5750 Eagle Oak Ranch Way Paso Robles, CA 93446

Estimated Value: $4,187,000 - $5,316,812

8

Beds

9

Baths

9,642

Sq Ft

$493/Sq Ft

Est. Value

About This Home

This home is located at 5750 Eagle Oak Ranch Way, Paso Robles, CA 93446 and is currently estimated at $4,751,906, approximately $492 per square foot. 5750 Eagle Oak Ranch Way is a home located in San Luis Obispo County with nearby schools including Kermit King Elementary School, Daniel Lewis Middle School, and Paso Robles High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 12, 2023

Sold by

Diane G Rochelle Family Trust

Bought by

Patti Mahaffey Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$5,600,000

Outstanding Balance

$5,442,290

Interest Rate

6.32%

Mortgage Type

New Conventional

Estimated Equity

-$690,384

Purchase Details

Closed on

Sep 6, 2000

Sold by

Rochelle Ben

Bought by

Rochelle Diane Gray

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,000,000

Interest Rate

7.62%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Patti Mahaffey Trust | $8,300,000 | First American Title | |

| Rochelle Diane Gray | -- | Chicago Title Co | |

| Rochelle Diane Gray | $4,950,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Patti Mahaffey Trust | $5,600,000 | |

| Previous Owner | Rochelle Diane Gray | $1,000,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $43,755 | $4,194,825 | $691,285 | $3,503,540 |

| 2024 | $30,436 | $4,054,209 | $687,641 | $3,366,568 |

| 2023 | $30,436 | $2,815,554 | $391,226 | $2,424,328 |

| 2022 | $29,929 | $2,761,772 | $384,979 | $2,376,793 |

| 2021 | $30,825 | $2,709,044 | $378,854 | $2,330,190 |

| 2020 | $29,097 | $2,685,050 | $378,753 | $2,306,297 |

| 2019 | $28,494 | $6,942,867 | $2,420,715 | $4,522,152 |

| 2018 | $27,832 | $2,568,312 | $351,570 | $2,216,742 |

| 2017 | $26,077 | $2,519,135 | $345,858 | $2,173,277 |

| 2016 | $25,477 | $2,461,232 | $330,568 | $2,130,664 |

| 2015 | $24,889 | $2,405,022 | $326,362 | $2,078,660 |

| 2014 | $24,062 | $2,368,568 | $330,626 | $2,037,942 |

Source: Public Records

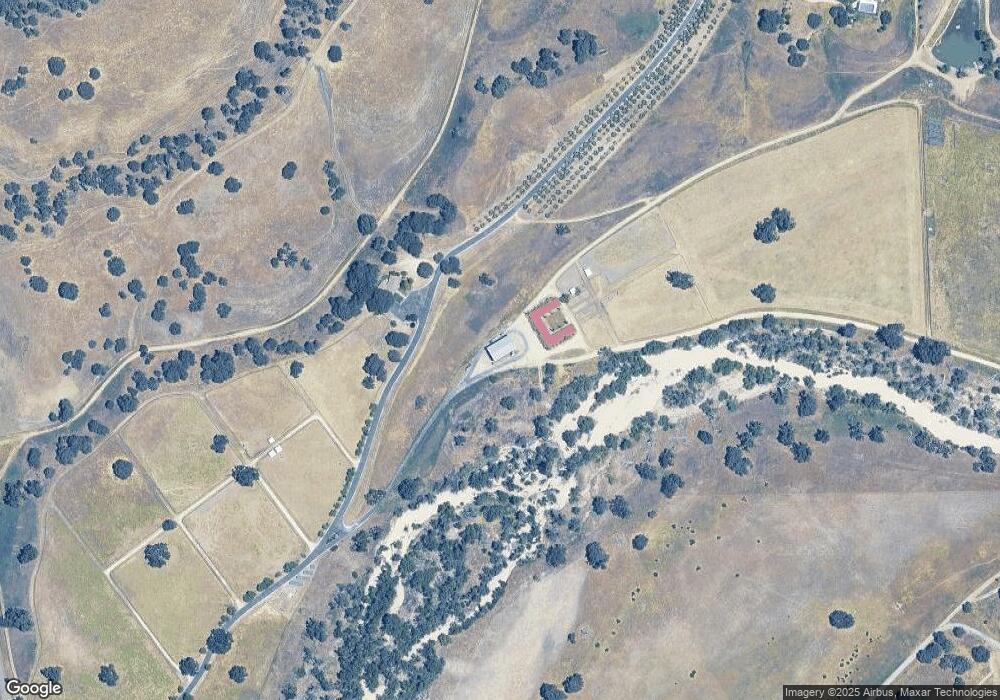

Map

Nearby Homes

- 2950 Old Ford Rd

- 1924 Surrey Way

- 7686 Feenstra Rd

- 1 Dry Canyon Rd

- 930 Windwood Rd

- 5920 Lone Pine Place

- 2495 Maverick Way

- 5010 Gate 4 Rd

- 5160 Needs Road Name

- 5625 Linne Rd

- 0 Maverick Way Unit NS25217169

- 0 Maverick Way Unit NS25217148

- 5558 Prancing Deer Place

- 4860 Camp 8 Rd

- 0 Camp 8 Rd Unit NS24178810

- 5095 White Tail Place

- 5995 Black Tail Place

- 5920 Forked Horn Place

- 5930 Forked Horn Place

- 5940 Forked Horn Place

- 5750 Eagle Oak Ranch Way

- 5750 Geneseo Rd

- 5710 Eagle Oak Ranch Way

- 2280 Geneseo Rd

- 3766 Geneseo Rd

- 3770 Geneseo Rd

- 2295 Geneseo Rd

- 2330 Geneseo Rd

- 2380 Geneseo Rd

- 5750 El Pharo Dr

- 2328 Geneseo Rd

- 2430 Geneseo Rd

- 5530 El Pharo Dr

- 2155 Geneseo Rd

- 2375 Geneseo Rd

- 0 Ground Squirrel Hollow Rd

- 5720 El Pharo Dr

- 3725 Geneseo Rd

- 2575 Geneseo Rd

- 7990 Rancho Verano Place

Your Personal Tour Guide

Ask me questions while you tour the home.