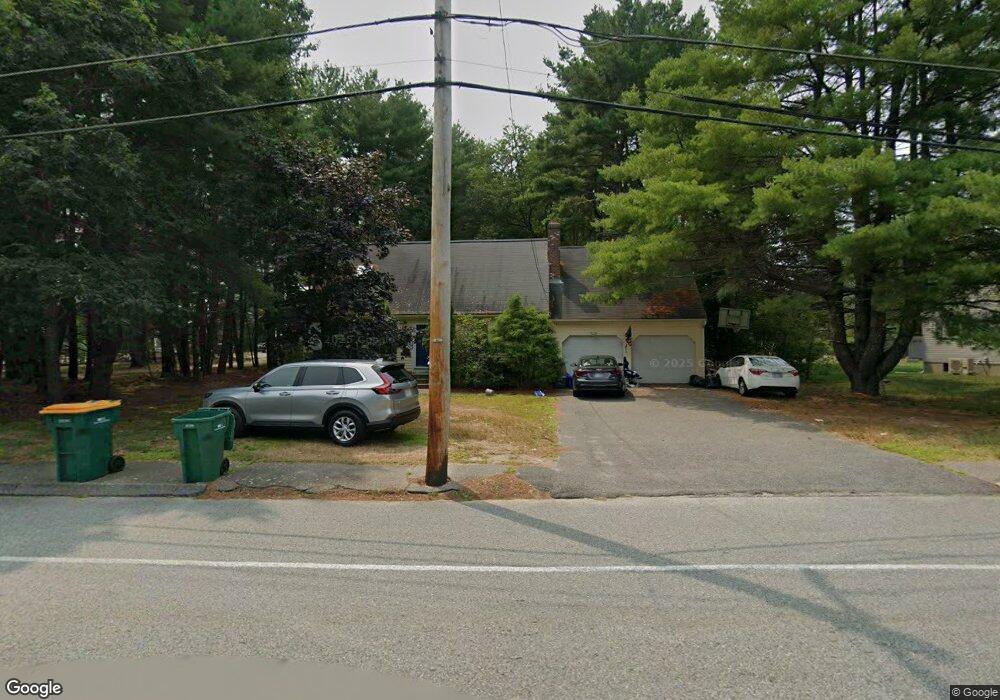

533 Elm St Mansfield, MA 02048

Estimated Value: $653,000 - $716,000

3

Beds

3

Baths

2,010

Sq Ft

$346/Sq Ft

Est. Value

About This Home

This home is located at 533 Elm St, Mansfield, MA 02048 and is currently estimated at $695,659, approximately $346 per square foot. 533 Elm St is a home located in Bristol County with nearby schools including Everett W. Robinson Elementary School, Jordan/Jackson Elementary School, and Harold L. Qualters Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 27, 1993

Sold by

Clifford William S and Clifford Andrea L

Bought by

Roche Joseph M and Roche Joanne D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,150

Interest Rate

7.1%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 5, 1992

Sold by

Desvergnes Donald

Bought by

Clifford William S and Clifford Andrea L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,900

Interest Rate

8.8%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Roche Joseph M | $157,000 | -- | |

| Clifford William S | $159,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Clifford William S | $80,000 | |

| Open | Clifford William S | $154,991 | |

| Closed | Clifford William S | $149,150 | |

| Previous Owner | Clifford William S | $127,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,403 | $562,100 | $259,000 | $303,100 |

| 2024 | $7,641 | $566,000 | $259,000 | $307,000 |

| 2023 | $7,562 | $536,700 | $259,000 | $277,700 |

| 2022 | $7,304 | $481,500 | $240,300 | $241,200 |

| 2021 | $4,529 | $460,000 | $209,900 | $250,100 |

| 2020 | $6,626 | $431,400 | $200,100 | $231,300 |

| 2019 | $6,138 | $403,300 | $167,400 | $235,900 |

| 2018 | $4,246 | $389,600 | $160,000 | $229,600 |

| 2017 | $5,469 | $364,100 | $155,700 | $208,400 |

| 2016 | $5,235 | $339,700 | $148,200 | $191,500 |

| 2015 | $5,199 | $335,400 | $148,200 | $187,200 |

Source: Public Records

Map

Nearby Homes

- 2 Oak St Unit 2A

- 2 Oak St Unit 2B

- 37 Oakleaf Dr

- 451R Gilbert St

- 14 Claire Ave

- 71 Richardson Ave

- 14 Country Club Way

- 143 Oak St Unit 10

- 150 Gilbert St

- 10 Walter St

- 65 Godfrey Dr Unit 65

- 78 Old Farm Rd

- 85 Jewell St

- 95 Godfrey Dr

- 49 Pheasant Hill Rd

- 345 Richardson Ave

- 4 Village Way Unit F

- 27 Smith St Unit 11

- 157 Mansfield Ave Unit 14

- 24 Maverick Dr