | $2,630 | $14,910 |

Source: Public Records

Map

Nearby Homes

- 5224 Snow Goose St

- 5292 Goldfinch St

- 33 Gaviota Ave

- 5113 Grey Swallow St

- 4950 Mount Cameron Dr

- 102 Pelican Ave

- 5624 Killdeer St Unit 5624

- 4828 Mount Cameron Dr

- 12 Golden Eagle Pkwy Unit 12

- 5157 Goshawk St

- 576 Tanager St

- 4749 Mount Shavano St

- 4723 Crestone Peak St

- 4670 Quandary Peak St

- 5161 Chicory Cir

- 5055 Pelican St

- 5277 Royal Pine St

- 5092 Sparrow St

- 329 Apache Plume St

- 178 Chardon Ave

- 5286 Red Hawk Pkwy

- 5270 Red Hawk Pkwy

- 5277 Grosbeak St

- 5271 Grosbeak St

- 5266 Red Hawk Pkwy

- 5287 Grosbeak St

- 5267 Grosbeak St Unit 18

- 5297 Grosbeak St

- 5257 Grosbeak St

- 5256 Red Hawk Pkwy

- 5275 Red Hawk Pkwy

- 5247 Grosbeak St

- 5269 Red Hawk Pkwy

- 5285 Red Hawk Pkwy

- 5265 Red Hawk Pkwy

- 5246 Red Hawk Pkwy

- 218 Paloma Ave

- 199 Paloma Ave

- 208 Paloma Ave

- 5272 Grosbeak St