5806 Ely Rd Cedar Rapids, IA 52404

Estimated Value: $286,000 - $495,152

--

Bed

3

Baths

1,456

Sq Ft

$278/Sq Ft

Est. Value

About This Home

This home is located at 5806 Ely Rd, Cedar Rapids, IA 52404 and is currently estimated at $404,288, approximately $277 per square foot. 5806 Ely Rd is a home located in Linn County with nearby schools including Prairie Heights Elementary School, Prairie Crest Elementary School, and Prairie View Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 26, 2005

Sold by

Kelley Paula K

Bought by

Kelley Paula K and Herold Timothy M

Current Estimated Value

Purchase Details

Closed on

Jun 4, 2001

Sold by

Harger Richard E and Harger Dorathy I

Bought by

Kelley Timothy F and Kelley Paula K

Purchase Details

Closed on

Jun 10, 1999

Sold by

Harger Richard E and Harger Dorothy I

Bought by

Kelley Timothy F and Kelley Paula K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,000

Interest Rate

10%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kelley Paula K | -- | -- | |

| Kelley Timothy F | $264,500 | -- | |

| Kelley Timothy F | $265,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kelley Timothy F | $245,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,760 | $485,000 | $84,500 | $400,500 |

| 2024 | $5,028 | $467,700 | $84,500 | $383,200 |

| 2023 | $5,028 | $458,900 | $84,500 | $374,400 |

| 2022 | $4,962 | $341,000 | $84,500 | $256,500 |

| 2021 | $4,868 | $341,000 | $84,500 | $256,500 |

| 2020 | $4,868 | $313,800 | $58,500 | $255,300 |

| 2019 | $4,522 | $294,200 | $58,500 | $235,700 |

| 2018 | $4,392 | $294,200 | $58,500 | $235,700 |

| 2017 | $4,108 | $271,100 | $58,500 | $212,600 |

| 2016 | $4,108 | $271,100 | $58,500 | $212,600 |

| 2015 | $4,089 | $271,100 | $58,500 | $212,600 |

| 2014 | $3,958 | $271,100 | $58,500 | $212,600 |

| 2013 | $3,714 | $271,100 | $58,500 | $212,600 |

Source: Public Records

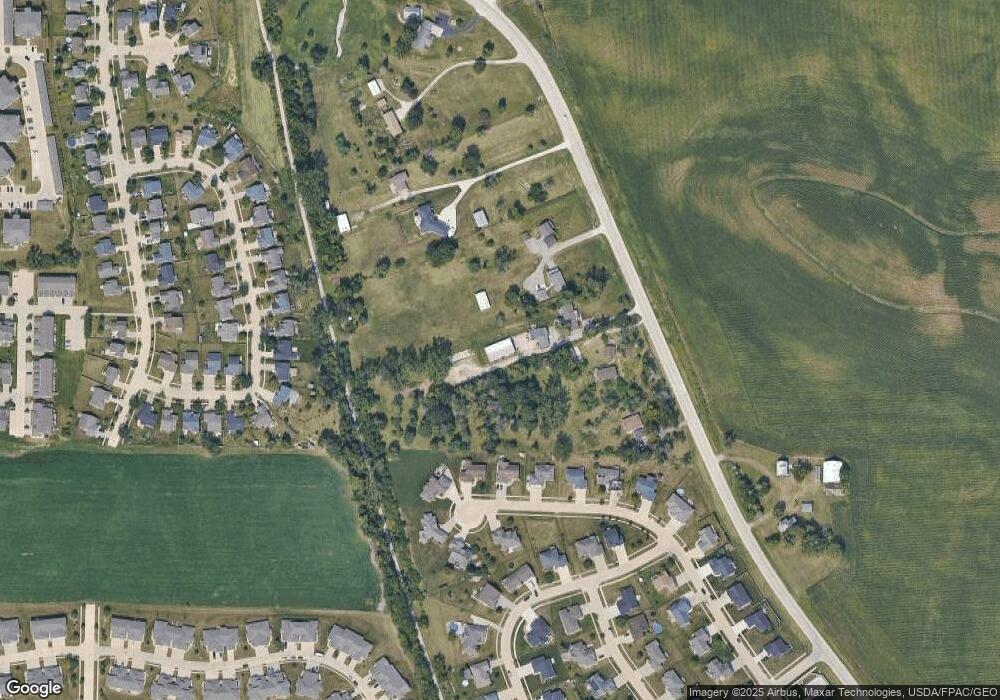

Map

Nearby Homes

- 5810 Bethpage Cir SW

- 1410 Scarlet Sage Dr SW

- 6614 Scarlet Rose Cir SW

- 1719 Prairie Rose Dr SW

- 6612 Artesa Bell Dr SW

- 6812 Artesa Bell Dr SW

- 7113 Chenango Ln SW

- 7006 Colpepper Dr SW

- 5112 Scenic View Ct SW

- Lot 6 College Farms 5th Addition SW

- Lot 2

- Tbd Old River Rd SW

- 3728 Sunshine St SW

- 51 Oklahoma Ave SW

- 4240 Briar Ridge Ct

- 0 41st Avenue Dr SW Unit 202507355

- 0 41st Avenue Dr SW Unit 1 Ac

- 0 41st Avenue Dr SW Unit 2.25 Ac

- 6620 Preston Terrace Ct SW

- 62 Oklahoma Ave SW

- 5800 Ely Rd

- 5900 Ely Rd

- 5712 Ely Rd

- 5908 Ely Rd

- 5708 Ely Rd

- 1706 Hoover Trail Ct SW

- 1802 Hoover Trail Ct SW

- 1700 Hoover Trail Ct SW

- 1608 Hoover Trail Ct SW

- 1808 Hoover Trail Ct SW

- 1814 Hoover Trail Ct SW

- 5704 Ely Rd

- 1602 Hoover Trail Ct SW

- 1509 Hoover Trail Cir SW

- 1503 Hoover Trail Cir SW

- 1701 Hoover Trail Ct SW

- 1515 Hoover Trail Cir SW

- 6203 Hoover Trail Rd SW

- 1605 Hoover Trail Ct SW

- 1601 Hoover Trail Cir SW