554 S 4th St Unit 556 Aurora, IL 60505

Bardwell NeighborhoodEstimated payment $1,578/month

Highlights

- Hot Property

- Two Heating Systems

- Paved or Partially Paved Lot

- Bungalow

- Multiple Water Heaters

About This Home

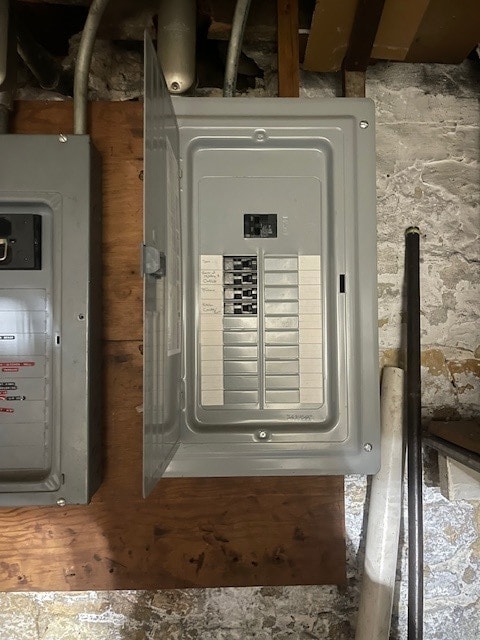

Investor Special! Live in one unit and rent the other or rent both units for maximum income potential. Current tenants may be willing to stay, as both are on MTM leases. The first floor unit offers 3 bedrooms and 1 bath; second floor unit features 2 bedrooms and 1 bath. Major mechanicals are newer, including an approximately 8-year-old roof, two furnaces about 4 years old, and two water heaters roughly 3 years old. Tenants pay gas and electric. Add sweat equity with rehab and unlock strong upside for a flip or long term investment. Property is being sold AS IS.

Listing Agent

Berkshire Hathaway HomeServices Starck Real Estate Brokerage Email: bar_admins@starckre.com License #475140805 Listed on: 12/15/2025

Property Details

Home Type

- Multi-Family

Est. Annual Taxes

- $4,723

Year Built

- Built in 1900

Parking

- 2 Car Garage

- Parking Included in Price

Home Design

- Duplex

- Bungalow

Bedrooms and Bathrooms

- 5 Bedrooms

- 5 Potential Bedrooms

- 2 Bathrooms

Utilities

- Two Heating Systems

- Forced Air Heating System

- Heating System Uses Natural Gas

- Multiple Water Heaters

Additional Features

- Basement Fills Entire Space Under The House

- Paved or Partially Paved Lot

Community Details

- 2 Units

- Water Sewer Expense $2,000

Listing and Financial Details

- Homeowner Tax Exemptions

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,723 | $76,892 | $8,528 | $68,364 |

| 2023 | $4,536 | $68,703 | $7,620 | $61,083 |

| 2022 | $4,307 | $62,686 | $6,953 | $55,733 |

| 2021 | $4,227 | $58,361 | $6,473 | $51,888 |

| 2020 | $4,009 | $54,208 | $6,012 | $48,196 |

| 2019 | $3,897 | $50,225 | $5,570 | $44,655 |

| 2018 | $3,891 | $48,734 | $5,152 | $43,582 |

| 2017 | $3,552 | $42,225 | $4,747 | $37,478 |

| 2016 | $3,495 | $39,211 | $4,521 | $34,690 |

| 2015 | -- | $35,099 | $3,888 | $31,211 |

| 2014 | -- | $32,389 | $3,573 | $28,816 |

| 2013 | -- | $34,368 | $3,594 | $30,774 |

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 12/15/2025 12/15/25 | For Sale | $225,000 | -- | -- |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | $172,500 | Multiple | |

| Warranty Deed | $92,500 | Law Title Ins Co Inc |

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Previous Owner | $172,000 | Unknown | |

| Previous Owner | $91,667 | FHA |

Source: Midwest Real Estate Data (MRED)

MLS Number: 12521785

APN: 15-27-326-017

- 417 Marion Ave

- 446 Seminary Ave

- 480 5th St

- 440 Center Ave

- 506 S Lasalle St

- 574 S Lasalle St

- 550 5th Ave

- 610 Watson St

- 332 North Ave

- 438 North Ave

- 937 Pearl St

- 332 S Broadway

- 466 Hinman St

- 328 Rosewood Ave

- 324 Rosewood Ave

- 168 S Lincoln Ave

- 640 S Spencer St

- 1026 S 4th St

- 1035 Talma St

- 312 S Spencer St

- 735 Sexton St Unit 1

- 735 Sexton St Unit 2

- 328 Rosewood Ave

- 79 S 4th St Unit 2

- 609 North Ave

- 733 Schomer Ave

- 220 E Downer Place

- 140 S River St Unit 402

- 7 S Stolp Ave

- 76 N 4th St Unit 76

- 86 N 4th St Unit 1

- 1037 Howell Place

- 839 Bishop Ave Unit 1

- 557 Hardin Ave

- 111 W Park Ave

- 192 N Smith St Unit 2

- 305 N View St Unit 2

- 1500 Briarcliff Rd

- 1154 Rathbone Ave

- 534 Palace St