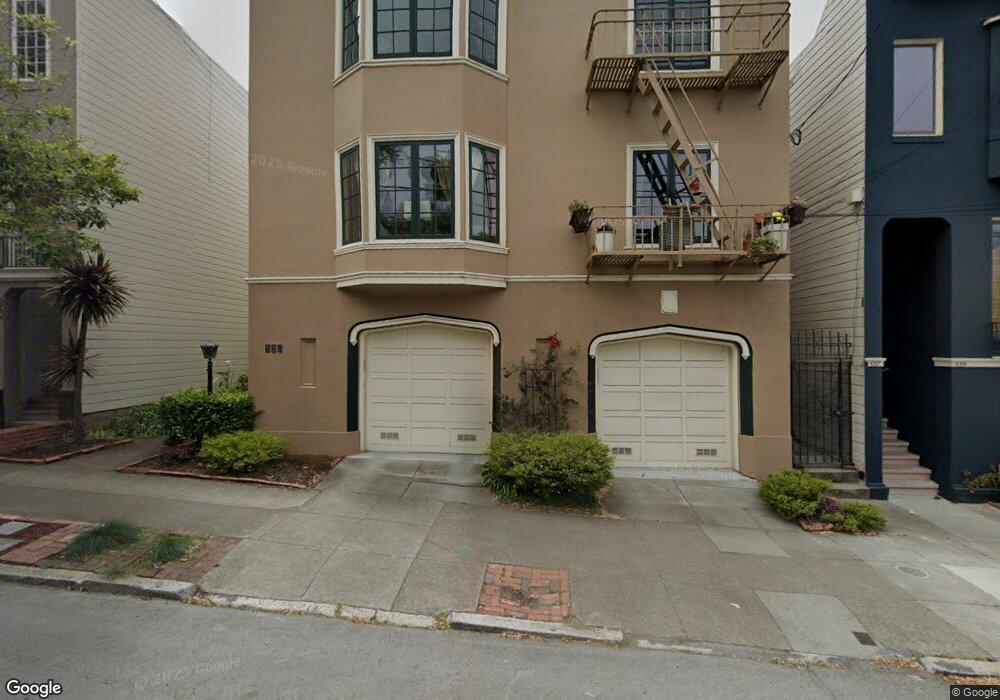

539 14th Ave Unit 4 San Francisco, CA 94118

Central Richmond NeighborhoodEstimated Value: $1,061,000 - $1,478,000

2

Beds

1

Bath

1,150

Sq Ft

$1,081/Sq Ft

Est. Value

About This Home

This home is located at 539 14th Ave Unit 4, San Francisco, CA 94118 and is currently estimated at $1,243,398, approximately $1,081 per square foot. 539 14th Ave Unit 4 is a home located in San Francisco County with nearby schools including Argonne Elementary School, Presidio Middle School, and Stratford School - San Francisco 14th Avenue.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 16, 2006

Sold by

Headington Geoffrey C

Bought by

Levinger Walter

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$510,000

Outstanding Balance

$296,383

Interest Rate

6.46%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$947,015

Purchase Details

Closed on

Jan 23, 2002

Sold by

Dippe Mark

Bought by

Headington Geoffrey C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$334,400

Interest Rate

6.25%

Purchase Details

Closed on

Jan 16, 2002

Sold by

Stephens Terry and Dippe Mark

Bought by

Dippe Mark

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$334,400

Interest Rate

6.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Levinger Walter | $785,000 | Fidelity National Title Co | |

| Headington Geoffrey C | $418,000 | First American Title Co | |

| Dippe Mark | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Levinger Walter | $510,000 | |

| Previous Owner | Headington Geoffrey C | $334,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,156 | $1,072,756 | $536,378 | $536,378 |

| 2024 | $13,156 | $1,051,722 | $525,861 | $525,861 |

| 2023 | $12,920 | $1,031,100 | $515,550 | $515,550 |

| 2022 | $12,657 | $1,010,884 | $505,442 | $505,442 |

| 2021 | $12,432 | $991,064 | $495,532 | $495,532 |

| 2020 | $12,493 | $980,902 | $490,451 | $490,451 |

| 2019 | $12,068 | $961,670 | $480,835 | $480,835 |

| 2018 | $11,663 | $942,814 | $471,407 | $471,407 |

| 2017 | $11,227 | $924,328 | $462,164 | $462,164 |

| 2016 | $11,037 | $906,204 | $453,102 | $453,102 |

| 2015 | $10,900 | $892,592 | $446,296 | $446,296 |

| 2014 | $9,145 | $750,000 | $450,000 | $300,000 |

Source: Public Records

Map

Nearby Homes

- 428 15th Ave

- 459 11th Ave

- 1608 Balboa St

- 1940 Anza St Unit 6

- 368 Funston Ave

- 1532 Cabrillo St

- 700 12th Ave Unit 6

- 511 9th Ave

- 369 18th Ave Unit 203

- 1633 Cabrillo St

- 1014 Clement St

- 251-255 14th Ave

- 756 18th Ave Unit 756

- 467 7th Ave

- 1827 Clement St

- 206 12th Ave

- 4328 Geary Blvd

- 476 7th Ave

- 3326 Fulton St

- 4829 California St

- 539 14th Ave Unit 3

- 539 14th Ave Unit 1

- 539 14th Ave Unit 2

- 535 14th Ave

- 549 14th Ave Unit 549

- 547 14th Ave

- 551 14th Ave Unit 553

- 531 14th Ave Unit 533

- 555 14th Ave Unit 557

- 523 14th Ave

- 527 14th Ave Unit 529

- 559 14th Ave Unit 561

- 525 14th Ave

- 561 14th Ave

- 563 14th Ave Unit 565

- 519 14th Ave Unit 521

- 515 14th Ave Unit 517

- 567 14th Ave Unit 569

- 540 15th Ave

- 532 15th Ave Unit 534