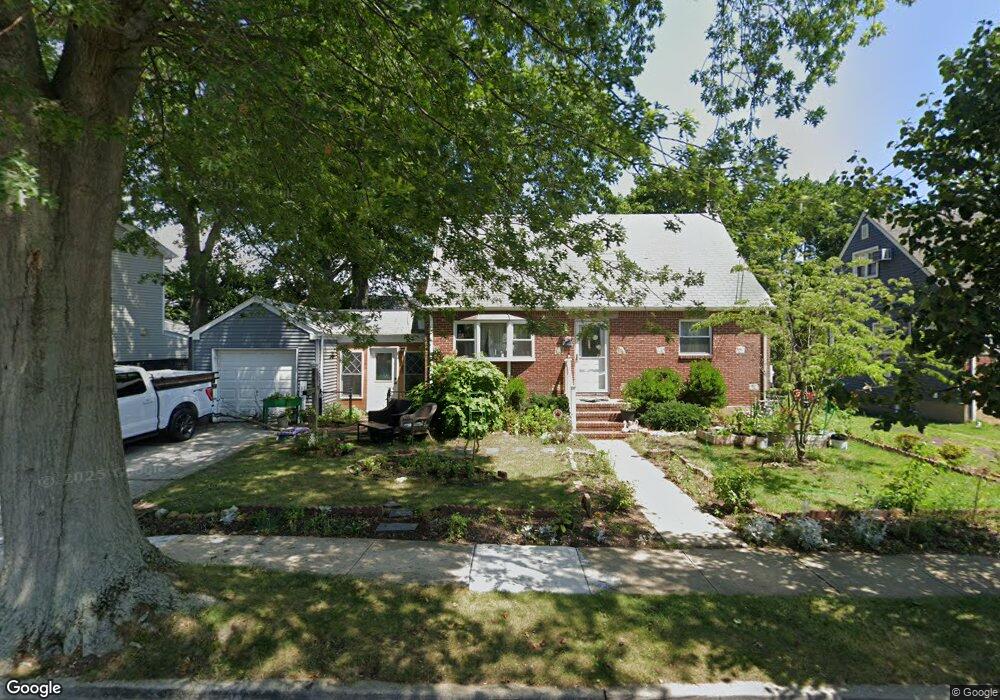

56 Croydon Dr Bellmore, NY 11710

Estimated Value: $576,000 - $677,890

--

Bed

2

Baths

1,240

Sq Ft

$506/Sq Ft

Est. Value

About This Home

This home is located at 56 Croydon Dr, Bellmore, NY 11710 and is currently estimated at $626,945, approximately $505 per square foot. 56 Croydon Dr is a home located in Nassau County with nearby schools including Grand Avenue Middle School, Wellington C Mepham High School, and Grace Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 19, 2022

Sold by

56 Croydon Drive Llc

Bought by

Burke Megan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$495,000

Outstanding Balance

$473,245

Interest Rate

5.51%

Mortgage Type

New Conventional

Estimated Equity

$153,700

Purchase Details

Closed on

Aug 9, 2022

Sold by

Devens Kenneth M and Konopka Lorraine M

Bought by

56 Croydon Drive Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$495,000

Outstanding Balance

$473,245

Interest Rate

5.51%

Mortgage Type

New Conventional

Estimated Equity

$153,700

Purchase Details

Closed on

May 5, 1999

Sold by

Devens Vivian L

Bought by

Konopka Lorraine M and Devens Kenneth M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Burke Megan | $550,000 | New York Title Research Corp | |

| 56 Croydon Drive Llc | $445,000 | New York Title Research Corp | |

| Konopka Lorraine M | -- | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Burke Megan | $495,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,952 | $486 | $197 | $289 |

| 2024 | $3,729 | $486 | $197 | $289 |

| 2023 | $13,707 | $486 | $197 | $289 |

| 2022 | $13,707 | $486 | $197 | $289 |

| 2021 | $5,489 | $466 | $189 | $277 |

| 2020 | $5,711 | $830 | $570 | $260 |

| 2019 | $4,629 | $830 | $570 | $260 |

| 2018 | $4,629 | $830 | $0 | $0 |

| 2017 | $1,582 | $830 | $570 | $260 |

| 2016 | $4,510 | $830 | $570 | $260 |

| 2015 | $3,385 | $830 | $570 | $260 |

| 2014 | $3,385 | $830 | $570 | $260 |

| 2013 | $2,423 | $830 | $570 | $260 |

Source: Public Records

Map

Nearby Homes

- 2434 Martin Ave

- 1776 Roberta Ln

- 1804 Leona Ct

- 208 Camp Ave

- 70 Nancy Blvd

- 10 Airway Dr

- 2288 Locust St

- 5 Oak Brook Ln

- 204 Howell St

- 2282 Sycamore Place

- 205 Howell St

- 335 Smith St

- 239 Stephen St

- 1585 Dewey Ave

- 123 Mitchell St

- 2468 Lincoln Blvd

- 2239 Henry St

- 105 Howell St

- 2355 Mitchell Place

- 13 Metropolitan Ave