5756 Pilot Rd Cherokee, IA 51012

Estimated Value: $235,000 - $472,668

3

Beds

6

Baths

1,820

Sq Ft

$199/Sq Ft

Est. Value

About This Home

This home is located at 5756 Pilot Rd, Cherokee, IA 51012 and is currently estimated at $362,917, approximately $199 per square foot. 5756 Pilot Rd is a home located in Cherokee County with nearby schools including River Valley Elementary School and River Valley Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2015

Sold by

Weaver Jeffrey A and Weaver Terri L

Bought by

Weaver Jeffrey A and Weaver Terri L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,000

Outstanding Balance

$121,825

Interest Rate

3.93%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$241,092

Purchase Details

Closed on

Feb 10, 2014

Sold by

Flewelling Linda L

Bought by

Weaver Jeffrey A and Weaver Terri L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,000

Interest Rate

4.54%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weaver Jeffrey A | -- | None Available | |

| Weaver Jeffrey A | $57,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Weaver Jeffrey A | $155,000 | |

| Closed | Weaver Jeffrey A | $57,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,318 | $470,140 | $63,840 | $406,300 |

| 2024 | $4,318 | $440,920 | $63,840 | $377,080 |

| 2023 | $2,526 | $324,770 | $63,840 | $260,930 |

| 2022 | $2,534 | $233,480 | $51,070 | $182,410 |

| 2021 | $2,534 | $233,480 | $51,070 | $182,410 |

| 2020 | $2,696 | $233,480 | $51,070 | $182,410 |

| 2019 | $2,852 | $233,480 | $0 | $0 |

| 2018 | $1,988 | $164,640 | $0 | $0 |

| 2017 | $2,004 | $164,640 | $0 | $0 |

| 2016 | $898 | $71,316 | $0 | $0 |

| 2015 | $800 | $60,954 | $0 | $0 |

| 2014 | $674 | $60,954 | $0 | $0 |

Source: Public Records

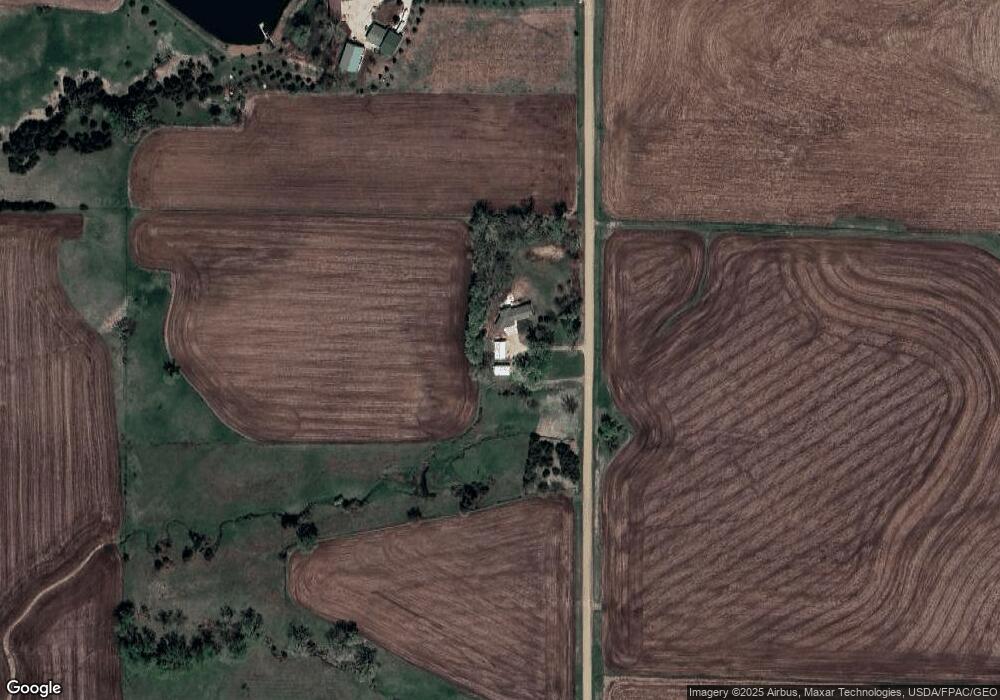

Map

Nearby Homes