569 Fairfield Rd Simi Valley, CA 93065

Wood Ranch NeighborhoodEstimated Value: $882,766 - $1,029,000

4

Beds

3

Baths

1,912

Sq Ft

$499/Sq Ft

Est. Value

About This Home

This home is located at 569 Fairfield Rd, Simi Valley, CA 93065 and is currently estimated at $954,942, approximately $499 per square foot. 569 Fairfield Rd is a home located in Ventura County with nearby schools including Wood Ranch Elementary School, Sinaloa Middle School, and Royal High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 1, 2014

Sold by

Hinds Cynthia Ann

Bought by

Hinds Miuccio Cynthia

Current Estimated Value

Purchase Details

Closed on

Jun 3, 2008

Sold by

Hinds Ronald Cliffords and Hinds Cynthia Ann

Bought by

Hinds Ronald Cliffords and Hinds Cynthia Ann

Purchase Details

Closed on

Feb 25, 2000

Sold by

Mc Knight David G & Emily D Trust and Grant David

Bought by

Hinds Ronald Clifford and Hinds Cynthia Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,700

Outstanding Balance

$85,951

Interest Rate

8.34%

Estimated Equity

$868,991

Purchase Details

Closed on

Sep 2, 1997

Sold by

Mcknight David G and Mcknight Emily D

Bought by

Mcknight David Grant and Mcknight Emily Denny

Purchase Details

Closed on

Feb 28, 1996

Sold by

Mcknight David G and Mcknight Emily D

Bought by

Mcknight David and Mcknight Emily D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hinds Miuccio Cynthia | -- | None Available | |

| Hinds Ronald Cliffords | -- | None Available | |

| Hinds Ronald Clifford | $342,500 | Progressive Title Company | |

| Mcknight David Grant | -- | -- | |

| Mcknight David | -- | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hinds Ronald Clifford | $252,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,501 | $526,379 | $210,549 | $315,830 |

| 2024 | $6,501 | $516,058 | $206,420 | $309,638 |

| 2023 | $6,119 | $505,940 | $202,373 | $303,567 |

| 2022 | $6,078 | $496,020 | $198,405 | $297,615 |

| 2021 | $6,037 | $486,295 | $194,515 | $291,780 |

| 2020 | $5,898 | $481,310 | $192,521 | $288,789 |

| 2019 | $5,641 | $471,874 | $188,747 | $283,127 |

| 2018 | $5,588 | $462,623 | $185,047 | $277,576 |

| 2017 | $5,459 | $453,553 | $181,419 | $272,134 |

| 2016 | $5,211 | $444,661 | $177,862 | $266,799 |

| 2015 | $5,097 | $437,985 | $175,192 | $262,793 |

| 2014 | $5,019 | $429,408 | $171,761 | $257,647 |

Source: Public Records

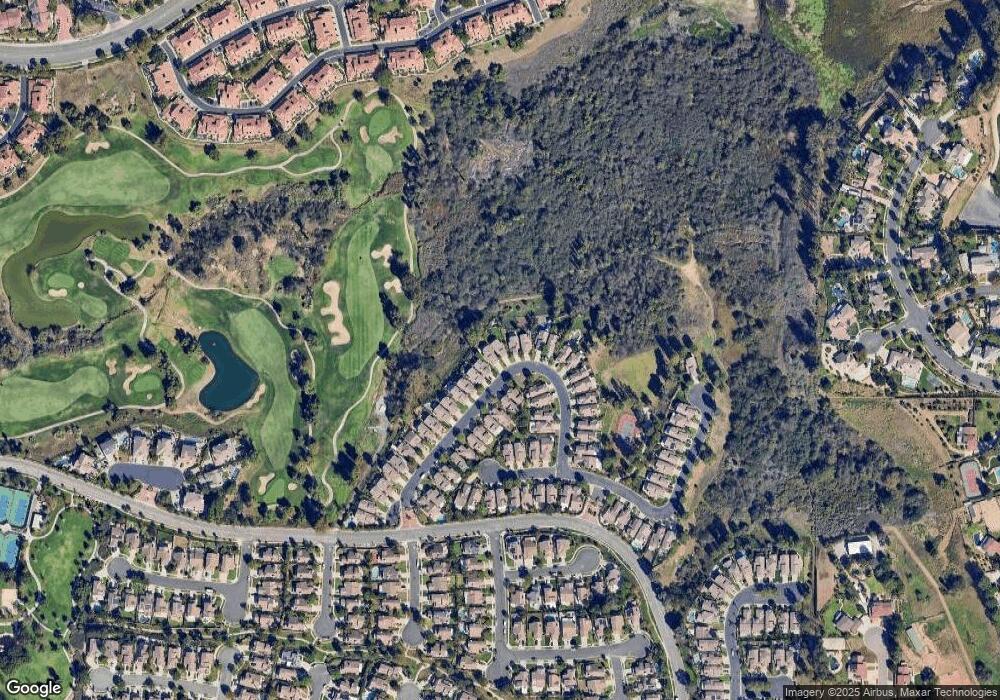

Map

Nearby Homes

- 582 Fairfield Rd

- 402 Country Club D Dr Unit D

- 117 Macademia Ln

- 406 Country Club Dr

- 286 Golden Fern Ct

- 453 Country Club Dr Unit 103

- 287 Goldenwood Cir

- 440 Huyler Ln Unit C

- 206 Shady Hills Ct

- 485 Country Club Dr Unit 225

- 272 Fieldstone Way Unit A

- 512 Roosevelt Ct

- 620 Ivywood Ln Unit F

- 600 Kingswood Ln Unit G

- 630 Kingswood Ln Unit F

- 625 Hazelwood Way Unit A

- 454 Longbranch Rd

- 1100 N Country Club Dr

- 927 Lincoln Ct

- 713 Twillin Ct

- 565 Fairfield Rd

- 571 Fairfield Rd

- 561 Fairfield Rd

- 573 Fairfield Rd

- 557 Fairfield Rd

- 553 Fairfield Rd

- 560 Fairfield Rd

- 549 Fairfield Rd

- 556 Fairfield Rd

- 577 Fairfield Rd

- 552 Fairfield Rd

- 584 Fairfield Rd

- 545 Fairfield Rd

- 579 Fairfield Rd

- 548 Fairfield Rd

- 581 Fairfield Rd

- 590 Fairfield Rd

- 541 Fairfield Rd

- 544 Fairfield Rd

- 583 Fairfield Rd