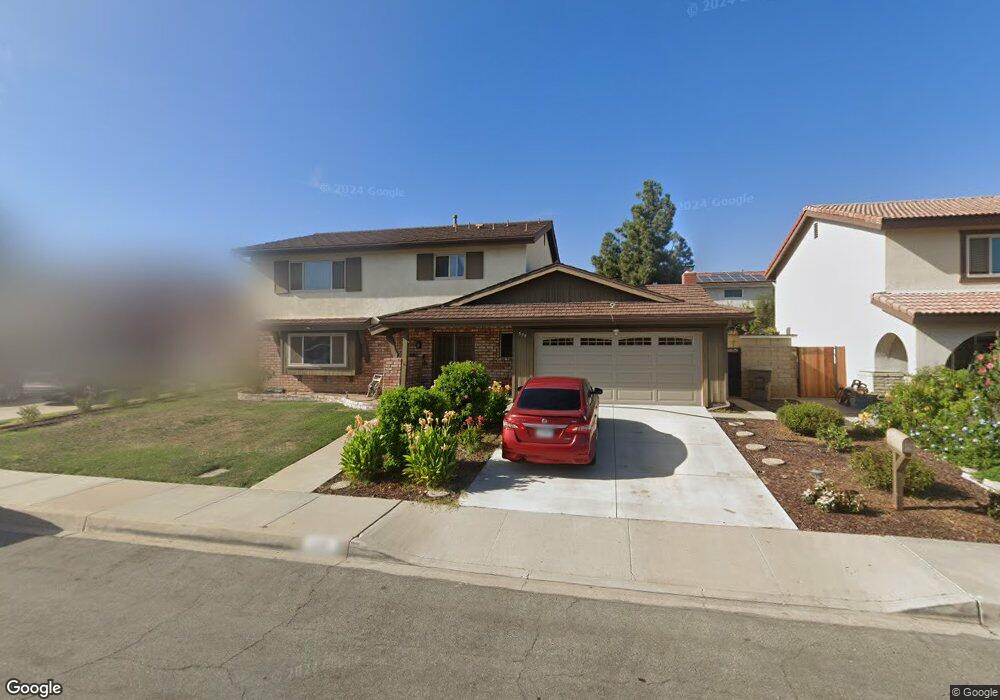

559 Corte Castano Camarillo, CA 93010

Estimated Value: $1,001,206 - $1,097,000

4

Beds

3

Baths

2,370

Sq Ft

$445/Sq Ft

Est. Value

About This Home

This home is located at 559 Corte Castano, Camarillo, CA 93010 and is currently estimated at $1,054,802, approximately $445 per square foot. 559 Corte Castano is a home located in Ventura County with nearby schools including Las Posas Elementary School, Monte Vista Middle School, and Camarillo Academy of Progressive Education.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 1, 2020

Sold by

Tapia Monica and Aguilera Alejandro Tapia

Bought by

Aguilera Alejandro Tapia and Tapia Monica

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$530,000

Outstanding Balance

$471,272

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$583,530

Purchase Details

Closed on

Mar 10, 2016

Sold by

Hagedorn Gregg

Bought by

Tapia Alejandro and Tapia Monica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$535,713

Interest Rate

4.12%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Aguilera Alejandro Tapia | -- | First American Title | |

| Tapia Alejandro | $585,000 | Equity Title Los Angeles |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Aguilera Alejandro Tapia | $530,000 | |

| Closed | Tapia Alejandro | $535,713 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,605 | $692,515 | $450,433 | $242,082 |

| 2024 | $7,605 | $678,937 | $441,601 | $237,336 |

| 2023 | $7,332 | $665,625 | $432,942 | $232,683 |

| 2022 | $7,311 | $652,574 | $424,453 | $228,121 |

| 2021 | $7,049 | $639,779 | $416,130 | $223,649 |

| 2020 | $7,024 | $633,220 | $411,864 | $221,356 |

| 2019 | $6,992 | $620,805 | $403,789 | $217,016 |

| 2018 | $6,864 | $608,633 | $395,872 | $212,761 |

| 2017 | $6,460 | $596,700 | $388,110 | $208,590 |

| 2016 | $1,059 | $98,301 | $20,681 | $77,620 |

| 2015 | $1,047 | $96,826 | $20,371 | $76,455 |

| 2014 | $1,022 | $94,931 | $19,973 | $74,958 |

Source: Public Records

Map

Nearby Homes

- 1665 Avenida Soltura

- 858 Calle Portilla

- 800 Calle Higuera

- 1075 Seybolt Ave

- 1974 Sierra Mesa Dr

- 2048 Sierra Mesa Dr

- 860 Big Horn Ct

- 25 Encino Ave

- 51 Calle Escalon

- 174 Gardenia Ave

- 813 N Calle Circulo

- 61 Paseo Esplendido

- 73 Paseo Esplendido

- 1566 Edgemont Dr

- 106 Calle Bella Vista

- 1519 Lyndhurst Ave

- 124 Reddington Ct

- 35 Estaban Dr

- 405 Paseo Del Valle

- 166 Bramble Ct

- 575 Corte Castano

- 543 Corte Castano

- 1617 Avenida Del Manzano

- 591 Corte Castano

- 1631 Avenida Del Manzano

- 574 Corte Castano

- 525 Corte Castano

- 558 Corte Castano

- 1611 Avenida Del Manzano

- 590 Corte Castano

- 617 Corte Castano

- 542 Corte Castano

- 1639 Avenida Del Manzano

- 616 Corte Castano

- 1603 Avenida Del Manzano

- 1454 Calle la Cumbre

- 591 Calle Portilla

- 1624 Avenida Del Manzano

- 575 Calle Portilla

- 1442 Calle la Cumbre