5461 Michelles Oak Ct Unit 5461G Cincinnati, OH 45248

Estimated Value: $184,000 - $192,549

2

Beds

2

Baths

1,283

Sq Ft

$146/Sq Ft

Est. Value

About This Home

This home is located at 5461 Michelles Oak Ct Unit 5461G, Cincinnati, OH 45248 and is currently estimated at $187,387, approximately $146 per square foot. 5461 Michelles Oak Ct Unit 5461G is a home located in Hamilton County with nearby schools including Charles W Springmyer Elementary School, Bridgetown Middle School, and Oak Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 20, 2017

Sold by

Muse Robert L and Muse Donna M

Bought by

Fey Joseph F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,200

Outstanding Balance

$58,830

Interest Rate

3.78%

Mortgage Type

New Conventional

Estimated Equity

$128,557

Purchase Details

Closed on

Dec 2, 2011

Sold by

Muse Robert L

Bought by

Muse Donna M

Purchase Details

Closed on

Apr 16, 2004

Sold by

Towne Development Group Ltd

Bought by

Muse Robert L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,060

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fey Joseph F | $89,000 | Prominent Title Agency Llc | |

| Muse Donna M | -- | Attorney | |

| Muse Robert L | $123,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fey Joseph F | $71,200 | |

| Previous Owner | Muse Robert L | $99,060 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,675 | $51,317 | $10,080 | $41,237 |

| 2023 | $2,612 | $51,317 | $10,080 | $41,237 |

| 2022 | $1,873 | $31,150 | $6,300 | $24,850 |

| 2021 | $1,684 | $31,150 | $6,300 | $24,850 |

| 2020 | $1,703 | $31,150 | $6,300 | $24,850 |

| 2019 | $2,258 | $37,730 | $6,300 | $31,430 |

| 2018 | $2,261 | $37,730 | $6,300 | $31,430 |

| 2017 | $2,133 | $37,730 | $6,300 | $31,430 |

| 2016 | $1,698 | $29,925 | $5,670 | $24,255 |

| 2015 | $1,711 | $29,925 | $5,670 | $24,255 |

| 2014 | $1,713 | $29,925 | $5,670 | $24,255 |

| 2013 | $1,777 | $33,250 | $6,300 | $26,950 |

Source: Public Records

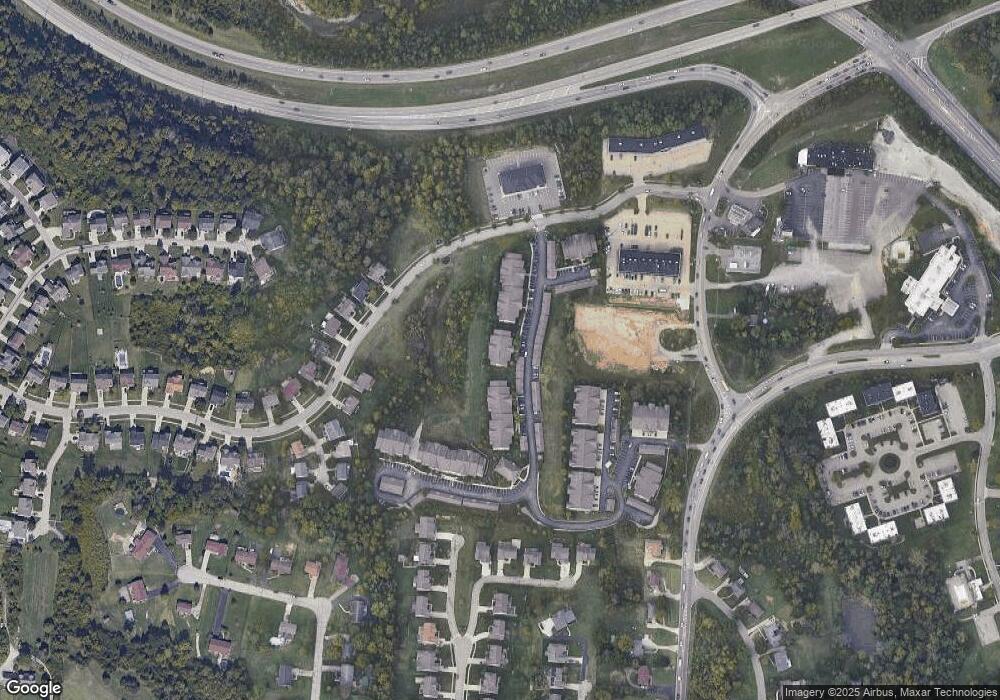

Map

Nearby Homes

- 5473 Michelles Oak Ct

- 6770 Kelseys Oak Ct Unit 67705

- 6864 Ruwes Oak Dr

- 5310 Rybolt Rd

- 6953 Carlinridge Ln

- SHELBURN Plan at Janson Woods

- BRENNAN Plan at Janson Woods

- STRATTON Plan at Janson Woods

- QUENTIN Plan at Janson Woods

- VANDERBURGH Plan at Janson Woods

- BUCHANAN Plan at Janson Woods

- ASH LAWN Plan at Janson Woods

- ALDEN Plan at Janson Woods

- BENNETT Plan at Janson Woods

- LYNDHURST Plan at Janson Woods

- 6586 Hearne Rd Unit 2T

- 6780 Harrison Ave

- 6646 Hearne Rd

- 5207 S Eaglesnest Dr

- 6765 Verde Ridge Dr Unit 20C

- 5461 Michelles Oak Ct Unit 5461B

- 5461 Michelles Oak Ct Unit 5461H

- 5461 Michelles Oak Ct Unit 5461L

- 5461 Michelles Oak Ct Unit 5461E

- 5461 Michelles Oak Ct Unit 5461K

- 5461 Michelles Oak Ct Unit 5461I

- 5461 Michelles Oak Ct Unit 5461C

- 5461 Michelles Oak Ct Unit 5461A

- 5461 Michelles Oak Ct Unit 5461D

- 5461 Michelles Oak Ct Unit J

- 5461 Michelles Oak Ct Unit B

- 5461 Michelles Oak Ct Unit H

- 5461 Michelles Oak Ct Unit E

- 5461 Michelles Oak Ct Unit A

- 5461 Michelles Oak Ct Unit L

- 5461 Michelles Oak Ct Unit I

- 5461 Michelles Oak Ct Unit D

- 5461 Michelles Oak Ct Unit F

- 5485 Michelles Oak Ct Unit E

- 5485 Michelles Oak Ct Unit 5485D