5303 Cribari Heights San Jose, CA 95135

The Villages NeighborhoodEstimated Value: $474,000 - $544,000

2

Beds

2

Baths

1,223

Sq Ft

$419/Sq Ft

Est. Value

About This Home

This home is located at 5303 Cribari Heights, San Jose, CA 95135 and is currently estimated at $511,846, approximately $418 per square foot. 5303 Cribari Heights is a home located in Santa Clara County with nearby schools including Tom Matsumoto Elementary School, Chaboya Middle School, and Evergreen Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 15, 2021

Sold by

Caraccilo Bonnie Gaye and Davis Barbara Lu

Bought by

Caraccilo Bonnie Gaye

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,000

Outstanding Balance

$119,460

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$392,386

Purchase Details

Closed on

Jul 27, 2011

Sold by

Davis Joseph E

Bought by

Davis Barbara Lu Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,625

Interest Rate

4.46%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 25, 2011

Sold by

Warner Carolyn L

Bought by

Caraccilo Bonnie and Davis Barbara Lu Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,625

Interest Rate

4.46%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 6, 1995

Sold by

Warner Ruth G

Bought by

Warner Ruth G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Caraccilo Bonnie Gaye | -- | First American Title Company | |

| Davis Barbara Lu Ann | -- | North Americna Title Company | |

| Caraccilo Bonnie | $147,500 | North American Title Company | |

| Warner Ruth G | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Caraccilo Bonnie Gaye | $131,000 | |

| Closed | Caraccilo Bonnie | $110,625 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,945 | $185,256 | $92,628 | $92,628 |

| 2024 | $2,945 | $181,624 | $90,812 | $90,812 |

| 2023 | $2,945 | $323,624 | $161,812 | $161,812 |

| 2022 | $4,726 | $317,280 | $158,640 | $158,640 |

| 2021 | $2,814 | $171,152 | $85,576 | $85,576 |

| 2020 | $2,722 | $169,398 | $84,699 | $84,699 |

| 2019 | $2,662 | $166,078 | $83,039 | $83,039 |

| 2018 | $2,616 | $162,822 | $81,411 | $81,411 |

| 2017 | $2,574 | $159,630 | $79,815 | $79,815 |

| 2016 | $2,448 | $156,500 | $78,250 | $78,250 |

| 2015 | $2,407 | $154,150 | $77,075 | $77,075 |

| 2014 | $2,276 | $151,132 | $75,566 | $75,566 |

Source: Public Records

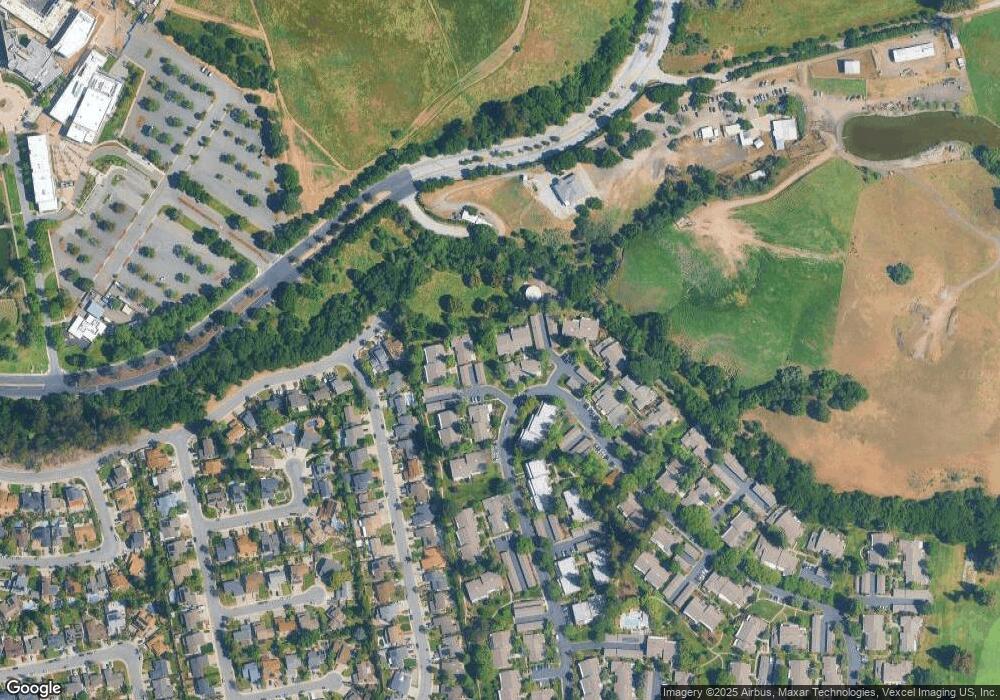

Map

Nearby Homes

- 5302 Cribari Heights

- 5336 Cribari Glen

- 5271 Cribari Corner

- 5286 Cribari Heights Unit A286

- 5264 Cribari Heights

- 5235 Cribari Hills

- 5189 Cribari Hills

- 5469 Cribari Green

- 5424 Cribari Ct

- 5437 Cribari Green

- 5274 Sunny Orchard Ln

- 5142 Cribari Place

- 5009 Cribari Vale

- 5277 Knights Estate

- 3123 Lake Trasimeno Dr

- 7111 Via Portada

- 5213 Silvercrest Ridge Ct

- 2010 Carignan Way

- 3308 Lake Albano Cir

- 2044 Folle Blanche Dr Unit 2044

- 5304 Cribari Heights

- 5301 Cribari Heights

- 5300 Cribari Heights

- 5299 Cribari Heights

- 5298 Cribari Heights

- 5297 Cribari Heights

- 5305 Cribari Heights

- 5306 Cribari Heights Unit A-306

- 5306 Cribari Heights

- 5307 Cribari Heights

- 5310 Cribari Glen

- 5309 Cribari Glen

- 5311 Cribari Glen

- 5308 Cribari Heights

- 5312 Cribari Glen Unit A312

- 5313 Cribari Glen

- 5315 Cribari Glen Unit A315U

- 5314 Cribari Glen Unit A314

- 5339 Cribari Glen Unit A339

- 5317 Cribari Glen