Estimated Value: $2,342,000 - $2,755,000

3

Beds

3

Baths

2,861

Sq Ft

$870/Sq Ft

Est. Value

About This Home

This home is located at 533 Quail Run Rd, Aptos, CA 95003 and is currently estimated at $2,489,181, approximately $870 per square foot. 533 Quail Run Rd is a home located in Santa Cruz County with nearby schools including Valencia Elementary School, Aptos Junior High School, and Aptos High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 26, 2017

Sold by

Houlemard Michael A and Valentino Christina L

Bought by

Houlemard Michael A and Valentino Christina L

Current Estimated Value

Purchase Details

Closed on

Aug 10, 2012

Sold by

Valentino Dominga and Valentino Dominga A

Bought by

Valentino Dominga A

Purchase Details

Closed on

Jun 17, 2003

Sold by

Andersen Scott A and Andersen Heidi M

Bought by

Houlemard Michael A and Valentino Christina L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$833,000

Outstanding Balance

$358,268

Interest Rate

5.53%

Mortgage Type

Unknown

Estimated Equity

$2,130,913

Purchase Details

Closed on

Nov 9, 1998

Sold by

Rittenhouse Robert R and Rittenhouse Robert R

Bought by

Andersen Scott A and Andersen Heidi M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,000

Interest Rate

8.5%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Houlemard Michael A | -- | None Available | |

| Valentino Dominga A | -- | None Available | |

| Houlemard Michael A | $1,190,000 | First American Title Co | |

| Andersen Scott A | $347,000 | Santa Cruz Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Houlemard Michael A | $833,000 | |

| Previous Owner | Andersen Scott A | $225,000 | |

| Closed | Houlemard Michael A | $150,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $22,558 | $2,086,905 | $1,019,856 | $1,067,049 |

| 2023 | $22,225 | $2,005,868 | $980,254 | $1,025,614 |

| 2022 | $21,841 | $1,966,537 | $961,033 | $1,005,504 |

| 2021 | $21,370 | $1,927,977 | $942,189 | $985,788 |

| 2020 | $21,057 | $1,908,208 | $932,528 | $975,680 |

| 2019 | $20,699 | $1,870,792 | $914,243 | $956,549 |

| 2018 | $20,183 | $1,834,110 | $896,317 | $937,793 |

| 2017 | $20,038 | $1,798,148 | $878,742 | $919,406 |

| 2016 | $19,515 | $1,762,890 | $861,512 | $901,378 |

| 2015 | $19,379 | $1,736,410 | $848,572 | $887,838 |

| 2014 | $18,965 | $1,702,396 | $831,950 | $870,446 |

Source: Public Records

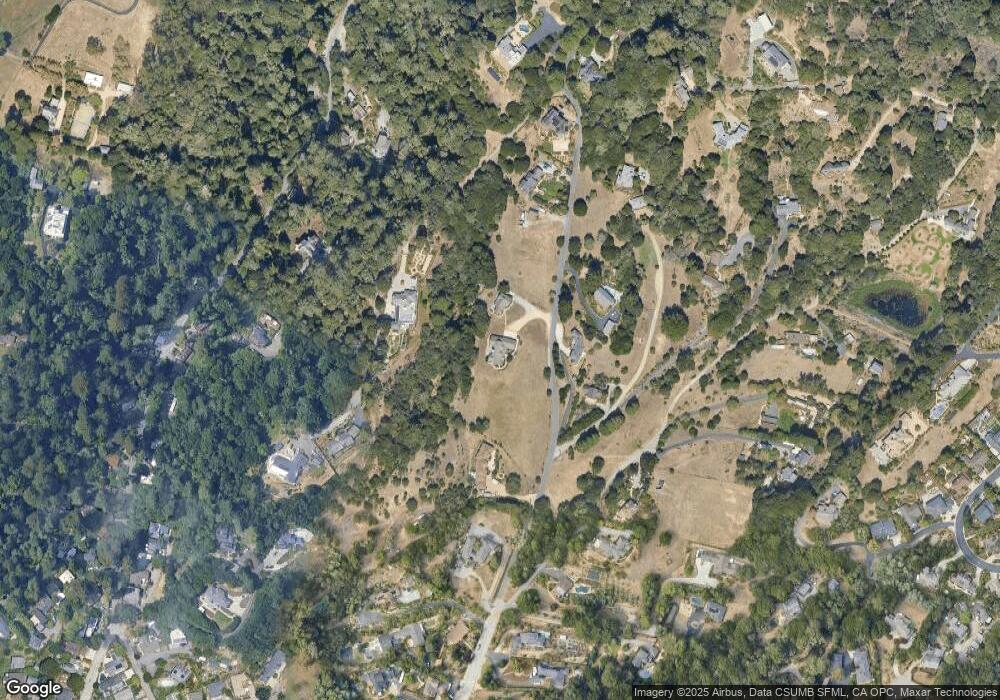

Map

Nearby Homes

- 000 Burns Ave

- 530 Quail Run Rd

- 532 Moonrise Ln

- Lot 02 Cathedral Dr

- 131 Aptos Village Way Unit 2

- 136 Aptos Village Way Unit 3

- 126 Aptos Village Way Unit 2

- 111 Aptos Village Way Unit 2

- 111 Aptos Village Way Unit 1

- 101 Aptos Village Way Unit 4

- 785 Cathedral Dr

- 645 Skyward Dr

- 373 Sandalwood Dr

- 300 Carrera Cir

- 0 Baker Rd

- 827 Valencia Rd

- 347 Treasure Island Dr

- 254 Center Ave

- 307 Treasure Island Dr Unit 1

- 610 Rio Del Mar Blvd

- 510 Quail Run Rd

- 400 Quail Run Rd

- 200 King Krest Ln

- 537 Quail Run Rd

- 240 King Krest Ln

- 210 Hawks Peak Rd

- 205 Quail Run Rd

- 420 Quail Run Rd

- 430 Quail Run Rd

- 575 Quail Run Rd

- 160 Hawks Peak Rd

- 651 Burns Ave

- 633 Burns Ave

- 675 Burns Ave

- 646 Cathedral Dr

- 120 Hawks Peak Rd

- 260 King Krest Ln

- 636 Cathedral Dr

- 652 Cathedral Dr

- 631 Burns Ave

Your Personal Tour Guide

Ask me questions while you tour the home.